Key Points

1. We see more “normal” markets ahead: lower returns and higher volatility amid rising economic uncertainty and less room for growth to top expectations.

2. Global equities clawed back into positive territory year-to-date in U.S. dollar terms, and China’s central bank cut its deposit reserve rate.

3. We see tax cuts and a healthy consumer supporting U.S. earnings this week. Risks to eurozone results: a stronger euro and weaker economy.

1. A Return To The Old Normal

Last year was an extraordinary one for markets with strong returns and rock-bottom volatility (vol) across most asset classes. The market environment in 2018 has returned to a more normal mix of lower returns and higher vol. This reflects rising economic uncertainty and less room for growth to exceed expectations.

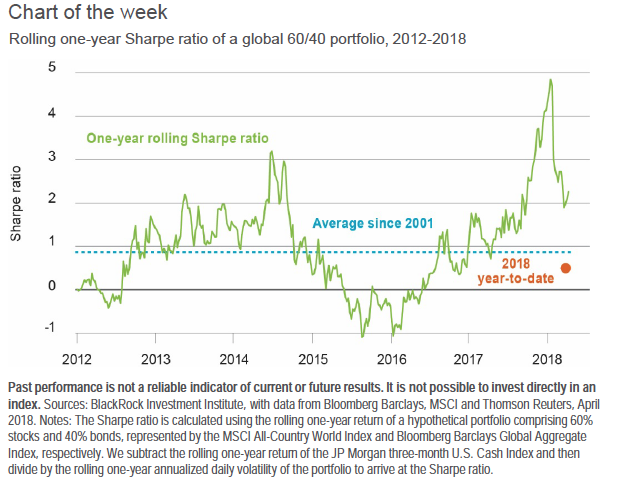

The chart above illustrates this reduced reward for risk, one of the three investing themes in our Q2 2018 Global Investment outlook. It shows how a hypothetical global portfolio of 60 percent equities and 40 percent bonds would have seen its Sharpe ratio, a measure of returns over cash relative to realized volatility, plummet this year (see the orange dot) from 2017 peaks. A key reason: a hefty rise in equity volatility back to more “normal” levels. Volatility was unusually low in 2017, even in the context of low-vol regimes we have seen since 1980. The recent plunge in the Sharpe ratio also comes amid more muted asset returns and rising U.S. cash rates – a product of the Federal Reserve’s gradual monetary tightening.

The Eurozone Example

What explains the shifting market backdrop? We see two key factors. First, economic uncertainty has risen as U.S. stimulus and trade policy actions have broadened the range of possible outcomes compared with 2017. Second, we see less scope for growth outside the U.S. to beat expectations. This is reflected in our BlackRock Growth GPS, which points to above-trend global growth in 2018 but shows consensus having caught up with or even overtaken our own measure. Europe provides a good example. Growth expectations there have likely overshot after last year’s unexpectedly strong data. Our GPS suggests the eurozone should experience decent above-trend growth in the coming year. Temporary factors, such as an inventory unwind, may explain some of the region’s recent disappointing economic data. Yet consensus estimates look too high and may need to revert to more realistic levels, we find.

This points to a bumpy road ahead for markets, especially when combined with elevated geopolitical risks and slowly rising inflation. Yet we do not believe lower returns and higher short-term volatility spell the end of the equity bull market, now in its ninth year. Nor do we see warning signs, such as a widespread buildup in leverage, that would signal the end of the expansionary cycle. We see synchronized global growth with room to run providing a solid foundation for equities. We see higher interest rates ahead, but plentiful global savings should keep yield rises moderate – even amid rising U.S. bond issuance. We prefer to take risk in equities over credit. We see market returns being driven by earnings growth, dividends and coupons, rather than rising valuations. This, too, is a return to normal. We prefer equity markets with higher earnings growth, such as the U.S. and emerging markets (EM). In fixed income, we prefer EM debt and short-duration U.S. bonds. The latter’s recent yield increases reflect anticipated Fed hikes and make for an attractive risk/reward tradeoff.

2. Week In Review

• Global equity markets rose, moving back into positive territory year-to-date in U.S. dollar terms. Materials and energy stocks led. Oil prices hovered at a 40-month high, supported by tighter U.S. inventories and the possibility of extended OPEC production cuts. The VIX declined. The two-year Treasury yield rose to its highest level since August 2008.

• First-quarter U.S. earnings came in solid. Roughly 80 percent of companies beat analysts’ expectations, and earnings are on track to grow at the highest rate in seven years. Reports from meetings of Germany’s and France’s leaders suggested eurozone reform momentum had stalled. UK inflation undershot expectations.

• China’s central bank cut its reserve requirement ratio for the first time in two years amid evidence deleveraging is causing a contraction in credit creation and hurting investment. China economic data marginally disappointed.

3. Week Ahead

April 23: Japan Nikkei Flash Manufacturing PMI; U.S., eurozone, Germany Markit Flash Manufacturing PMIs

April 24: U.S. consumer confidence

April 26: European Central Bank monetary policy meeting announcement

April 27: U.S. Q1 GDP, employment cost index; UK Q1 GDP; eurozone economic sentiment; Bank of Japan monetary policy meeting announcement

The bulk of U.S. and European first-quarter earnings come in this week. The pace of analyst upgrades versus downgrades has slowed recently for most regions after peaking in March. However, first-quarter earnings and sales growth in the U.S. so far have been solid, on average, supported by tax cuts and healthy consumer spending. We see more of this trend ahead. In the eurozone, we are focused on how the earnings of globally exposed firms compare with those of domestic-focused ones amid the region’s disappointing economic data and a stronger euro versus the U.S. dollar. In both regions, we expect the results of energy and materials firms to benefit from higher commodity prices.

Richard Turnill is global chief investment strategist at BlackRock.