There are two main ways you can be amazingly successful as a wealth manager. One is to do a sensational job for your clients, helping them build their optimal financial world.

The other is by building your own highly profitable advisory practice. There are a number of ways to measure this success. Consider your income. A million-dollar annual income (or better) puts you at the very top of the advisory income hierarchy.

So why are not all wealth managers becoming personally very wealthy? The answer is pretty simple. They are hanging onto ineffective approaches, or they are simply not willing to put in the energy and time required to excel.

So why are not all wealth managers becoming personally very wealthy? The answer is pretty simple. They are hanging onto ineffective approaches, or they are simply not willing to put in the energy and time required to excel.

There are three things that success is strongly predicated on: 1) working smart and hard on behalf of your clients and yourself; 2) being able to identify appropriate wealth management solutions and efficiently deliver them; and 3) being able to build powerful business relationships.

Let’s look at each of these in turn.

Working Smart And Hard

Most wealth managers certainly work hard. They put in a great deal of time and effort attending to clients and building their businesses. A somewhat smaller percentage work both hard and smart.

The latter means you keep learning. Then you apply what you’ve learned to both better serve your clients and make yourself more successful. The world is changing at an incredibly fast pace (and so is the private wealth industry). Wealth managers need to stay on top of these changes because they affect everyone.

Consider the virtual family office, which offers the same benefits of the best single-family offices without the accompanying expenses. Virtual family offices are going to be increasingly asked for by the wealthy, and if you’re oblivious to them, you’re not being as smart as you could be. You don’t have to focus your business solely on such services, but you need to know what they offer and when they are appropriate.

Identify And Deliver Wealth Management Solutions

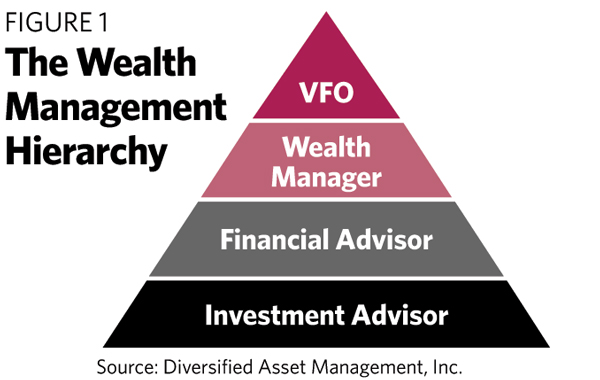

“Wealth management” is an umbrella term for both investment management and wealth planning. But quite a few self-proclaimed wealth managers are really just investment advisors who may occasionally refer someone to a lawyer or accountant. For them, the moniker is more about marketing and hype than reality.

Even those wealth managers striving to provide a comprehensive suite of products and services are most of the time poorly informed or ill-equipped to meet the needs of wealthier clients with more complex professional and life situations. These advisors are often referred to as “pretenders.” They mean well and they try hard. But they are sometimes not up to the job.