A Canadian baby boomer couple would have amassed an additional $360,000 over 40 years by investing in an all-bond portfolio rather than in one based on Modern Portfolio Theory and the Efficient Market Hypothesis, a new study shows.

Their all-bond portfolio would have performed even better than an all-equity one, outperforming by more than $700,000.

The study, by Jim Fischer of the Mount Royal University in Canada, was the subject of a breakout session at the FPA’s annual conference today in Minneapolis. Its purpose was to evaluate how well Modern Portfolio Theory (MPT) and the Efficient Markets Hypothesis (EMH) served Canada’s baby boom generation.

The study did concluded that the portfolio based on MPT and EMH did serve a hypothetical average baby boomer couple well after 40 years of investing because it would have provided adequate income for their retirement beginning in 2017. Skeptics might conclude that the results are skewed because the 40-year period starting in 1977 begins when interest rates in both Canada and America were approaching historical peaks.

The authors address this. “While the 40-year period does suggest bonds outperform stocks, longer-term analysis still says otherwise,” the study said. “While the couple in this study from 1977 to 2016 would have done better had they invested only in the bond index, the anomalies of the stock market in the new millennium could not have been known to them. In any time period measured, either bonds or stocks will likely outperform the other by some degree. While stocks might historically have been the favorite in the long term to outperform, the 40-year period studied here provides proof that diversification among asset classes is necessary, and returns in any one-time period can be surprising.”

In the 40-year time period studied, the Canadian stock market “underwent two 50% corrections," beginning in 2000 and 2007 respectively. "The ‘lost decade’ followed the historical bull market for stocks in the 1990s,” it noted. While the performance of U.S. stocks and bonds were somewhat different from Canada's over that 40-year time period—America's economy has a bigger technology sector while Canada's is more dependent on resources and energy—the larger trends were somewhat similar.

The study modeled retirement planning for a couple during the 40-year period from 1977 through the end of 2016. At retirement in 2017, the husband would have been 65 and his wife, 63, and they would have two grown children, two year apart in age, who were no longer dependents. The study considered all income sources, and the family was employed in jobs that didn’t have traditional pensions. The family invested 20% of their after-tax income in investments at the end of each month into a retirement account, where the investment grew tax-free.

The equity portion of any of the portfolios studied was invested in the S&P/TSX Composite Index, the main broad-based index of the Canadian stock market. The fixed-income portion of the portfolios was invested in a bond-index fund based on the total returns of the FTSE TMX Canadian Universe Bond Index, the broadest and most widely used measure of performance of marketable government and corporate bonds outstanding in the Canadian market.

The amount invested was dollar-cost averaged into either equity or fixed income. The couple used dynamic asset allocation so the MPT/EMH portfolio would be adjusted annually in December if it became unbalanced. By December 2016, the couple would have invested a total of $425,389.68.

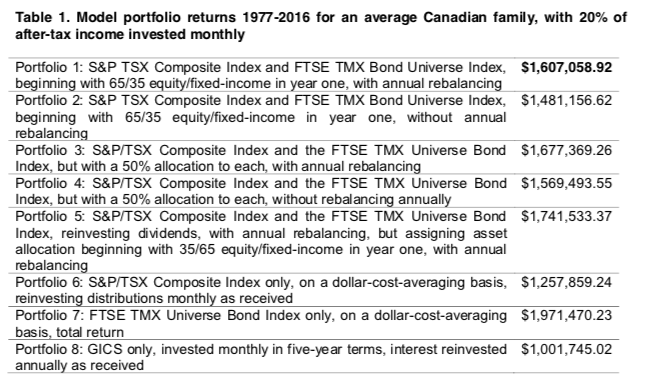

The study looked at returns of eight different portfolios. The MPT/EMH portfolio was to have assets of 65% equities/35% fixed income in year one, with annual rebalancing. The total accumulated in that portfolio after 40 years by the end of December 2016 was $1,607,058.92 – which included $629,580.99 in the equity index fund and $976,079.60 in the bond index fund.

On the other hand, the all-bond portfolio hit $1,971,470.23, while the all-equity portfolio reached only $1,257,859.24. (See table 1.)

The study also looked at how long the portfolio could fund retirement for the couple, based on various scenarios. The annual income of the hypothetical couple was $83,900 during the last year they were in the workforce, and the study assumed they would need only 70% of that income, or $58,730, indexed to 2% inflation, after retirement. With a 5% annual investment return, all of the portfolios had balances of more than $1 million when the couple reached age 100.

However, if the couple were to begin yearly withdrawals at the amount they earned in their last year before retirement -- $83,900 – the portfolio based on MPT/EMH was depleted by age 93 and some were depleted far earlier. The only portfolio with a balance when they reach 100 under that scenario was the all-bond one, which had started at nearly $2 million and had $844,559.59 left.

The study also looked at how the various portfolios would be depleted if there were no annual investment return. Not surprisingly, they were depleted even sooner.

Fischer’s study is entitled “Modern Portfolio Theory and the Efficient Market Hypothesis: How Well did they Serve Canada’s Baby-Boom Generation?”