In the last couple of years, there have been many proclamations declaring the “death of the 60/40 portfolio.” The results in the first half of the year have prompted those declarations to proliferate, with stocks down 20% and bonds down over 10%—the 60/40 portfolio was off 16.9% through June 30. So why the fascination with the 60/40 portfolio, and if it is really dead—what’s next?

Following the lead of many institutions, the wealth management community began to focus on the 60/40 portfolio as a market proxy in the 1990s. This naïve benchmark provided a way to compare diversified portfolios, and it was easy to increase the equity allocation for aggressive investors (70/30) or decrease the allocation for conservative investors (50/50).

The expectation was that the 60% equity allocation would provide the growth in the portfolio, while the 40% bond allocation provided income. Together, investors got some level of diversification because stocks and bonds reacted to different fundamentals. The 60/40 portfolio worked well during the latest bull market, where U.S. equity returns soared to new highs, fueled by easy money and a zero-interest policy.

Today’s Market

After the longest bull market in history (2009-2020), the next 10 years are likely to be very different than the last 10 years. The easy fiscal and monetary policy served as an accelerant for the U.S. markets, pushing up stock prices without regard for valuations. With the strong U.S. market characterized by slow growth, low fixed-income yields and challenging economic conditions abroad, investors adopted a TINA (there is no alternative) approach to investing.

Today, we are dealing with the residual effects of the global pandemic, the Russian invasion of Ukraine, changing Fed policy, and record levels of inflation. The bottom line is the current market environment presents several challenges for advisors and investors—lower equity returns, low yields, elevated correlations, increasing bouts of volatility, and record inflation not seen since the early 1980s.

Let’s examine more closely and consider the responses.

Equity returns. The pandemic exposed supply-chain issues and an unhealthy dependence on certain countries for valuable resources (Russia, China, etc.). Companies have been impacted by supply access issues, rising costs, challenges in hiring people, and lagging revenues.

Takeaway. Many strategists are predicting substantially lower equity returns over the next 10-15 years.

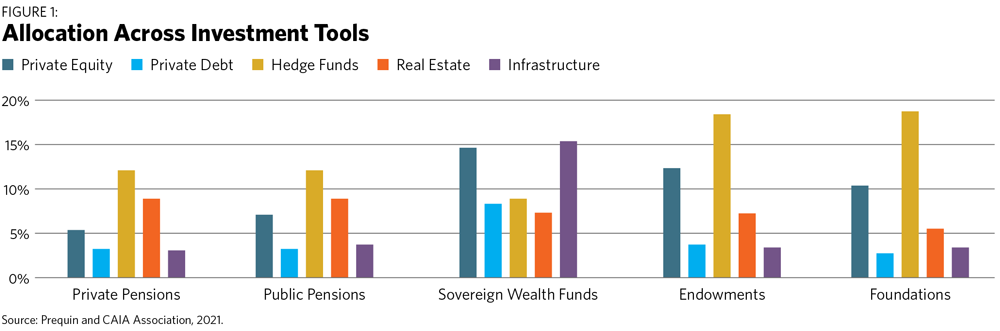

Potential solutions: Private equity, real estate, event-driven and long-short hedge funds.

Fixed income. After the Great Financial Crisis, many countries began to offer negative-yielding debt. The Fed and other central banks kept rates near zero for many years before beginning to raise rates recently, with plans to raise rates dramatically to combat inflation underway.

Takeaway. While fixed-income yields have been rising, they are still below historical levels, and investors are seeking alternative sources of yield.

Potential solutions: Private credit, real estate and alternative credit funds.

Correlations. Due to the interconnectivity of the global markets, correlations have risen over the last couple of decades. To compound the problem, in periods of shocks like the pandemic, most major asset classes moved in lockstep with one another.

Takeaway. Investors need to identify asset classes and investments that exhibit low-negative correlation with traditional investments.

Potential solutions: Global macro, managed futures and natural resources.

Inflation. After the economy was flooded with easy money to offset the effects of Covid-19, inflation began spiking in 2021, reaching levels not seen in decades. Many pundits have suggested the Fed is behind the curve and waited too long to begin combating inflation. In July, the inflation rate was reported at 9.1%, its highest level since the early 1980s.

Takeaway. Investors need to identify investments that can help in fighting the corrosive impact of inflation.

Potential solutions: Real estate, private credit, infrastructure and natural resources.

Volatility. The events above have led to increasing volatility, both in the number and magnitude of market shocks. We are constantly reminded of the fragility and interconnectivity of the markets and need to prepare for future shocks.

Takeaway. Investors need to identify investments to help buffer increased bouts of volatility.

Potential solutions: Natural resources, macro and multi-strategy hedge funds.