Not in this case.

Ever since 1986, when the government introduced new rules to promote the development of essential energy infrastructure, master limited partnerships (MLPs) have become compelling income investments. The reasons are simple.

They provide a crucial service that's always in demand-the distribution of energy resources. Most are liquid, exchange-traded securities that are easy to track and trade. They expand their networks organically and through acquisitions to increase distributable cash flow and payout to investors, which helps propel price growth. And they distribute the vast majority of their profits to investors in a unique way that pushes off the payment of most taxes until investors sell out of the partnership.

On average, 80% of an MLP's quarterly distribution is a write-down on an investor's cost because it's considered a return of capital. This means if you paid $12 per unit of partnership, which distributes $1, you would pay taxes on $0.20 based on your individual tax rate. But your cost basis would be reduced by $0.80 with no taxes immediately paid on that amount.

It may take 15 years to write down the cost to zero, and afterwards one must pay taxes on all future distributions. When units with a zero cost basis are sold, an investor must pay ordinary income taxes on the value up to his original investment. Any appreciation above the original cost would be taxed as capital gains.

Sounds complicated?

Well, yes. MLPs are certainly not your average stock play. Some are directly involved in energy exploration and refining, exposing them to commodity price volatility.

MLPs typically require filing of K-1 tax forms in every state that a pipeline passes through. That can be a somewhat costly headache for some investors.

Let's say you opt for a fund manager to do all the work. You would have four different fund types to consider-exchange-traded funds, exchange-traded notes, open-ended funds, and closed-end funds-each having its own issues.

Advisors who have put in the time to study MLPs, however, have been well rewarded. "With an expanding income stream and low volatility relative to the market," says Leo Marzen, a partner at Bridgewater Advisors in New York, "MLPs are a conservative, compelling asset class, comparable to utilities."

Outperformance

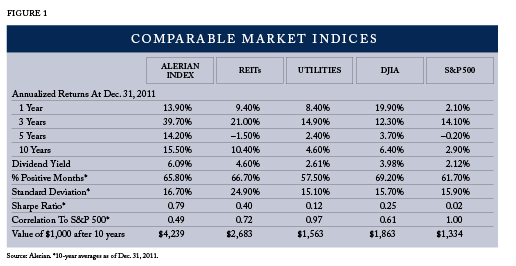

As Figure 1 indicates, only the Dow Jones Industrials outperformed the MLP Index. And it did so only last year. For all other time periods, the Alerian Index blew past the Dow. And it outperformed REITs, utility shares, and the S&P 500 by a minimum of 50% on an annualized basis over the past 1-, 3-, 5-, and 10-year periods through 2011 while delivering a superior yield that averaged over 6%.

Perhaps most compelling for equity investors, total returns of energy master limited partnerships annually outpaced the S&P 500 over the past decade, through December 2011, by 12.6 percentage points a year. It did so with only slightly greater volatility: 16.7% versus 15.9%, with performance that was only 49% correlated with the market.

Kenny Feng, Alerian's CEO, says the index achieved this not through the turnover of weak MLPs with those that are rallying but in the steady performance of core constituents that have generated consistent distributions and total returns.

He also sees increasing institutionalization of the asset class driving demand for MLPs. "Despite compromising the tax advantage of the partnership when a fund invests exclusively in MLPs [exposing it to taxation at the corporate level]," explains Feng, "the yields and expanding distributions in this low-interest rate environment has been worth the trade-off to funds and their investors-both personal and retirement."

Wells Fargo reported the market capitalization of MLPs increased 13% in 2011 to over $271 billion, with the help of 14 new equity offerings that raised a one-year record of $21.3 billion.

The bank's senior analyst, Michael Blum, believes MLPs will continue to perform well in 2012, driven by four basic trends: continuation of low interest rates and maintenance of attractive yield spreads, solid industry and corporate fundamentals, accelerating demand for energy distribution and reasonable valuations of MLPs.

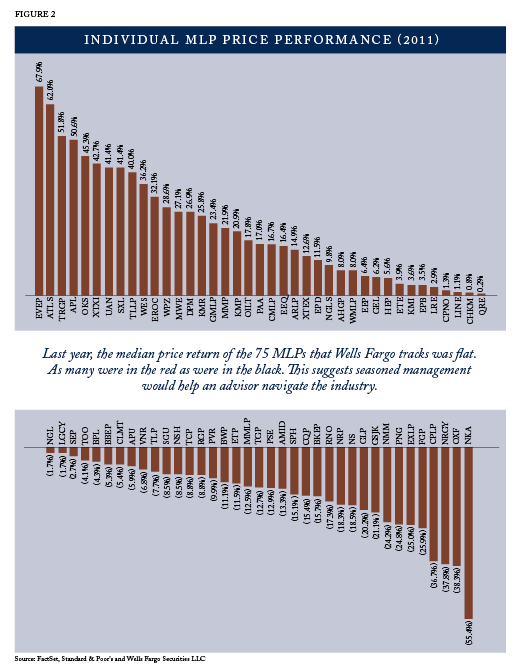

All this doesn't mean profiting from MLPs is a cinch. The industry proved as vulnerable as any asset class during the financial crisis. And last year, the median price return of the 75 MLPs that Wells Fargo tracks was flat. As many were in the red as were in the black. This suggests seasoned management would help an advisor navigate the industry.

However, performance indicates that size matters. Nine out of the Alerian Index's top ten constituents enjoyed price gains in 2011. And five of them turned in total returns of more than 20%.

Sean Wells, an analyst at Steelpath Advisors, an industry specialist with $2.1 billion under management and which manages several open-end MLP mutual funds, believes that partnerships with market caps over $8 billion to $10 billion are generally less volatile than smaller ones. "Their steady performance," he explains, "comes from more diverse assets, more fee-based income, less commodity exposure and higher credit ratings that allow them to finance expansion at a cheaper cost."

MLPs

If advisors are most attracted to the industry for its steady, attractive payouts, then they may be most effectively served by investing in transportation, i.e., infrastructure pipelines. "These MLPs offer the most transparent and steady stream of predictable, fee-based distributable cash flow, which is key for sustaining and growing yields and helping to ensure price stability," says Blankenship.

The business model of transport MLPs is development and maintenance of pipeline networks, from which they charge rent, to enable energy developers to move their resources from wells to storage and refineries and eventually toward distributors.

"Demand for pipeline access is fairly steady," according to Ron Weiner, CEO of Westport, Conn.-based asset manager RDM Financial, "giving these MLPs fairly predictable and attractive net income. Many contracts include inflation adjustors, providing investors a partial hedge against rising prices." And with little direct commodity exposure, he believes this segment of the industry is the least volatile.

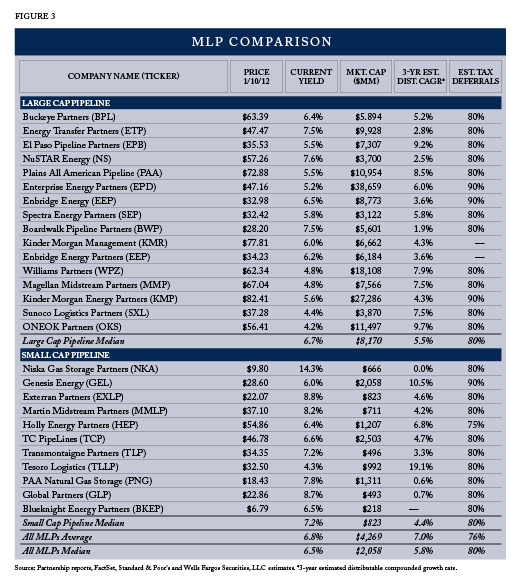

According to the Wells Fargo MLP Index, there are 16 large-cap pipeline plays (Figure 3). Their market capitalizations range from the $3.1 billion Spectra Energy Partners (NYSE: SEP) to the $38.7 billion Enterprise Products Partners (NYSE: EPD), the industry's largest.

Selman Akyol, analyst at Stifel Nicolaus, the St. Louis-based brokerage and investment bank with $119 billion under management, believes EPD remains a compelling play.

After returning nearly 20% over the past year through mid-January, Akyol believes the firm "remains well positioned to continue to expand its asset base across the energy logistics value chain for oil, natural gas and natural gas liquids." He sees continued development of shale resources as a source of profitable investment, enabling the firm to accelerate distribution growth."

Akyol also recommends Plains All American Pipeline (NYSE: PAA), whose yield and total returns exceeded EPD's over the past year. He sees even greater near-term upside given its solid forward growth in distributable cash flow, which doesn't take into account three potential acquisitions.

MLP Funds

Despite a stated annual expense of 1.74%, TYG has been delivering equity-market-topping returns. In 2011, it was up 10.7%. Its three-year annualized gain was 40%, and the fund's five-year return was 10.3%. Since inception, TYG has generated average yearly returns of 13.3%.

Being a closed-end fund, TYG's market price isn't the same as its net asset value. As of late January 2012, new investors would pay a 14% premium for each dollar of assets the fund owns. And like most other closed-end funds, TYG relies on leverage to boost returns, which currently stands at 19.3%.

The first MLP exchange-traded product-the JP Morgan Alerian MLP (NYSE: AMJ)-came to market in 2009 in the form of an exchange-traded note. As such, the security comes with counterparty risk to the bank. But otherwise, AMJ is an efficient way to gain exposure to the industry benchmark. And demand has turned the ETP into the industry's largest with $3.7 billion in assets.

Its annual expense of 85 basis points does cut into returns. Last year the fund was up 13.21%, inclusive of an annual yield of 5.46%. Annualized return since inception was 22.36%, 95 bps below the index's rate of return.

Open-end mutual funds are the most recent addition to the MLP investment universe, brought to market first by Steelpath Advisors. Its MLP Select 40 Fund (MLPFX) started up in March 2010 and currently has $753 million. Last year, it delivered total returns of 6.54% (net of annual expense of 1.1%), fractionally having exceeded its yield of 6.35%. But since its inception, its annualized rate of return was a healthier 11.94%.

With only 77 energy MLPs and fewer that offer significant liquidity, funds end up owning many of the same partnerships. However, as indicated above, performance among funds varies significantly. Therefore, when selecting a product, advisors should be mindful of sales loads and expenses, leverage, volatility, MLP selection process and MLP-generated unrelated business tax income. These distinctions have made a difference.

Risks

Most advisors, however, limit MLP exposure to mid-single digits. Mostly focused on portfolio diversification, Weiner of RDM Financial says his limit "comes under the basic belief: You never know."

Kaufman is mindful of industry risks. Even transport-focused MLPs have direct commodity exposure that could account for up to 20% of their cash flow. While this can be hedged, he agrees there's no getting around the effects that a slowdown in energy demand could have on performance. He advises investors to identify an MLP's precise asset exposure before investing.

He also sees pipeline maintenance as an under-recognized issue. "Investors should check an MLP's 10Qs and annual reports to discern a partnership's commitment to this maintenance," cautions Kaufman. The cost of overseeing expanding networks rises over time, as does capital maintenance.

Chris Cordaro, CIO of asset manager RegentAtlantic, is also concerned about the eventual risk of rising inflation and interest rates. "Both rates will eventually rise," says Cordaro, "and this will compress yield spreads over Treasurys, which would typically push down the value of MLPs."

Increased borrowing costs would also cut into the bottom line. Save for another credit crisis, Cordaro believes the industry should be able to access debt at affordable rates for at least the near to medium term.

MLPs' favorable tax status could be at risk if Congress attempts to close certain loopholes to deal with the country's budgetary crisis. But Kaufman believes, "since the country still needs to improve its energy infrastructure, it's not likely that Congress would target this advantage."

Weiner thinks there's a decent chance that by 2013 the country could revert to the Clinton era's higher tax rates. This would likely benefit MLPs by making their special tax treatment that much more valuable to investors, leading to higher valuations.

Weiner is also concerned about the "fracking" debate. If the government decides to even temporarily suspend such excavation practices, he feels it would have a direct negative impact on MLPs, at least over the short run.

Until a systemic risk to the industry appears to threaten the status quo, including the possibility of too many MLPs eventually chasing not enough infrastructure, these alternative investments should remain a source of reliable income and asset price stability that's hard to match by most other asset classes.