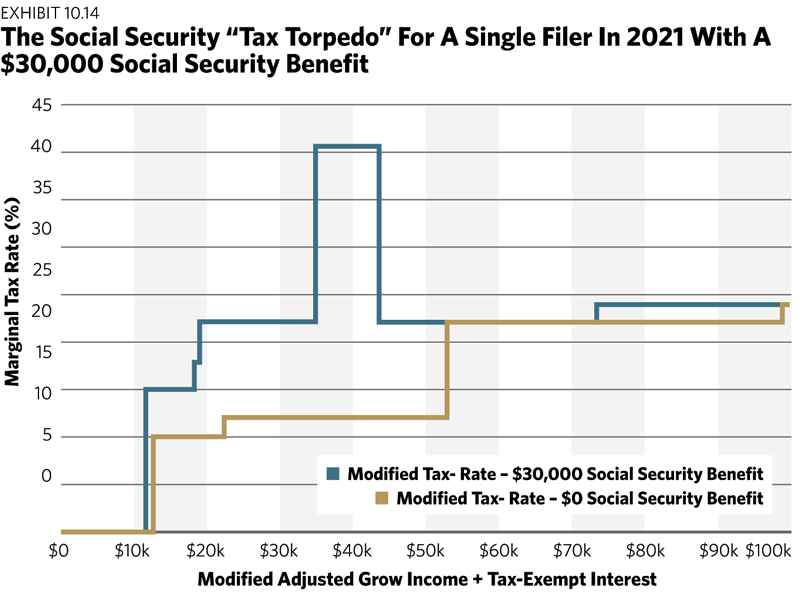

Exhibit 10.14 provides a visual illustration of the tax torpedo for Social Security. In this example, we consider a single filer in 2021, and the assumed Social Security benefit is $30,000. The exhibit plots the MAGI plus tax-exempt interest against the marginal tax rate on $1 of additional income. I will simply call this amount MAGI to avoid having to keep writing “plus tax-exempt interest” every time as well. When the liMAGI reaches $11,700, the marginal tax rate jumps to 15% (this is a 10% federal tax bracket and a trigger of 50% of a Social Security dollar becoming taxable). It jumps to 18% at $18,334, 22.2% at $19,000, and 40.7% at $34,987. It then drops to 22% at $43,706. The MAGI of $43,706 is the point which serves as the upper limit of the tax torpedo with the $30,000 benefit, as now 85% of Social Security is taxed. Subsequent increases in taxable income do not also cause more Social Security taxation. With this benefit, a MAGI of $43,706 represents an AGI of $69,206 with 85% of Social Security added. With a standard deduction of $14,200 for single filers over 65, this represents a taxable income of $55,006.

For tax bracket management, the MAGI of $43,706 becomes an important threshold where there can be extra advantages to stay below it as possible. Otherwise, once getting past this threshold, taxpayers then experience a range where the marginal tax rate is back down to 22%. Understandably, it can be very clunky to move this discussion back and forth between MAGIs, AGIs, and taxable incomes, but at least I hope this discussion has helped to provide a sense about how this tax torpedo can uniquely increase marginal tax rates for retirees as income triggers taxes on itself as well as on more of Social Security.

Social Security taxation creates a case for more than just tax bracket management; it also can add greater after-tax value for delaying Social Security benefits. If one is already retired at age 62, delaying Social Security benefits to 70 could help to provide a foundation for making more Roth conversions before Social Security benefits begin, which could then help keep taxable income lower after age 70 so that Social Security then does not experience as much of the tax torpedo. If Social Security is delayed until age 70, then pre-70 taxable income is reduced. Those waiting to age 70 will have more opportunity to conduct Roth conversions and realize long-term capital gains on taxable accounts at lower tax rates. This will also help to reduce taxable income later after benefits begin. Subsequent Roth distributions do not count when determining how much of Social Security is taxable. Those with the capacity to get a large portion of their IRAs converted to Roth accounts prior to beginning Social Security could enjoy substantial tax improvements. Not only will Social Security benefits be larger, but less, or at least a smaller percentage, of those benefits count as taxable income. These strategies may also help later in retirement to lower the amount of RMDs, to increase the cost-basis for taxable accounts, and to create less pressure to make taxable withdrawals to meet retirement spending needs. Social Security delay frequently complements strategies to support more after-tax spending power.

The tax torpedo can apply for couples as well, and its specific shape does depend on the level of Social Security benefits. The torpedo has the biggest impact when it is adding Social Security taxes on top of the 22% tax bracket, getting the marginal rate up to 40.7% for a portion of income. If the old tax code returns in 2026, the tax torpedo could impact the 25% tax bracket, which would amplify the marginal tax rate to 46.25% with Social Security’s impact included.

That is not even the whole story. These tax rates could be even higher if there were long-term capital gains that further get pushed from the 0% tax bracket to the 15% tax bracket as Social Security becomes taxable. For this to be relevant, the household would need to still be in the 12% tax bracket and in a range where a dollar of income is taxing 85% of a dollar of Social Security. If this also then pushes $1.85 of long-term capital gains from the 0% to the 15% tax bracket, then suddenly the marginal tax rate is 49.95%. With the tax rates scheduled to return in 2026, the 12% tax bracket becomes 15%, which then increases the overall marginal tax rate to 55.5% for this perfect tax storm. Retirement tax rates will not always be lower in retirement, especially when a dollar of income leads to tax on that income, tax on more of Social Security, and tax on more of long-term capital gains or qualified dividends.