This year has been a great one for many financial advisors, says a new report from LIMRA and Ernst & Young (EY).

Eight out of 10 advisors reported a significant increase in income over the past few years -- exceeding double-digit increases among all practice models in a two-year period, according to the report.

Consumers are growing more interested in getting services rather than products from their advisor. Advisor services were the largest and fastest-growing business channel, according to the findings of the survey. Similarly, fee-based advisory services experienced the largest growth among full-service broker-dealer advisors. The study says fee-based services make up 48 percent of B-D business in 2018, up nearly five times from 10 percent in 2008.

The increased emphasis on providing advisory services has seemed to impact the business of career insurance professionals, the study suggests. Life insurance was once the most dominant product among career insurance professionals; today, life insurance accounts for less than half of their overall business, according to the report.

When evaluating business channels, the study found advisory services were the largest channel of business among independent broker-dealer financial advisors in 2018, nearly tripling in the past 10 years. Advisory services now account for 37 percent of the business of independent broker-dealer (IBD) financial advisors (up from 14 percent in 2008).

In contrast, advisors were primarily product focused in 2008, with the majority (53 percent) of their business stemming from investment products. Investment and insurance products both account for the same percentage (31 percent) of overall business in 2018, the study found.

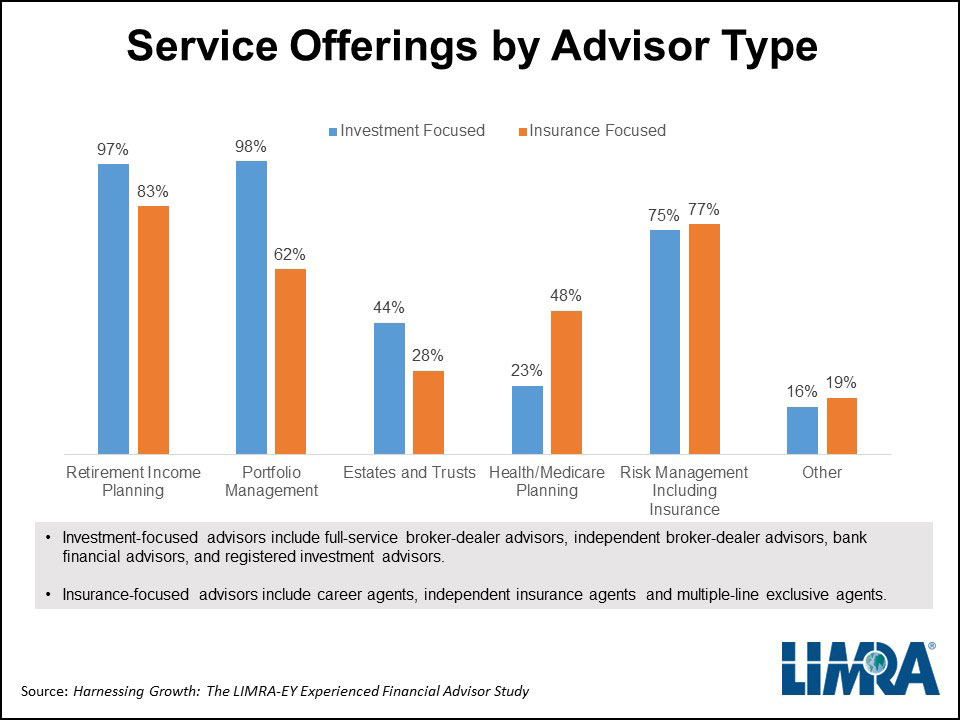

“As competition grows, consumers now expect their financial advisor to offer a broad range of products and services to meet their individual financial needs,” said Laura Murach, LIMRA associate research director for distribution. “As a result, we are seeing similarities across all practice models in terms of their service and product offerings. And by offering a wider array of services, advisors can deepen their relationships with clients.”

Income Growth

Massive income growth among financial advisors came from increases in their client base, the survey said. Although many financial advisors benefited from market gains that increased the value of their book of business and the volume of assets under management, most of the additional income came from an increase in their client base, according to the report. Overall, survey respondents reported a 22 percent increase in clients over the last two years.

“Not surprisingly, almost all advisors (99 percent) rely on referrals to expand their client base and it is considered the most effective way to get new clients,” said Murach. “Interestingly, advisors’ websites and social media accounts are considered the next most valuable tools to market to new clients, which were rarely used 10 years ago.”

The findings of the 2018 study were fielded via an online quantitative survey of roughly 1,500 financial advisors, and insurance and investment professionals by LIMRA and EY. Data from 2008 was based on a joint survey of 1,200 sales professionals and financial advisors from LIMRA and McKinsey & Co.