The proliferation of fintech firms claiming to be able to guess how investor portfolios will behave compels us to highlight the stark philosophical differences between the “Historical Data Model” Riskalyze has always leveraged, versus the “Predictive Guesswork Model” used by a few others.

It’s Time To Bring Sunlight And Transparency To These Levers That Have Been Hidden From View

These differences have profound implications for the liabilities shouldered by financial advisors and wealth management enterprises as they serve investors, and we believe risk analytics should control and reduce those liabilities, not increase them.

More importantly, deeply flawed predictive methodology puts the mission we share with these advisors—empowering the world to invest fearlessly—at risk.

That’s why we have consistently won plaudits from compliance teams, enterprise executives, and regulators. They understand that Riskalyze isn’t a liability-creating prediction engine. Instead, we use objective data to calculate historical ranges of risk for portfolios, and help investors react to risk appropriately, so they can invest without fear.

Why speak up about the small number of providers who use dangerous methodology? Isn’t Riskalyze’s approach winning in the market?

It’s true: over 4x as many advisors have chosen Riskalyze as all of the other risk solutions combined (Source: According to the T3 Market Research Survey in 2021, Riskalyze had 16x the market share of HiddenLevers and 123x the market share of Rixtrema.). We serve tens of thousands of financial stewards who have a fiduciary duty to act in the best interests of their clients. We can’t stay silent and allow flawed methodology to put our profession at risk of violating its fiduciary responsibilities.

A Tale Of Two Completely Different Approaches

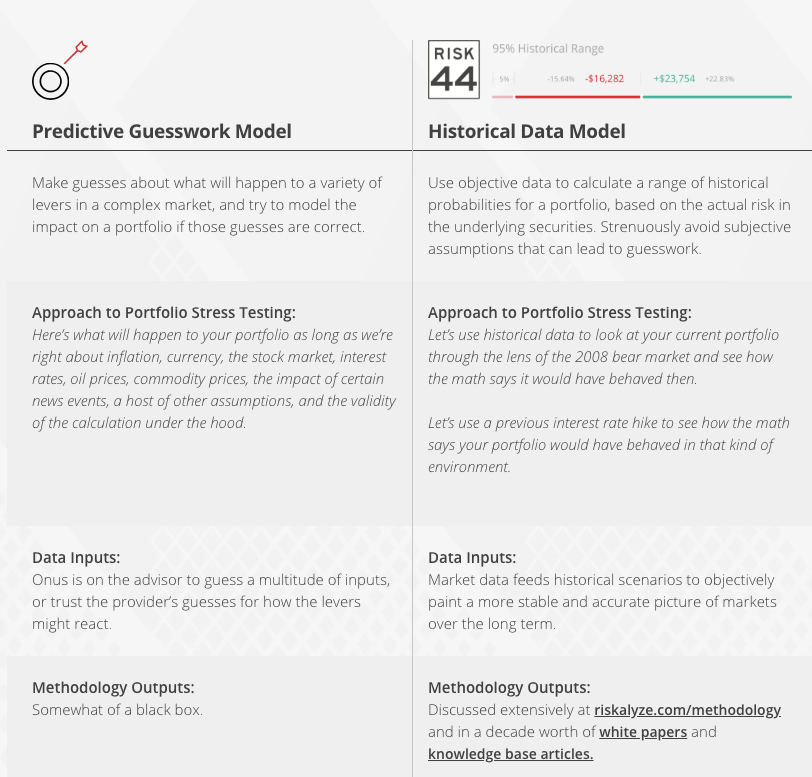

Advisors should beware: there are two very different approaches to risk analysis and stress testing. Riskalyze leverages a Historical Data Model and calculates a historical range to illustrate risk and support client behavior.

Tools like HiddenLevers and RiXtrema are spearheading a Predictive Guesswork Model that attempts to forecast what complex markets and portfolios will do.

These are two fundamentally different views of how to approach risk.

Not only is the Predictive Guesswork Model fundamentally flawed, the providers who use it are wildly inaccurate.

If You’re Going To Make Predictions, You’d Better Be Accurate When Your Clients’ Future Is On The Line

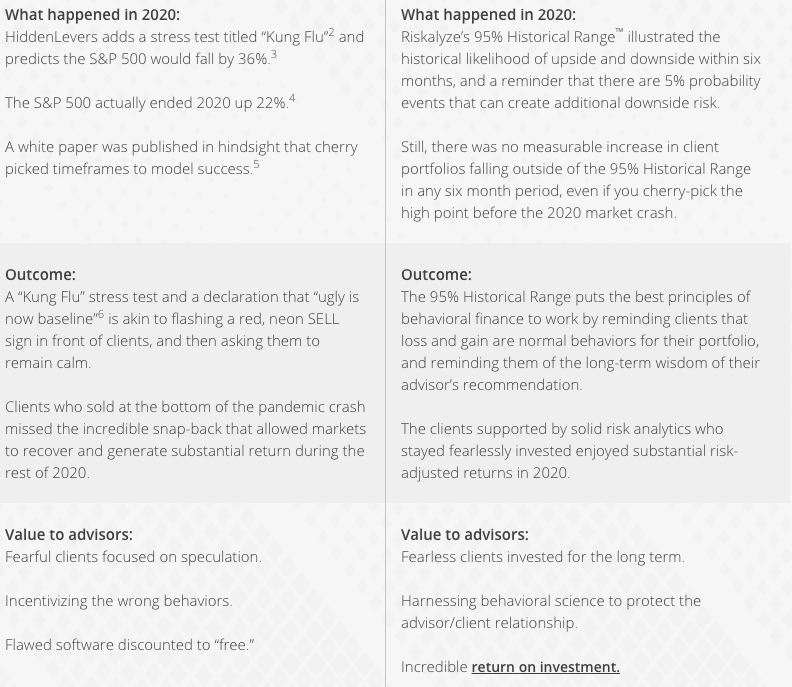

On March 12, 2020, HiddenLevers hosted a webinar titled “Black Swans are the New Black,” and highlighted the potential S&P outcomes. They shared a risk model that said the S&P 500 should be expected to drop 24.8% in the coming year, when in fact the S&P 500 returned a positive 22%, a difference of 47% (Source: HiddenLevers "Black Swans are the New Black" Webinar, March 12, 2020). Another webinar3 predicted the S&P 500 would drop 36% in the coming year, a difference of 58%!

Even more disturbing? Despite being irresponsibly wrong in their analysis, they had the audacity to publish a white paper rewriting that history with cherry-picked timeframes claiming their prediction was a success (Source: HiddenLevers 2020 Model Performance Review White Paper).

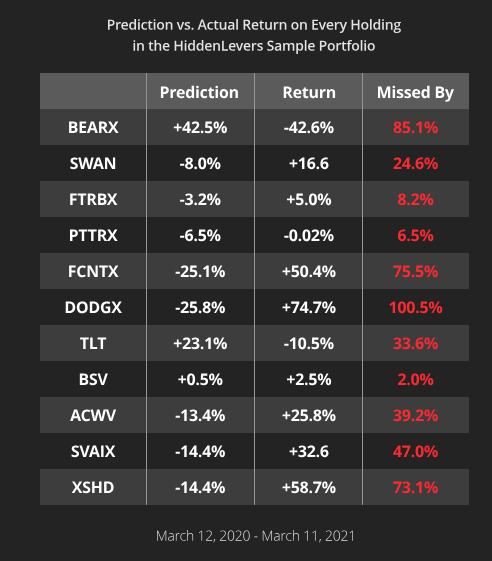

Here’s a table that illustrates the danger of the Predictive Guesswork Model, with the eleven holdings HiddenLevers tried to predict on March 12, 2020.

Rixtrema’s Predictive Guesswork Hasn’t Held Up Either

When their crash test modeled oil dropping 50%, they projected that three different funds would therefore be down between 22% and 38% (Source: Rixtrema's predictions of portfolio behavior in response to changes in oil prices are outlined in Mike McDaniel's 2019 Fearless Investing Summit keynote.)

Soon after, it just so happens that we got to see the scenario play out in real life. Oil actually did drop 50%, and all three funds went up.

If you had been lucky enough to guess the price of oil correctly, the Predictive Guesswork Model would’ve gotten it completely wrong—all because of bad methodology.

Now imagine having to correctly guess on 10 different factors.

Which Leads Us To The Critical Question: Do You Want Your Risk Solution To Create Fear, Or Fight It?

The approach championed by HiddenLevers and RiXtrema—modeling doomsday scenarios based on guesswork about how they will impact market levers—does nothing but incite fear in your clients. It’s like a neon red “SELL” sign flashing in their faces. It completely undermines your message as an advisor, and exacerbates a client’s natural tendency to make fear-driven decisions that can blow up their financial futures.

Riskalyze was founded on the belief that you solve the behavior problem, and fight fear, by helping clients see what is normal behavior for their portfolio using the 95% Historical Range, and educate them about 5% downside events using historical stress tests. When you do that effectively, you empower that client to make fearless investing decisions that lead to great long-term financial outcomes.

2HiddenLevers "Fighting the Kung Flu" Webinar, January 30, 2020

3HiddenLevers "Recession Immunity" Webinar, February 26, 2020

4Actual results of the S&P 500 index for 2020