Now that the cryptocurrency market has rebounded somewhat from the mid-June lows—which were as low as any since 2020—and volatility is muted by crypto standards, many investors are asking if we’ve seen the bottom. The forced de-levering from earlier in the month seems to be over, and the scattered collapses in various digital assets do not seem to have triggered an unstoppable cascade. Remaining investors seem to have the will to withstand further declines if they happen, and surviving crypto institutions seem to be in reasonably good shape.

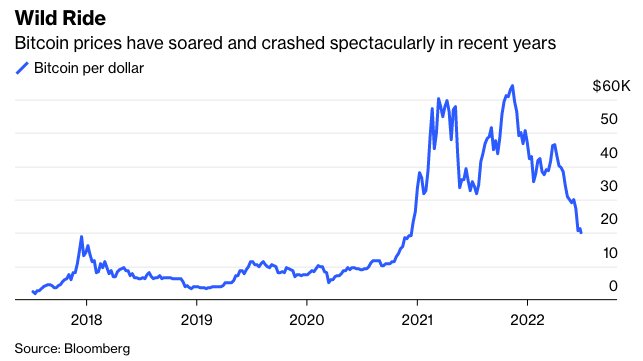

Even if the worst is over, we don’t know if there will be a rapid recovery. Recall that after the 50% decline from April to July 2021 prices quickly rebounded to a new peak but following the crash that began in December 2017 it was more than two years before prices increased on a sustained basis.

Calculating a fundamental value for crypto is impossible as there are too many essential unknowns. We can, though, try to compare crypto with other assets to see if it seems under or overvalued on a relative based on a historical basis. I will look at Bitcoin only, because it is the liquid of digital currencies, and has long served as a bellwether for much of the crypto market. (I own Bitcoin and other crypto assets.)

One major component of Bitcoin is a levered investment in technology. The same forces that drive profits in technology firms in general drives the financial success of crypto, although not necessarily its fundamental utility, which is something quite different. Crypto projects are certainly riskier than most technology stocks, and more thinly capitalized.

Bitcoin is also correlated to the price of gold. It’s often assumed the correlation should be positive, as both gold and Bitcoin can be used to store value unaffected by inflation and other currency problems and can be transferred more easily than dollars when sanctions are a problem. In actuality there is a strong negative correlation when adjusting for other factors. Gold and Bitcoin are opposite solutions to a lack of faith in currency. Gold is simple and tangible, and supported by thousands of years of history, and no theory. Bitcoin is complex and abstract, supported by 14 years of extreme volatility, with a great theory. Gold requires no infrastructure; Bitcoin requires enormous worldwide infrastructure.

Bitcoin has also benefitted historically from volatility in both tech stocks and Bitcoin itself. It’s not as if investors like the volatility and bid up the price as a result, it’s that innovation requires volatility to thrive.

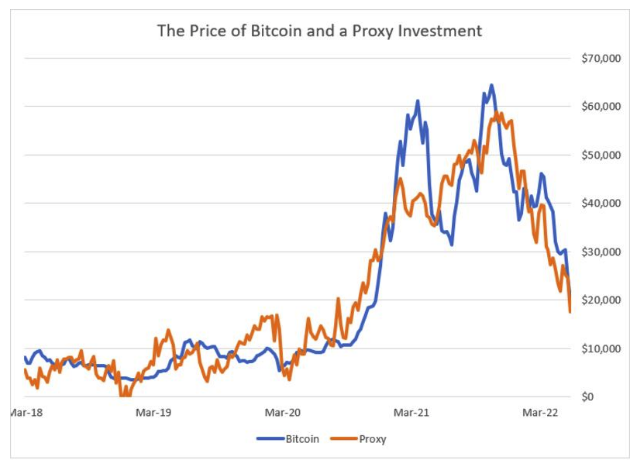

Four factors to proxy Bitcoin prices explains 88% of the variance in prices the last four years, as shown in the chart below. The proxy portfolio matching one Bitcoin today consists of - in round numbers - $82,000 of the Nasdaq 100 Technology Index, with $21,000 of borrowed money and $50,000 of borrowed gold. So, the value of that proxy today is $11,000, but we add $8,000 for the current level of the Nasdaq index and $6,000 for the value of Bitcoin volatility, to get $25,000, versus a current market price for Bitcoin of about $20,000. (To construct the proxy portfolio, I gathered data on financial instruments with economic relations to Bitcoin, their levels and volatilities. Volatility is one-week volatility using a blended high/low and daily close estimator. I used regression analysis to select the best combination of variables to get a fit that was parsimonious, statistically solid and passed normal diagnostics.)

Before discussing what the proxy portfolio means, consider the chart. It shows that the proxy portfolio has done a decent job of tracking Bitcoin prices since 2018. The one major discrepancy is the March 2021 boom, quickly followed by a bust, but leaving Bitcoin in line with historical price relationships.