Big data and artificial intelligence (AI) have tremendous disruptive potential in nearly every industry, and financial services is no exception. These powerful technologies are set to change the way in which plans are delivered, as well as the resulting relationship between financial professionals and clients.

In a recent study, eMoney found that financial professionals believe in many instances that big data and AI technologies are already impacting the financial planning process, as outlined by the CFP Board or will be impacting this process in the near future (Source: eMoney Advisor, Power to the Plan Research, July 2020, Advisors n=420, End clients n=403).

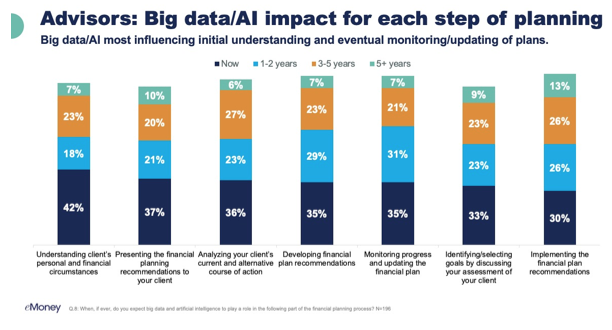

The results of this study are largely consistent: Over half of financial professionals believe every step of the planning process will soon be impacted by these technologies, if it's not already impacted, and the vast majority of financial professionals believe these technologies will make an impact within five years.

Big data and AI are no longer buzzwords—they are having a tangible impact on the industry today, and their influence on financial plan delivery is going to grow at a rapid pace. If we take a closer look at the technology that's impacting each step of the planning process, we can start to paint a picture of what the future of financial planning may look like.

New Technology For The 7-Step Financial Planning Process

Big data and AI will not change the process of planning—their impact will primarily be in enhancing efficiencies, taking much of the burden of planning off the financial professional's shoulders, and improving outcomes for clients.

These technologies may offer solutions the industry has long sought: personalization at a scale never before possible, a planning workflow that intuitively facilitates all other wealth management activities and planning services that are accessible to the masses.

Steps One, Two And Three: Intelligent Financial Planning Technology Guides The Beginning Of The Relationship

The first three steps of the CFP Board's financial planning process are all about getting to know the client's personal circumstances, their financial situation, their short- and long-term goals, as well as their most closely held values, so that you can build a plan that supports their financial health and a fulfilling lifestyle.

The majority of financial professionals believe that big data and AI are impacting these steps or will impact these steps within two years (Source: eMoney Advisor, Power to the Plan Research, July 2020, Advisors n=420, End clients n=403):

• Step 1: Understanding the client's personal and financial circumstances—60%

• Step 2: Identifying and selecting—56%

• Step 3: Analyzing the client's current course of action and potential alternative courses of action—59%

The types of technology that will enhance this part of the process focus on streamlining the start of the planning engagement and ensuring both client and planner are prepared to build a relationship based on holistic financial advice.

Account aggregation technology will go beyond the ability to simply pull together financial information—it will also pull in the context of each account's activity, along with the ability to automate the execution of account actions within predetermined parameters in a financial plan developed by a financial professional.