The rapid spread of the omicron variant has sent office workers back to their kitchen tables and put the business travel recovery on pause. But the longer-term outlook is actually looking brighter these days.

First, it’s important to note that despite the doomsday predictions early in the pandemic, business travel isn’t dead so much as hobbled. Before the omicron variant sent demand plummeting, domestic corporate volumes in early December were about 40% below 2019 levels, United Airlines Holdings Inc. said this week when it reported fourth-quarter earnings. That’s a meaningful recovery; on the same measure, corporate travel was 90% below pre-pandemic levels in the early part of the second quarter and down 60% as of June. United expects the rehabilitation trend to get back on track by the end of February as the surge in cases ebbs and more companies start to treat Covid-19 as endemic. But there’s clearly still a ways to go.

One interesting divide that has emerged is that smaller businesses have proved much more willing than larger corporations to put workers back on planes. At American Airlines Group Inc., travel demand in the fourth quarter from small and medium-sized businesses returned to 80% of its pre-pandemic level, compared with only 40% for large companies. A Jefferies Financial Group Inc. survey of U.S. adults who took business trips in 2019 found that those who worked at companies with fewer than 1,000 employees were much more likely to predict a return to pre-Covid patterns in the near term. About 80% of that group on average expected to be traveling as much for business as they were before the pandemic by the end of 2022, compared with just 55% of workers at bigger enterprises. Among the 9% of previous business travelers who said corporate trips would never return to a 2019 pace, two-thirds work at companies with more than 1,000 employees, the Jefferies data show. The results of the survey were published in January.

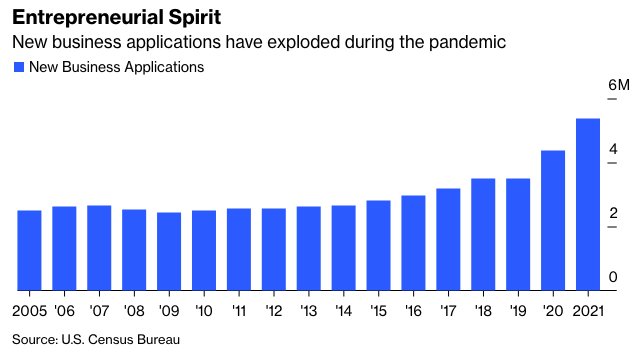

This makes sense in the short term: Corporate giants with storied reputations and long-standing customer relationships are less likely to lose out on opportunities by keeping workers at home a little longer. The gears of change grind slowly at bigger companies, particularly in the face of a constantly evolving virus. Upstarts don’t have the same luxuries—and there are many more of them these days. Entrepreneurs filed a record 5.4 million new business applications last year, almost double the annual average between 2005 and 2019, according to data from the U.S. Census Bureau. This creates new opportunities for the airlines. Corporate giants typically negotiate deals for preferred rates in exchange for their premium business, but most carriers haven’t targeted small and medium-sized entities in the same way. That means the cost of sales for this category is much lower and more akin to that of leisure passengers, even though small businesses tend to mimic their larger peers in their tendency to buy higher-priced last-minute tickets, Vasu Raja, American Airlines’ chief revenue officer, said on a call this week to discuss earnings.

But a world in which smaller entities send workers out on the road to chase new opportunities and collaborate with colleagues while larger ones are content with Zoom calls in perpetuity feels weird and highly unlikely. At Siemens AG, some internal meetings can be done virtually and certain equipment can be maintained just as effectively by remote systems. But it’s “one of those companies” that relies on aviation to move products around the world and get people to where they need to be, Barbara Humpton, president and chief executive officer of the industrial giant’s U.S. operations, said in an interview.

One argument against a full-scale revival of corporate travel has been that large public companies are under increasing pressure to reduce their carbon footprint, and curbing flights is one of the easiest ways to accomplish that. But sustainable aviation fuel(SAF) has the potential to change that calculus, particularly over the longer periods that many companies have given themselves to reach carbon neutrality. SAF—which is derived from cooking oils, waste and other byproducts—can reduce life-cycle greenhouse gas emissions by as much as 80%, depending on the type of feedstock and how it’s produced. There’s currently only enough production to cover a fraction of global needs, and the little SAF that is available costs significantly more than kerosene. Airlines are eager to change that. In November, British Airways flew an Airbus SE jet from London to New York City on 35% SAF. In December, United flew a Boeing Co. 737 Max jet from Chicago to Washington using 100% SAF in one engine. The latter flight was meant to demonstrate that existing aircraft infrastructure can support higher levels of SAF use than the current 50% blend with traditional fuels allowed by regulators and to increase pressure on governments to subsidize expanded production.

The International Air Transport Association estimates widespread adoption of SAF could help the global aviation industry get 65% of the way toward its goal of net-zero emissions by 2050. Whether SAF availability improves enough to actually allow widespread adoption remains to be seen. But corporate travel customers are already benefiting from airlines’ efforts. Siemens is part of United’s Eco-Skies Alliance, which allows companies to contribute to the purchase of SAF for the carrier’s network. This investment has addressed 17% of Siemens’s typical annual environmental footprint from business travel on United flights and reduced its carbon emissions by 2,400 metric tons, Humpton said. Siemens plans to make similar SAF investments with other frequently traveled airlines.

It makes sense that ticket prices would be higher for SAF-powered flights because a trip that relies on kerosene carries an additional carbon cost, Humpton said. Without the benefits of the greener alternative fuel, companies striving for carbon neutrality would need to invest in offsets or otherwise make up the emissions impact. Siemens aims to be carbon neutral in its own operations by 2030 and to establish an emissions-free supply chain by 2050.

For months, airline CEOs have been telling anyone who would listen that the work-from-home lifestyle could actually open up new business travel opportunities, but there wasn’t much concrete evidence to support that theory—until recently. Earlier this month, Yahoo Japan told its 8,000 employees that they could work anywhere in the country and that the company would pay for them to commute by plane to offices when required. The company, a unit of SoftBank Group Corp.’s Z Holdings Corp., set a commuting budget of 150,000 yen ($1,300) a month for each worker. This may be the start of a larger trend: The Jefferies survey found that more than a third of employees who now had more flexibility to work from home had moved their primary residence as a result. Within that group, 75% said they expected to fly to an office on occasion. This “creates a new type of corporate travel that largely doesn't seem to have been factored into estimates of a recovery,” Jefferies analysts led by Sheila Kahyaoglu wrote in the January report.

Will business travel come all the way back? No one truly knows. But as the world tries to edge back to some semblance of normalcy, there are a lot of reasons to think that the future will include a healthy amount of travel for corporations big and small. Southwest Airlines Co., JetBlue Airways Corp. and Alaska Air Group Inc. round out the main airline earnings next week.

Quote Of The Week

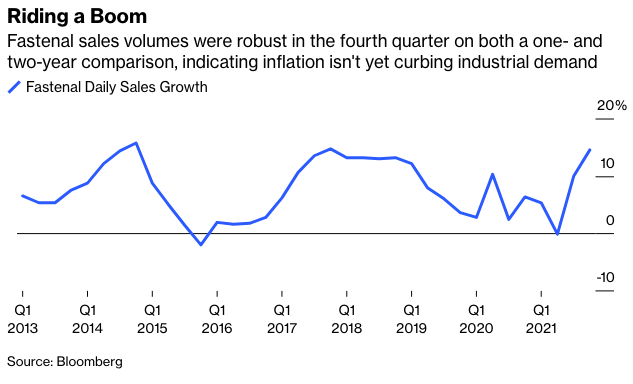

“Customers were asking us to do something different, which was get Covid materials in 2020, and in 2021, get any materials. And we grew market share because we did that really effectively. In 2022, we’re expecting our customers’ environments to become a little less chaotic.” — Holden Lewis, chief financial officer of Fastenal Co.

Lewis made the comments on a call this week to discuss the industrial distributor’s latest results. Fastenal’s sales and gross margin for the fourth quarter were higher than analysts expected, thanks to robust demand from manufacturing and construction customers and price increases that neutralized the impact of rising raw material and logistics costs. Product availability should improve in the first quarter of 2022 and stabilize throughout the year, although initially that will largely be a reflection of Fastenal’s efforts to gobble up more inventory than normal to ensure supply for customers. Supply chains remain strained, Lewis said. In fact, ocean transit times for goods Fastenal imports actually worsened in November and December after easing a bit in the fall. “At some point in time—and I don't know when that point in time is—that will get better,” CEO Dan Florness said.

The third-quarter industrial earnings season brought some cautious optimism that supply chain logjams had peaked. That theory appears to be holding in aggregate, but as I have written repeatedly, peaked is much different from solved, and the disruptions wrought by the omicron variant are creating fresh headaches, particularly in Asia. Companies that struggled with shortages and rising costs in the fall likely kept struggling in the final stretch of 2021, and investors’ patience appears to be wearing thin. The fourth quarter is shaping up to be a tale of two kinds of companies: those, like Fastenal, that have a handle on the operating environment and others, like Sherwin-Williams Co. and PPG Industries Inc., that don’t.

In a sign that supply chain and inflation pressures have leaked into businesses with longer selling and development cycles, Siemens Gamesa Renewable Energy SA warned this week that its profit margin may turn negative this year because of higher raw material costs for its wind turbines. The shares plunged as much as 16% on Friday for the worst intraday showing since July. That, coupled with a sales warning earlier this month from health-care equipment maker Royal Philips NV, raises questions about the extent to which supply chain pressures will weigh on General Electric Co.’s rival businesses. GE reports earnings on Tuesday, kicking off a jam-packed week of reports from industrial giants including 3M Co., Raytheon Technologies Corp. and Rockwell Automation Inc.

Looking ahead to the rest of 2022, this week also brought news that Peloton Interactive Inc. is trimming production and cutting costs as demand fades for one of the pandemic’s top sellers. Peloton’s woes indicate that the long-awaited shift in consumer spending back to services may finally be happening, as my Bloomberg Opinion colleague Robert Burgess notes. That would help curb the relentless, record-breaking flow of physical goods into the U.S. and give the West Coast ports an opportunity to clear logjams—perhaps at the expense of companies that may find themselves stuck with a glut of unsellable inventory.

Deals, Activists And Corporate Governance

GE’s digital business still exists. The operations—which former CEO Jeff Immelt once said would compete with the top 10 largest software companies in the world—have largely faded into the background amid GE’s debt and cash-flow problems. But the business is set to be packaged with the spinoff of GE’s gas turbine and renewable energy divisions targeted for early 2024. And this week brought the news that GE Digital is getting a new CEO. Scott Reese, executive vice president of product development and manufacturing solutions for Autodesk Inc., will take over the job in mid-February. This continues a string of outside hires by GE’s CEO Larry Culp, who spent most of his career at Danaher Corp. The current head of the digital unit—Patrick Byrne—will remain at the company as CEO for GE’s onshore wind business. In other GE news, the company announced it would freeze the accrual of pension benefits for around 800 employees in Canada, effective Dec. 31, 2023. The freeze doesn’t impact retirees already collecting benefits or active workers covered by union agreements. Recall that GE announced in 2019 that it would freeze U.S. pension benefits for approximately 20,000 salaried employees and supplemental payouts for 700 executives.

American Airlines tapped former Boeing CFO Greg Smith to join its board. Smith retired from Boeing in July 2021 after about a decade in a CFO role that was later expanded to give him additional responsibilities. He was well-respected on Wall Street, but his legacy at Boeing was tainted by the 737 Max crisis and an embarrassing string of production issues. This included an almost complete halt in deliveries of Boeing’s 787 Dreamliner that has been dragging on since October 2020. American offered some good news on this front this week, saying it expects to take delivery of all 13 of its delayed Dreamliners this year, with the first on track to arrive in April. The 787 issues have left the airline with less flying capacity than it might otherwise have wanted, and Boeing is compensating it for that, American executives said this week. The planemaker has also committed to pay for losses tied to additional delays, should they arise. Boeing is scheduled to report earnings on Wednesday.

Ford Motor Co. and ADT Inc. are jointly investing $105 million in a new venture to provide security systems for cars and vans that link up to a smartphone app. The technology combines ADT’s professional security monitoring services with Ford’s artificial intelligence-driven video cameras. The companies are pitching their new security offering to commercial drivers, pointing to an FBI estimate that thieves stole more than $7.4 billion of work equipment from vehicles in 2020. The venture, known as Canopy, will launch the security product and subscription-based monitoring service early next year in the U.S. and U.K. The ADT tie-up is another example of automakers seeking out unconventional partners to expand in more lucrative corners of the car market, cut out middlemen or take greater control of vulnerable parts of their supply chain. Ancillary services such as security monitoring tend to be less volatile than new car purchases in the face of economic swings. Elsewhere in this trend, General Motors Co. is launching an online parts marketplace featuring a catalog of 45,000 repair and maintenance products including brake pads and windshield wiper blades.

Brooke Sutherland is a Bloomberg Opinion columnist covering deals and industrial companies. She previously wrote an M&A column for Bloomberg News.