… Hits The Buffers

The age of plenty is now drawing to a close.

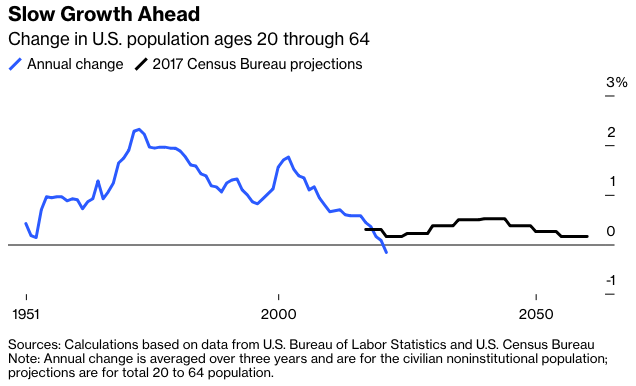

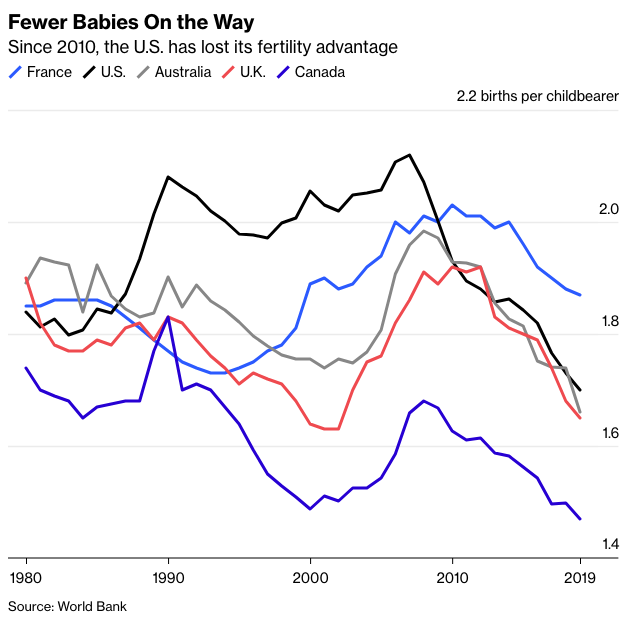

The United States is belatedly following the rest of the rich world into a low-fertility future. The 2020 census showed that the previous decade had the slowest growth rate since the Great Depression. And the 2020s don’t look as if they will be any better: The population grew by just 0.1% in 2021, the slowest rate since the nation’s founding.

There is little sign that the waning of the pandemic will lead to a new age of optimism and surging fertility like in the 1950s. Younger Americans are opting not to have children, whether because the cost of child-raising is so prohibitive or because they are worried about climate change. Indeed, San Francisco, the capital of the new tech economy, reportedly has far more dogs than children.

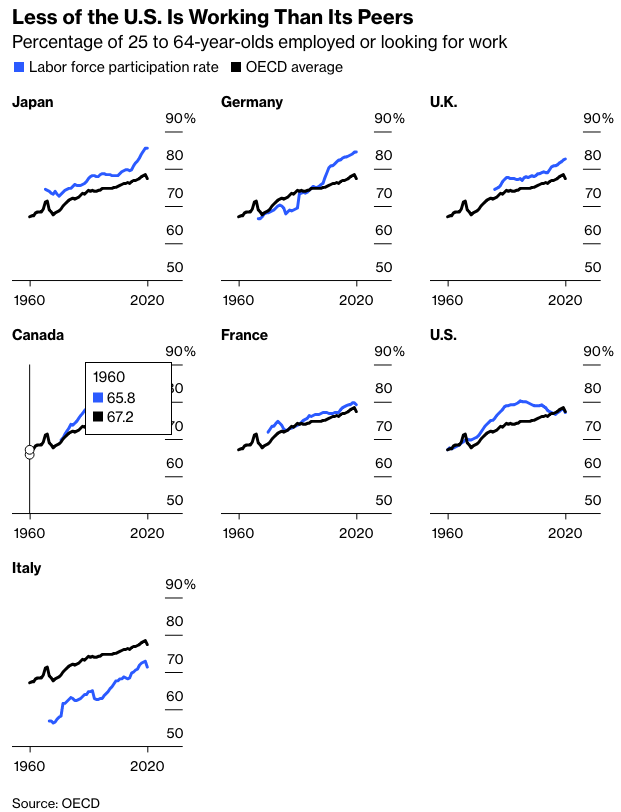

Compounding the fertility problem is the withdrawal of so many working-age people from the workforce. America’s total civilian labor force participation rate, which measures the share of working-age Americans who are either employed or looking for work, declined from 67% in 2000 to 62% in December 2021. By contrast, Britain’s rate stands at 77% and Germany’s at 76%. “We lag all of our peers in labor force participation now,” Federal Reserve Chair Jerome Powell told a Senate banking committee meeting in July 2021, “which is not where we want to be as a nation.”

A key driver of this depressing trend is the choice by so many men to drop out of the labor force. In 1961, the labor force participation rate for prime-age men was 97%; today it is 88%, lower than during the Great Depression. In other words, 1 in 10 men ages 25 to 54 is neither employed nor looking for work.

America’s triumphant educational story has taken a darker turn. High school graduation rates have stagnated: America is the only member country of the Organization for Economic Cooperation and Development in which the graduation rate for those ages 24 to 34 is no higher than for those ages 55 to 64. The expansion of college education is hitting the twin buffers of debt and utility: Americans owe $1.75 trillion in student loan debt, spread out among some 43 million borrowers, yet according to the Federal Reserve Bank of New York, more than 40% of recent graduates are underemployed in jobs that don’t require a college education. That’s a lot of money to spend on creating Nietzsche-reading baristas.