Key Takeaways

• Policy uncertainty remains high, particularly around trade.

• While it is good news that an agreement was reached with Mexico over the weekend to avoid those tariffs, a trade deal with China is unlikely until more economic pain is incurred by both China and the United States.

• We have reduced our 2019 earnings estimates to acknowledge the increased risk of a prolonged trade conflict, though we remain above consensus estimates.

Last week stocks enjoyed their best week since November 2018 despite rampant policy uncertainty. Policy uncertainty remains high, particularly around trade, but you wouldn’t know it from last week’s stock market rally, which jumped 4.4 percent on increasing hopes for Federal Reserve (Fed) rate cuts. That jump brought the S&P 500 Index to within 2.5 percent of its April 30 record high. However, that doesn’t mean stocks are in the clear as the trade conflict with China continues.

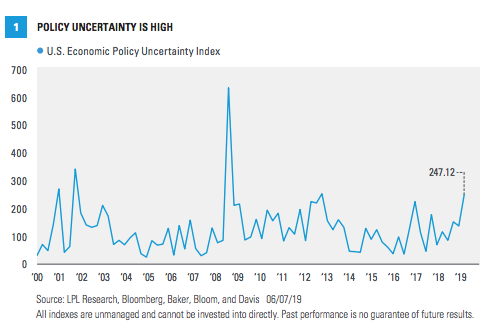

Policy Uncertainty Is High

We know policy uncertainty is high, but researchers have actually quantified it by creating a policy uncertainty index [Figure 1]. The U.S. version of this index, which counts words in news stories associated with economic and Washington, D.C., policy and tracks them over time, is high—no surprise. The trade-policy-specific version of this index is similarly high and trending upward—no surprise there either. Our friends at Strategas Research Partners tell us that searches for “tariffs” on Bloomberg hit their highest level of President Trump’s presidency last week.

So where are we now with regard to trade uncertainty? First, we received some good news over the weekend as President Trump announced a deal with Mexico to avoid tariffs on Mexican goods. The agreement, which will be finalized over the next 90 days, calls for Mexico to commit resources to immigration enforcement.

Turning to China, the outlook is more muddled. We suspect that more economic pain will be inflicted on both countries, which ultimately will push the process forward. That pain, we believe, will eventually result in a trade agreement—hopefully by the end of the summer—but that is hardly assured. The good news is the two sides are talking again. U.S. Treasury Secretary Steven Mnuchin spoke to Chinese central banker Yi Gang at the G20 Finance Ministers meeting in Japan this weekend, and President Trump plans to talk to Chinese President Xi at the (broad) G20 in Japan later this month.

Even if the United States and China can resolve their differences, trade battles may not be over. President Trump may put tariffs on European and/or Japanese autos to extract concessions after a potential China deal.

Policy uncertainty is not just trade related. Monetary policy uncertainty has swung stocks around quite a bit recently. After last week’s disappointing jobs report that included a smaller-than-expected increase in wages, the odds of a July rate cut by the Fed jumped to more than 80 percent, based on what the bond market is pricing in. The longer China tariffs remain in place, the greater the chances of a rate cut. The Fed's current monetary policy is probably too tight for a prolonged trade war.

Meanwhile, parts of the yield curve remain inverted, which will become increasingly concerning the longer it lasts. The 3-month/10-year spread currently is -0.19 percent, which historically has preceded stock market weakness by about nine months, if the inversion has persisted.

Finally, although it’s more than a year off, uncertainty surrounding the U.S. presidential election has begun to impact markets already, particularly health-care stocks. Internationally, Brexit still has not been resolved, and Italy is again fighting with European regulators about its deficit spending.

Reducing Earnings Estimates

Despite the agreement with Mexico over the weekend, the odds of a prolonged trade war with China have increased. Whether companies pay the tariffs or shift supply chains to other countries to avoid them (we have seen plenty of evidence in economic data that this is already happening), costs could rise and profit margins could narrow. As long as the tariffs remain in place, earnings growth will be tougher to come by.

We think a reasonable worst-case scenario for tariffs in 2019 is in the $8–10 range of S&P 500 earnings per share. That implies a three-month delay could be worth $2–2.50 per share. Factoring in tariffs, ongoing trade uncertainty, and the related drag on business confidence and economic growth, we are reducing our 2019 S&P 500 earnings forecast from $172.50 per share to $170 [Figure 2].

Importantly, our forecast is still above consensus estimates of $168 per share (source: FactSet), and we still see upside potential depending on the path of China negotiations.

We have not changed our year-end fair value target on the S&P 500 of 3,000. We expect a slightly lower earnings figure will be offset by a marginally higher price-to-earnings ratio.

Conclusion

Policy uncertainty is high, especially on trade. We have reduced earnings estimates to acknowledge the increased risk of a prolonged trade conflict. We remain optimistic that these trade disputes can be resolved this summer, though probably not until more economic pain is inflicted on the U.S. and China economies.

That doesn’t mean stocks won’t add to last week’s gains. We remain confident in our forecast for year-end fair value on the S&P 500 in the range of 3,000. It may be a grind as the U.S. economy muddles along, but fundamentals for equities remain favorable.

John Lynch is chief investment strategist at LPL Financial.