Key Takeaways:

• We believe the performance of real estate, after adjusting for key differences, should be largely independent of the ownership structure used to make that investment.

• Real estate securities (publicly traded or listed vehicles, often structured as Real Estate Investment Trusts, “REITs”) represent an intersection of the equities and private real estate markets.

• Given the potential benefits of the public market, we believe that REITs offer a compelling complement to the private market for investors seeking to access the potential benefits real estate provides to a diversified portfolio.

Commercial real estate investments have generated compelling returns over the past 20+ years, both via public and private markets, outperforming both equities and bonds.1 In recognition of its strong performance and unique investment attributes, real estate has become an integral component of virtually all asset allocation models.

Source: FactSet, NCREIF. Note: As of December 31, 2016. For illustrative purposes only. US REITs = FTSE NAREIT All Equity REITs Index. US Equities = S&P 500 Index. US Corporate IG Fixed Income = Barclays US Aggregate Credit Corporate Investment Grade Index. US Private Real Estate = NCREIF Property Index. Past performance does not guarantee future results, which may vary.

Despite the increased size and recognition of REITs, we believe that investors are not properly allocated to the asset class due to concerns that REITs behave more like stocks than like real estate.

Real estate securities (publicly traded or listed vehicles, often structured as Real Estate Investment Trusts, REITs) represent an intersection of the equities and private real estate markets. Real estate securities have performed particularly well over the past two decades, and now comprise roughly $2tn in market cap globally (50% of which lies in the US). As an important part of broader equity markets, real estate has recently earned its own GICS sector classification.

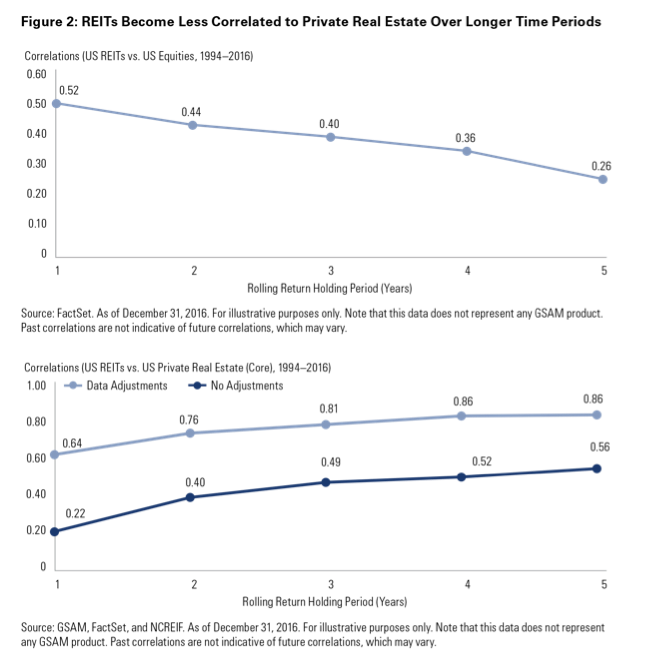

However, after adjusting for leverage, pricing frequency and composition, we find that REITs behave like real estate over the long term. In particular, our analysis tells us that REIT volatility and correlations resemble those of private real estate more closely than those of equities (Figure 2).

While there are similarities in the investment outcomes of both REITs and private real estate, REITs are not completely different from public securities either. Indeed, we believe REITs provide numerous potential benefits associated with listed securities. For example, unlike private real estate, REITs offer daily liquidity, which allows investors to increase or decrease exposure to different sectors, geographies or management teams as markets evolve.

Furthermore, REITs offer access to non-traditional property types such as cell towers and data centers, which are accessible primarily through public markets. Better yet, investors can diversify across property types at investments of all sizes. As a result, investors are more easily able to reduce idiosyncratic risk associated with each property.

By virtue of being publicly traded companies registered with the Securities and Exchange Commission, REITs are required to regularly file public financial statements, allowing for greater transparency. Having access to key fundamental metrics reported in the statements such as leverage, occupancy, lease terms, fees and management compensation, can help investors make better informed investment decisions.

Finally, REITs offer relatively low costs compared to the private market. Since transaction costs have already been paid by REIT sponsors, brokerage and legal fees are not borne by investors, nor are investors charged performance-based incentive fees.

For investors seeking real estate exposure, we believe that REITs offer the best of both worlds: real estate assets with equity-like implementation attributes. Given this attractive blend, we believe that REITs deserve closer consideration when investors make asset allocation decisions in the context of a broadly diversified portfolio.

Correlation measures the degree to which two securities move in relation to each other.

The FTSE NAREIT US Real Estate Index is designed to present investors with a comprehensive family of REIT performance indexes that spans the commercial real estate space across the US economy. The index series provides investors with exposure to all investment and property sectors. In addition, the more narrowly focused property sector and sub-sector indexes provide the facility to concentrate commercial real estate exposure in more selected markets. The FTSE NAREIT All Equity REITs index contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 7.8 trillion benchmarked to the index, with index assets comprising approximately USD 2.2 trillion of this total. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors and held in a fiduciary environment.

The Barclays US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers. The US Corporate Index is a component of the US Credit and US Aggregate Indices, and provided the necessary inclusion rules are met, US Corporate Index securities also contribute to the multi-currency Global Aggregate Index. The index was launched in July 1973, with index history backfilled to January 1, 1973.

Equity securities are more volatile than bonds and subject to greater risks. Small and mid-sized company stocks involve greater risks than those customarily associated with larger companies.

An investment in real estate securities is subject to greater price volatility and the special risks associated with direct ownership of real estate.

Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. REITs whose underlying properties are concentrated in a particular industry or geographic region are also subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors.

Collin Bell is managing director at Goldman Sachs Asset Management.