In the last couple of years, there have been many proclamations declaring the “death of the 60/40 portfolio.” The results in the first half of the year have prompted those declarations to proliferate, with stocks down 20% and bonds down over 10%—the 60/40 portfolio was off 16.9% through June 30. So why the fascination with the 60/40 portfolio, and if it is really dead—what’s next?

Following the lead of many institutions, the wealth management community began to focus on the 60/40 portfolio as a market proxy in the 1990s. This naïve benchmark provided a way to compare diversified portfolios, and it was easy to increase the equity allocation for aggressive investors (70/30) or decrease the allocation for conservative investors (50/50).

The expectation was that the 60% equity allocation would provide the growth in the portfolio, while the 40% bond allocation provided income. Together, investors got some level of diversification because stocks and bonds reacted to different fundamentals. The 60/40 portfolio worked well during the latest bull market, where U.S. equity returns soared to new highs, fueled by easy money and a zero-interest policy.

Today’s Market

After the longest bull market in history (2009-2020), the next 10 years are likely to be very different than the last 10 years. The easy fiscal and monetary policy served as an accelerant for the U.S. markets, pushing up stock prices without regard for valuations. With the strong U.S. market characterized by slow growth, low fixed-income yields and challenging economic conditions abroad, investors adopted a TINA (there is no alternative) approach to investing.

Today, we are dealing with the residual effects of the global pandemic, the Russian invasion of Ukraine, changing Fed policy, and record levels of inflation. The bottom line is the current market environment presents several challenges for advisors and investors—lower equity returns, low yields, elevated correlations, increasing bouts of volatility, and record inflation not seen since the early 1980s.

Let’s examine more closely and consider the responses.

Equity returns. The pandemic exposed supply-chain issues and an unhealthy dependence on certain countries for valuable resources (Russia, China, etc.). Companies have been impacted by supply access issues, rising costs, challenges in hiring people, and lagging revenues.

Takeaway. Many strategists are predicting substantially lower equity returns over the next 10-15 years.

Potential solutions: Private equity, real estate, event-driven and long-short hedge funds.

Fixed income. After the Great Financial Crisis, many countries began to offer negative-yielding debt. The Fed and other central banks kept rates near zero for many years before beginning to raise rates recently, with plans to raise rates dramatically to combat inflation underway.

Takeaway. While fixed-income yields have been rising, they are still below historical levels, and investors are seeking alternative sources of yield.

Potential solutions: Private credit, real estate and alternative credit funds.

Correlations. Due to the interconnectivity of the global markets, correlations have risen over the last couple of decades. To compound the problem, in periods of shocks like the pandemic, most major asset classes moved in lockstep with one another.

Takeaway. Investors need to identify asset classes and investments that exhibit low-negative correlation with traditional investments.

Potential solutions: Global macro, managed futures and natural resources.

Inflation. After the economy was flooded with easy money to offset the effects of Covid-19, inflation began spiking in 2021, reaching levels not seen in decades. Many pundits have suggested the Fed is behind the curve and waited too long to begin combating inflation. In July, the inflation rate was reported at 9.1%, its highest level since the early 1980s.

Takeaway. Investors need to identify investments that can help in fighting the corrosive impact of inflation.

Potential solutions: Real estate, private credit, infrastructure and natural resources.

Volatility. The events above have led to increasing volatility, both in the number and magnitude of market shocks. We are constantly reminded of the fragility and interconnectivity of the markets and need to prepare for future shocks.

Takeaway. Investors need to identify investments to help buffer increased bouts of volatility.

Potential solutions: Natural resources, macro and multi-strategy hedge funds.

Putting Theory Into Practice

To effectively deal with the challenging environment, advisors should utilize alternative investments, as sources of growth and income, as tools to dampen volatility, and as a means of hedging the impact of inflation. These valuable and versatile tools are now available to a broader group of investors, at lower minimums, with lower fees, and more flexible features, as I described in articles in the January-February Investments & Wealth Monitor and the May issue of Financial Advisor.

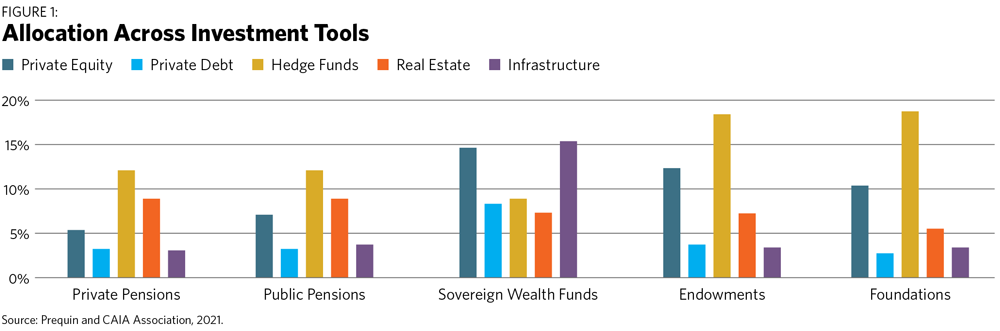

As the chart below illustrates, institutional investors have allocated to an entire spectrum of alternatives in a diversified fashion. Public and private pension funds, sovereign wealth funds, and endowments and foundations have all committed significant capital to private equity, private debt, hedge funds, real estate, and infrastructure.

The largest institutions often allocate most of their capital to a diverse set of alternatives. For example, the target alternative allocation for Yale’s endowment is more than 78% as of June 30, 2020, with specific target allocations to venture capital, leveraged buyouts, real estate, natural resources, and absolute return strategies.1 The target allocation to U.S. equities is a mere 2%. We’re not suggesting that advisors follow the Yale allocation with their HNW investors; we’re using the example to illustrate how one of the most successful endowments allocates capital.

Let’s consider the following case study.

Jim and Mary Smith are both 60 years old and have three children—Jamie 25, Jackie 21 and Joanie 18. Jim is a successful attorney and Mary is a schoolteacher. They both plan to retire at 65 years old. The Smiths have been able to save $5 million ($3.5 million in their personal accounts and $1.5 million in their IRAs). Their current income is approximately $650,000 per year (Jim’s salary is $500,000, Mary’s salary is $75,000, and they have $75,000 in portfolio income). They have no debt, no immediate cash flow needs, and they have experience investing in alternative investments. The Smiths are focused on capital appreciation over the next 10 years and have a healthy appetite for risk.

Based on the Smiths’ wealth and income, their experience with alternative investments, and their long time horizon, they are good candidates for alternative investments. But what types of alternatives? How should their allocation in their personal and retirement accounts differ?

Personal Accounts. Because they are primarily focused on capital appreciation, and have no immediate cash-flow needs, the Smiths can afford to lock up capital for an extended period of time. Their allocation would be as follows: private equity 10%, private real estate 5% and equity hedge 5%.

Retirement Accounts. Because the Smiths will be retiring in the next five years, they will need a combination of growth and income, and will want to buffer market shocks. Their allocations would be as follows: private real estate 10%, private credit 5% and relative value 5%.

The case study is designed to illustrate how to allocate capital for a sophisticated investor with significant wealth and income. Advisors should determine the appropriateness and amount of capital to allocate using several factors, including investor eligibility, risk profile, cash-flow needs, sophistication, time horizon and the goals they are trying to achieve. For private market funds, advisors should determine each client’s liquidity needs, as these funds should be viewed as long-term investments (seven to 12 years).

Conclusion

We can learn a lot by observing how institutions allocate capital. We adopted the 60/40 portfolio because we wanted to follow the institutional approach. As institutions have evolved their approach over the years, they increased their allocations to alternative investments to meet their portfolio needs—growth, income, defense, and inflation hedging.

Product evolution has helped democratize these once-elusive investments by making them available to a larger group of investors, at lower minimums and with more flexible features. Advisors should use these versatile and valuable tools to achieve their clients’ goals.

Tony Davidow, CIMA, is president and founder of T. Davidow Consulting LLC.

1. Andrew Bary, “Yale Endowment Has Just 2% In U.S. Stocks. Don’t Expect Major Changes Under The New Investment Chief,” Barron’s (September 2, 2021), www.barrons.com/articles/yale-endowment-only-2-percent-u-s-stocks-51630535033.