Alternative investments are popular topics of conversation these days, and rightfully so. Equity markets have been volatile, fixed-income investing isn't as productive as it used to be, and according to a variety of surveys and research, correlations are on the rise. Advisors need to find other ways to diversify client portfolios to generate needed income without exposing clients to too much market risk.

Personally, I've explored a number of alternative strategies and investments but found problems with them, including the fact that they break two of my deepest held investment beliefs:

1) If you can't explain it you shouldn't own it.

2) Every investment should have, a buy, sell and hold price.

Alternative investments have become an interesting wrinkle in the life of advisors. In the not too distant past, they were only available to wealthy, sophisticated clients who understood the risks associated with them. Now that they are available to more clients who aren't so well informed, advisors are faced with the difficult tasks of balancing the risks and diversification benefits from these strategies, as well as monitoring them and communicating the details to clients.

Instead of trying to stretch for yield, take on too much risk, or increase the time I spend monitoring new, alternative investments, I've opted for a couple of alternative retirement income strategies that are easy for clients to grasp and offer advisors the opportunity to add similar value as those pitching more complex approaches.

It's important to point out that no one strategy is right for every client, and in most cases, any one strategy should constitute less than 10 percent of an overall portfolio. It's also significant that alternative investment strategies are designed primarily to create income, reduce market risk relative to Modern Portfolio Theory (MPT) measures, and be psychologically satisfying -- clients feel secure in employing these strategies based on realistic knowledge and expectations about them.

Low Correlation Dividend-Paying Stocks

Instead of turning to alternative investments for income, advisors can turn to low correlation stocks such as Annaly Capital Management (NLY), Exelon (EXC), and Kimberley Clark (KMB).

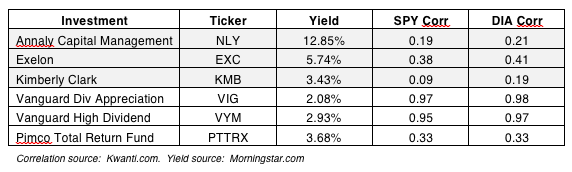

Generally, an investment with a correlation below .50 is considered to be a low correlation option. The three stocks listed below carry dividend yields well above those of popular dividend-paying ETFs such as Vanguard Dividend Appreciation (VIG) and Vanguard High Dividend (VYM), as you can see in the table. Furthermore, their individual and mean correlations are well below those of the Dow and the S&P 500 (SPDR S&P 500 (SPY) and SPDR Dow Jones Industrial Average (DIA) are proxies for the indexes).

Combined the three companies' correlations are in line with that of the popular fixed-income investment Pimco Total Return Fund (PTTRX). There are some other risk-associated advantages of a bond fund compared with individual stocks, but the point is to illustrate how using a sub asset class of large-cap dividend-paying stocks can provide diversification similar to a bond fund while providing income.

Timing The Market

People may say you can't time the market, but I believe you can if you look at it through the correct lens. Instead of trying to pick market tops and bottoms, advisors can use dividend-paying stocks to time the market relative to a client's needs and situation.In the old days, I wasn't embarrassed to tout a bond or CD yield, and use them in combination to match payment dates with financial events or generate retirement income. For example, in Michigan property taxes are usually paid twice per year. I could therefore use short-term CDs or bonds with payments in corresponding months to support or offset client withdrawal needs. But with interest rates so low, advisors may need to consider dividend-paying stocks for these kind of goals. Many clients (and even some advisors) don't realize that different companies pay their dividends in different months of each quarter. By matching the payment of company dividends to when withdrawals are required, advisors can help clients offset or lessen withdrawals of other funds.

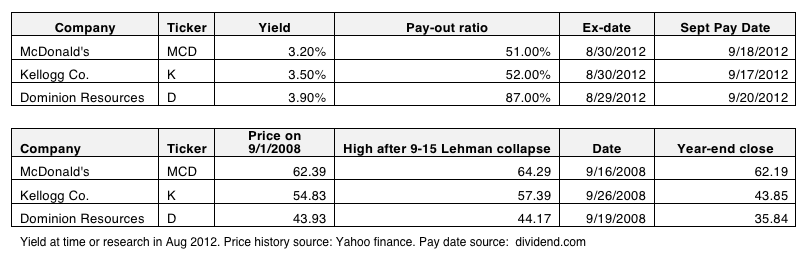

Likewise, you can use the time of year and current economic environment to add yield and give your clients a fresh perspective. Heading into September, for example, we wanted to seek out some additional income strategies for clients before yea-rend, but we weren't sure if Ben Bernanke would come through with QE3 or if Mario Draghi would fulfill his promise to save the Euro "no matter what."

Therefore, we focused our first phase of income timing on dividend-paying companies with yields above 3% and those companies that had two dividend payments remaining this year (September and again in December). On top of that, we wanted to ensure we used low-risk companies and those with good shock value, because if there was no QE3 or Greece left the Euro, there could be a ripple across the markets similar to the collapse of Lehman Brothers in September 2008.

After we had our short list of stocks, we looked at how each performed after the 2008 collapse of Lehman Brothers. We wanted to find solid income-producing companies that were capable of absorbing the initial part of a major shock, giving us time to exit in case the market began to truly unravel.

As a result of this screening process, we found three companies that fit the bill. I felt clients could understand how these stocks were being used to generate income while combating the current economic headlines. Because they were popular blue chip names,I felt clients would feel comfortable employing this strategy.

Alternative Strategies Are Worthless Without Good Communication

Whether you decide to use my strategy or more complex alternative investments to drive retirement income, they won't be truly effective unless you take the time to educate clients on what to expect from them. For example, many investors don't realize that dividend payments from a company are not an expense.They represent a share of the company's profits that are awarded to shareholders.

Therefore, once a company trades without its dividend (ex-dividend date), its share price will be reduced by the amount of the dividend. I learned this the hard way when a client wondered why a stock we just bought weeks ago was already trading down almost 4%. Of course it was a large dividend payer like Annaly (NLY), and instead of starting on the right foot through education, I had to react and reason with the client over the process and strategy.

It's also important to set specific goals for alternative strategies like these. One way to do this is to establish contact points with clients, setting a performance target range wherein we will discuss the options for a specific investment or group of investments. The contact point can be a market level like Dow 13,500 or a specific return percentage such as -5% or +10%. Either way, by establishing a point when a review will take place, advisors can build trust and keep clients comfortable with alternative strategies in place as they acclimate to doing something new and different.

Overall, when it comes to retirement income, advisors and clients alike are faced with an environment in which rising correlations and near-zero interest rates are making alternative investments a necessary consideration. While true alternatives investments like private equity and long-short funds may have a place in some portfolios, I've found that by focusing on the unique aspects and measurements of more traditional investments, advisor are better positioned to add value and income without overexposing clients to market risk. By taking the time to first educate clients on how a strategy will work for them, and then following up with a performance review, advisors can set realistic expectations for alternative strategies and help clients feel more comfortable using them.

Follow Robert on Twitter @robertlaura. He is the president of SYNEGOS Financial group, co-founder of RetirementProject.org, creator of the Laddered Dividend Portfolio, and author of Naked Retirement. He can be reached at [email protected].