The sluggish US housing market is offering hope to first-time buyers that after years of soaring prices, competition and frantic bidding wars they may finally have a shot at homeownership.

They’ll just need to pay up.

Rising borrowing costs and still-high prices have pushed housing to the most unaffordable levels in records going back almost four decades, delivering a particularly hard blow to people trying to enter the market. First-time buyers made up the smallest share of sales on record last year, at 26%, even as home values started to cool, according to the National Association of Realtors.

With the spring homebuying season approaching — a time young families often try to find houses before summer and a new school year — scant inventory means there likely will be little reprieve. That’s pushing the American Dream of a single-family house with a yard, or even just a simple starter condo, increasingly to people who already have an economic advantage — be it high-paying jobs, a lot of cash or access to the bank of mom and dad. The rest are left out of a key opportunity to build wealth.

“We’re far from affordability for the masses,” said Nicole Bachaud, senior economist at Zillow Group Inc. “The scales are shifted toward homebuyers with higher incomes and a better financial background. This will be the norm until we get more inventory in the market.”

First-Time Buyers Face the Least Affordable Market on Record | Housing affordability has reached the lowest in data going back to 1986

The difficulties for first-time buyers have been escalating for years. During the pandemic boom, they were frequently squeezed out as they competed against people with cash and investors who frequently target starter homes. The typical household income for first-time buyers soared to as much as $90,000 in 2022 from about $70,000 in 2019.

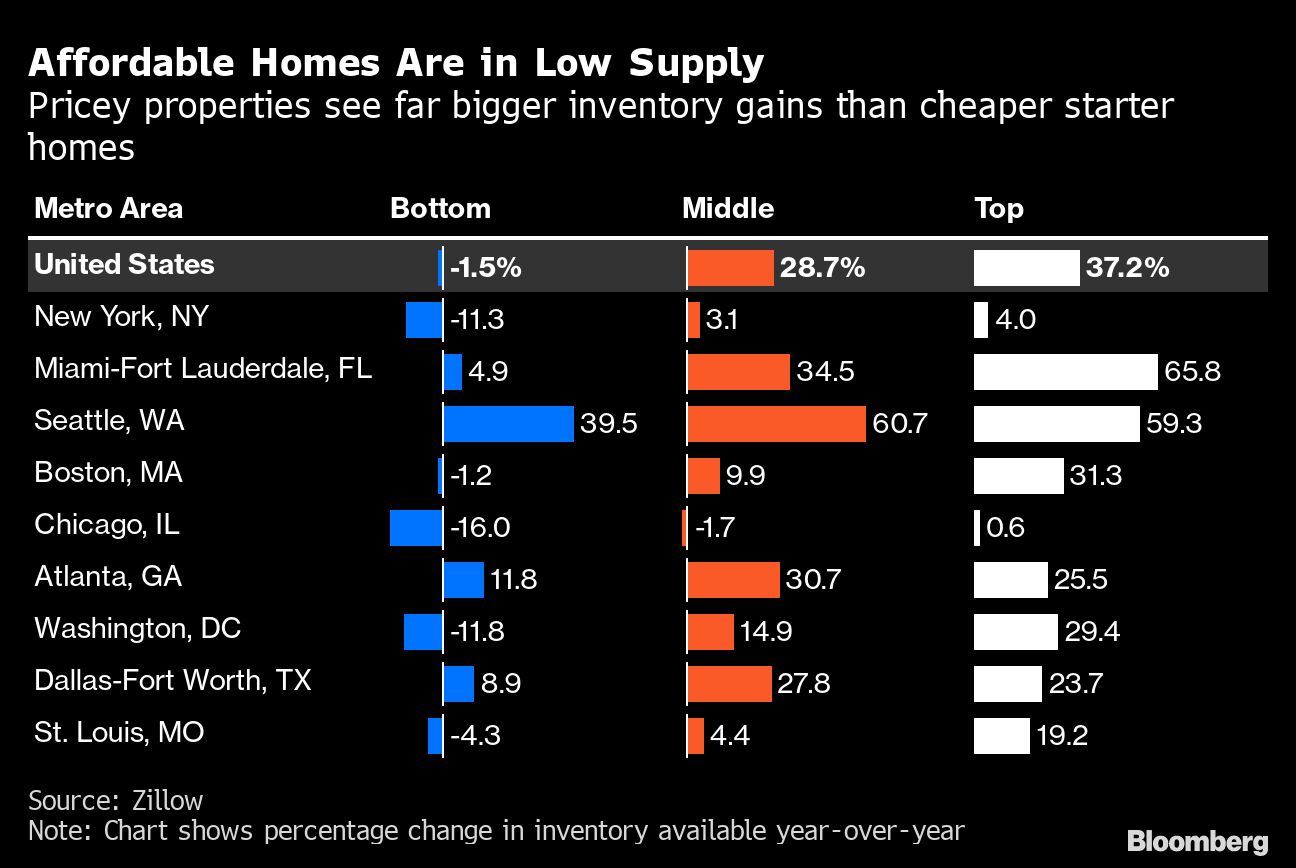

Now, the rapid surge in borrowing costs has created an additional barrier, Bachaud said. When mortgage rates hit 7% last fall, Zillow estimated it would take nearly 10 years for an individual saving 5% of the median household income every month to put aside a 10% down payment on a typical home. And entry-level supply remains tight: The inventory of the country’s cheapest houses was down 1.5% in January from a year earlier, while it jumped 37% for the most-expensive properties.

Falling Behind

After waiting out two years of all-cash buyers and bidding wars, Rob and Kelsey Scott began the hunt for their first home in Seattle in August. With a combined income of $200,000, they had jobs that enabled them to build savings toward a $70,000 down payment. Still, they had to lower their budget from $800,000 after the surge in mortgage rates.

The newlyweds were able to land a two-bedroom house in a quaint neighborhood with local pubs and parks just north of Seattle, but only after bidding $50,000 over the $650,000 asking price.

“If we compared ourselves to our parents who bought in their late 20s, we felt like we were behind. But if we look around today, we’re on track,” said Rob Scott, 35. “Where we were workwise as a couple is the only reason we’re in a house.”

Indeed, the median age of first-time buyers jumped from 29 in 1981 to 36 in 2022 — the oldest in the National Association of Realtors’ records. That’s because home values have far outpaced wage gains, said Skylar Olsen, Zillow’s chief economist.

The widening chasm stands to exacerbate wealth and racial disparities. For a disproportionate number of Black and Latino families who have never owned, it’s harder to “get a foot on the wealth-building ladder,” said Jenny Schuetz, a senior fellow at the Brookings Institute’s Brookings Metro.

It also hinders the type of generational wealth that helps some first-time buyers get in the door in the first place.

In New York City, Maddy Duleyrie was able to buy a condo for one reason: help from her parents. Even though she’s “fortunate to have a well-paying job,” the 29-year-old New Jersey native said she couldn’t buy her own place on her own with the “cost of living and the lifestyle” she wants.

“I don’t know how anyone could afford a home on their own at my age,” she said.

With her parents funding the purchase, Duleyrie placed an all-cash offer for a unit in an elegant postwar building with a full-service doorman in Manhattan’s West Village at the end of the year and is on track to close by March.

“It’s a buyers market for a few, not a ton,” Duleyrie said.

Parental Help

Before the pandemic, about a third of first-time homeowners relied on a gift or loan from families or friends for at least part of their down payment, said Zillow’s Olsen. That increased to about 40% in 2021, she said. Meanwhile, the number of young adult buyers with an co-borrower over the age of 55 has spiked since 2021, according to Freddie Mac.

“I see some parents giving gifts for the full price of a million-dollar property,” said Kimberly Jay, a New York broker with Compass, whose clients include the Duleyrie family. “This is a city with wealthy people.”

Even in far-cheaper Dallas, at least half of young first-time buyers are getting financial assistance from their families, said real estate agent Connie Segovia. Most are receiving the entirety of the minimum down payment, she said.

For other buyers, the only option is to stretch.

Ashley Shipp-McGhee didn’t just want to buy her first house — she urgently needed more space after adopting her late aunt’s two children. The 39-year-old nurse started her search in December 2021 in the Illinois suburbs north of St. Louis, with a $260,000 budget.

Nearly one year and 30 houses viewed later, she finally landed a place for $256,000, a higher price than she had hoped.

She used an escalation clause to pay $1,000 over competing offers, waived the inspection and paid all the closing costs. She felt “uncomfortable” with her monthly mortgage payments after she was preapproved for 2.9% at the beginning of her hunt, only to close on the home at 6.4%. But she’s holding on to hope that she can refinance down the line if rates go down.

“We needed a house now,” Shipp-McGhee said. “With two additional kids, I knew I had to finish and do this.”

Bloomberg News is conducting a survey on what it means to be rich in America and we want to hear from you. Take our survey here.

--With assistance from Prashant Gopal and Patrick Clark.

This article was provided by Bloomberg News.