Rob Conzo and Eric Diton know a thing or two about navigating the challenges of working for “Big Broker.” They spent more than 45 combined years working at wirehouses.

Now that they broke away, they are highlighting experiences from their wirehouse days and the benefits of going independent through a series of comic strips.

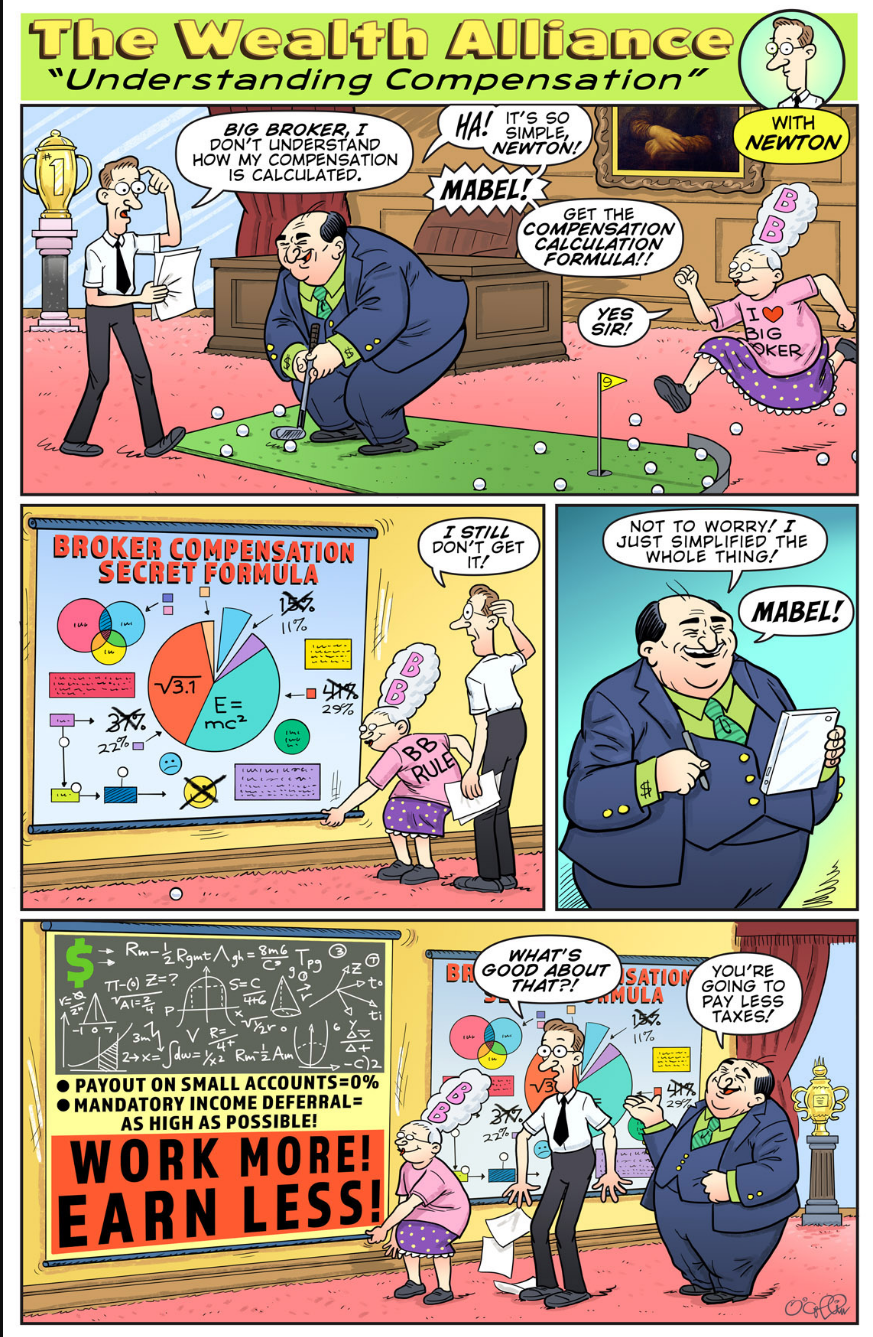

Conzo and Diton, who created The Wealth Alliance in 2019, said the comic strips feature three characters: Big Broker, Mabel, his cheerful and loyal assistant, and Newton, a financial advisor who is trying to navigate his way at the firm. The duo said the creation is an attempt to display their personalities and humor and serve as a recruitment tool for their firm.

“I wanted to bring up the issues of big wirehouses in a comedic way,” said Conzo, CEO and managing director of the $1.2 billion registered investment advisor. The firm is based in Melville, a town in the Long Island section of N.Y., with an office in Boca Raton, Fla. Conzo noted that the initial thought was to create a series of videos and post them on social media. That process had begun but time was limited once they broke away. So they decided to create the comic strips.

Diton, president and managing director, was all for the comics, having had an uncle who was noted for his creation of the character "Margie" for Timely Comics, the 1940s predecessor of Marvel Comics. He also was the final cartoonist on the comic strip "Mickey Finn." “I grew up just really appreciating the power of comics because you can get across really serious issues in a humorous way.”

Conzo said he and Diton worked over a number of days to create vignettes highlighting issues at big wirehouses. “The purpose of the whole thing was to highlight the issues to attract financial advisors to maybe look at our RIA,” he said.

As for the name Newton, Diton takes credit. “I can’t give you a great reason why that popped into my head,” he said, noting that they both immediately agreed that Newton would fit the character. Also under consideration were Norbert and Dexter.

The duo hired a cartoonist last year to bring their vision to life. So far, they have created two strips, one of which had Newton scratching his head at the complex compensation structure at his wirehouse firm. The other one highlighted the hoops the financial advisor must jump through to qualify for a sales assistant or client associate.

“The compensation grid is actually a myriad of rules and different percentages and almost impossible to figure out,” Diton said. He added that it is difficult to take ownership of the business in the wirehouse environment. “You feel like you want to call it your business, but is it your business when someone is going to tell you each year, ‘oh, here is what you’re going to get paid?’ We are going to give you this percent and oh, by the way, your account is under $250,000, you’re not getting paid on those anymore. Those are the things that happen,” he said.

As for getting a client associate, Diton explained that the firm sets an amount that the advisors must produce. For example, if the advisor produces $1 million in revenue, he will get a client associate to help grow the business and if he produces $2 million, he will get a second associate. But both advisors said that conveniently changes when you hit the target.

“All of a sudden you do $2 million, and you come in and tell Big Broker that you qualify for the second client associate and it’s “oh, no, sorry, we actually increased that to $1.25 million [for one]. They kept changing the number when you hit it. And that has happened to me two or three times,” Diton said.

The next set of comic strips likely will focus on marketing your business and retiring or selling your business back to the brokerage, Conzo said. Others will involve the issues of mandatory deferred compensation that is restrictive and “difficult and painful for Newton to leave,” and the difficulties financial advisors face when they leave a firm due to the abandonment of protocols, he said.

The comic strips are advertised on LinkedIn as part of a sponsored campaign to help recruit wirehouse advisors who meet specific criteria such, as 10 years at the firm and location. When an advisor sees the comics on LinkedIn, he or she would click and go to the landing page to learn more about The Wealth Alliance.

Diton said in the three months since its debut, the initial response to the comic strips has been positive. “Advisors are just really enjoying it and it’s brought us some potential hires,” he said.

Conzo added that people overwhelmingly said they have not seen a comic strip in the form of an advertisement. “People agree that it’s pretty unique,” he said.

And although the comic strips shed light on pain points for advisors at wirehouses, the duo said their intention is not to come off as negative or angry. “This is fun and that’s who we are. We are not angry. We are actually very happy. So, we are trying to target those types of people who get it,” he said.

Diton acknowledges that there is a tremendous amount of stress that comes with owning a sizable firm as theirs. The firm has 18 employees. “But here we are with an incredible staff, a beautiful building and most importantly, we are having so much fun on the journey and our clients are right there along with us cheering us on,” he said. “We knew it would be good, but we didn’t know it would be this great and we are really enjoying it.”