If you met someone from asset manager ARK Invest in an elevator and asked them for their quick-hit pitch on what they do, they’d probably say, “We invest in disruptive innovation.” If you were in a tall building and both of you were heading to the top floor and you had time to hear more, they might explain that the firm has identified 14 transformative technologies—grouped within five transformative innovation platforms—it believes will fundamentally change the world within 10 years or so.

And as the elevator reached its final destination and you and the ARK person were stepping out, that person could leave you with this parting shot: “Given the magnitude of the technological impulse we are anticipating, aggregate equity market capitalizations could appreciate at a more rapid rate than historically has been the case, as the exponential growth associated with innovation increases average returns.”

That last quote was ripped from a 2019 white paper written by ARK research director Brett Winton that laid out the company’s case for investing in disruptive innovation right now while these various trends are in their early stages. And for the most part, the New York City-based firm has nailed it since it set up shop in early 2014 and began running its strategies in exchange-traded funds, mutual funds, managed accounts and other investment vehicles.

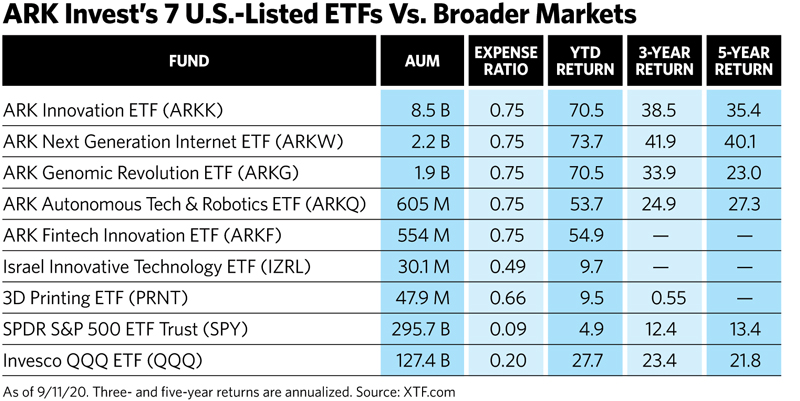

More than 40% of its total asset base of $28.4 billion (as of August 31) resides overseas thanks to its partnership with Japan’s Nikko Asset Management, but the stars of the show in this country are its seven U.S.-listed ETFs, five of which are actively managed. The largest product, the ARK Innovation ETF (ARKK), had nearly $8 billion in assets and a year-to-date return of 70.5% through September 11. It and Ark’s next two largest funds—the ARK Next Generation Internet ETF (ARKW) and ARK Genomic Revolution ETF (ARKG), both with assets of about $2 billion—have generated returns that blew away the S&P 500 and Nasdaq-100 indexes during the past five years (see the accompanying chart). The firm’s other two active ETFs are also strong performers, while the two passive funds have produced modest results.

Has the ARK team benefited mainly because the company came of age during a long bull market in equities, or have they presciently identified—and consistently exploited—massive early-stage opportunities with tons of upside potential? In other words, are they good or just lucky?

Naturally, ARK believes it’s the former. “How we structure our research ecosystem allows us to capture innovation, and it really takes a firm that’s solely dedicated to that,” says Renato Leggi, ARK Invest’s client portfolio manager. “It’s hard to wrap that into a larger firm with multiple portfolio management teams and in some cases with conflicting views about different asset classes. Cathie experienced those challenges at her prior firm, and she wanted to start ARK in order to create a firm that’s solely focused on innovation.”

That would be Catherine Wood, the firm’s CEO and chief investment officer, who before creating ARK spent 12 years at AllianceBernstein as CIO of its global thematic strategies. According to the firm’s website, ARK stands for “active” management; an open “research” ecosystem not bound by sectors, geographies or market caps in the attempt to capture the convergence of technology; and sharing “knowledge” to gain a deeper understanding of the areas the firm researches and invests in.

The crux of ARK’s investment thinking is that we’re in an era of unprecedented technological change that will see critical inflections in 14 transformative technologies. And because many of them overlap, ARK groups them into five platforms: artificial intelligence, DNA sequencing, robotics, energy storage and blockchain technology.

In his white paper, Brett Winton wrote that transformative technologies cause dramatic declines in costs, impact many industries and geographies, and serve as platforms for more innovation. He noted the world “has yet to feel the full force of the rogue technology wave that is likely to crest at three times the amplitude of any technology cycle in history.”

According to ARK’s estimates, the five technology platforms should generate more than $50 trillion in business value and wealth creation over the next 10 to 15 years. “Today, they are in their infancy and account for less than $6 trillion in global equity market capitalization, giving investors an opportunity to capitalize by almost 10-fold if they have positioned their portfolios on the right side of innovation,” Winton wrote last year.

Inflection Points

In ARK’s quest to identify potential winners among the innovators, the firm’s analysts eschew benchmarks and indexes when screening for ideas because these are backward-looking tools. “The core of our philosophy is we’re 100% forward looking,” Leggi says, adding that the firm’s research focuses on identifying where the innovation platforms or technologies are, and from there whether they meet certain criteria that make them ready for prime time.