This year hasn’t been any kinder to real estate funds than it has to any other asset class. As of early September, the largest, most notable mutual funds in this space had all suffered double-digit losses this year.

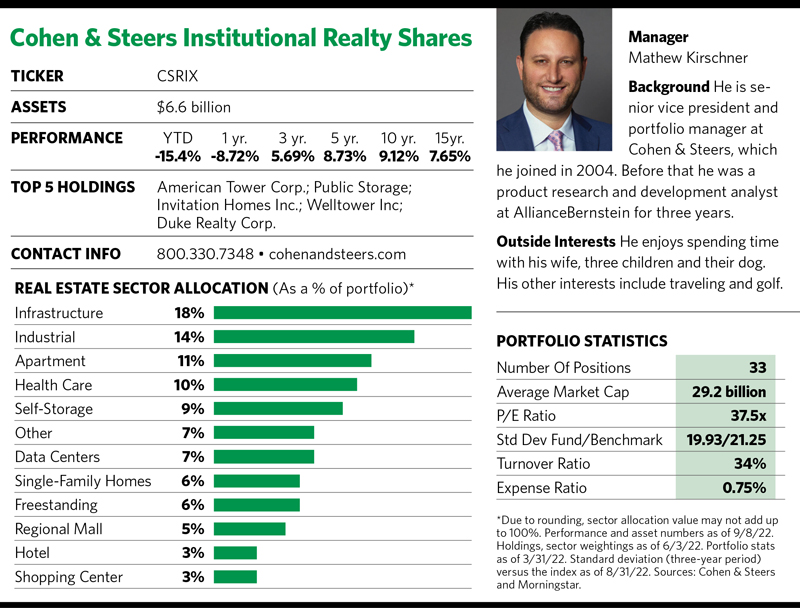

The Cohen & Steers Institutional Realty Shares fund, however, was one of the category’s better year-to-date performers. It lost only 15%. Granted, that’s a backhanded compliment and doesn’t generate much excitement.

The better way to think about this fund is to remember that real estate traditionally is seen as an important portfolio diversifier. Furthermore, the recent downturn has trimmed valuations and laid the groundwork for the sector’s eventual rebound. On top of that, the Cohen & Steers fund has a stellar track record that places it in the top quartile of Morningstar’s real estate category in every measurable time frame from year to date through the past 15 years.

As for why real estate funds are taking it on the chin these days, this sector—like the financial markets in general—is grappling with the toxic stew of higher inflation and rising interest rates, combined with fears of a slowing economy and possible recession. For now, investors who believe in the real estate sector need to hold their nose during the current stink and remain focused on the long-term picture.

The good news is that real estate investment trusts and other listed real estate securities historically have been a good inflation hedge thanks to the price appreciation of properties and rising rental income. But the potential positive aspects derived from higher inflation—and higher interest rates—can be tempered depending on macroeconomic conditions.

“Real estate can do well in a moderate inflationary environment characterized by a growing economy,” says Mathew Kirschner, a portfolio manager at the Cohen & Steers Institutional Realty Shares fund. “If interest rates go up in that environment, it’s usually a healthy backdrop for real estate and REIT returns. But if you get an environment like we’ve had year to date where rates are going up and expectations for growth are coming down, that’s a challenging backdrop for both real estate and all asset classes.”

Kirschner cites some positive attributes offered by REITs that can be helpful during troubled economic times like this. For starters, they typically pay dividends that are much higher than the broader equity market. A recent Cohen & Steers report showed that as of June 30, U.S. REITs offered a collective dividend yield of 3.3% against 2.1% for global stocks, 1.6% for U.S. stocks and 2.8% for 10-year U.S. Treasurys.

“Because REITs learned their lessons from the global financial crisis, they have good balance sheets and low payout ratios,” Kirschner says. “We think dividends will grow at a healthy clip over the next three to five years.”

He adds that REITs have stable cash flows thanks to lease-based rental income. They also have greater operating margins than the broader market because supply-and-demand factors during the past couple of years have limited new construction. And valuations have come down because Mr. Market has priced in a lot of concerns about higher interest rates.

“The market has sold off REITs based on those concerns, but we think when you look at value in the REIT space versus the broader equity and fixed-income markets, they’re on the relatively attractive side,” Kirschner posits.

He also notes that his fund is domestically focused with little exposure to foreign currencies, which is important in the current period when the U.S. dollar has appreciated dramatically.

Favorable Sectors

The FTSE Nareit All Equity REITs Index, which is the Cohen & Steers fund’s benchmark, has 16 different REIT sectors for the fund’s managers to choose from.

“Most people don’t realize that the space has evolved dramatically during the past 15 years. It’s not just about office and retail,” says Kirschner, who manages the fund along with Jon Cheigh and Jason Yablon. The fund began trading in 2000, and for a little more than half of its existence it was managed by Martin Cohen and Robert Steers, who started their namesake company in 1986. Cohen & Steers bills itself as the first investment manager dedicated to listed real estate.

Kirschner says he and his co-managers are most focused on sectors that can sustain their growth and maintain sustainable pricing power in a variety of economic environments. “What drives that pricing power is positive supply demand, so we look for sectors where the leverage is in the favor of the landlord,” he explains. “We’re also focused on businesses that can defend well when things are going the other way, and we seek out companies that have a valuation we think is reasonably attractive relative to the rest of the market.”

Kirschner says that in the second quarter he and his partners started to rotate the portfolio to take advantage of some of the disconnect they saw in the broader market. That led them to buy companies in sectors such as cell towers, single-family homes for rent, and industrials. Recent holdings in those sectors included the likes of American Tower Corp., a cell tower REIT; Invitation Homes Inc., a home-leasing company; and Prologis Inc., an industrial REIT whose forte is warehouses.

They also sold some holdings that were performing well relative to the market but suffered from stretched valuations. These included companies in some areas of healthcare as well as the net lease sector comprising single-tenant, freestanding commercial properties.

Capturing The Angles

Kirschner says the fund’s managers combine both top-down and bottom-up approaches to portfolio construction. From the top-down perspective, the managers tap into members of Cohen & Steers’ sizable research team who focus on risk and macroeconomic considerations.

“We acknowledge that understanding the macroeconomic environment is very important,” he says. “But in terms of getting a real edge, we don’t feel we have a sustainable competitive advantage from the top down. So the top down is maybe 20% of what we do, and the bottom-up underwriting of the stocks and sectors is about 80%.”

Kirschner describes the fund’s investment process as very disciplined and ever-evolving. The portfolio managers work with an analyst team that each has its own coverage universe. They hold both informal meetings and more formal investment committee meetings where portfolio managers, analysts and associates debate different issues ranging from stocks to sectors to the macroeconomic environment.

“We look at what the inputs are that are driving our numbers, and try to challenge each other’s assumptions and viewpoints, and we try to challenge our thesis and what could be wrong with our thesis,” Kirschner says. “We try to capture each and every angle that exists. That whole process drives not just our views on value but helps bring to the surface what are the best ideas.”

He notes the portfolio managers try to come to a consensus as much as possible in terms of which stocks to own and how much they should own, and what that means in terms of the fund’s sector weights and risk profile. “It’s a team-based approach from the research analysts and associates up to the portfolio managers,” he says.

Upside, Downside

The fund’s comprehensive approach to portfolio construction has created a product with a higher Sharpe ratio (higher is better) and a lower standard deviation (lower is better) than both its category and index over the past three-, five- and 10-year periods, according to Morningstar. Its upside capture ratio has been in line with both the category and index during these time frames, while its downside capture ratio has consistently been less, to the tune of 10 percentage points.

In discussing whether this fund is more about upside capture or downside downside, Kirschner says he and his partners try to keep it balanced over the long term but it probably is a tad better at downside protection. That’s because the team tends to favor companies that he describes as good operators with properties that can outgrow the market and have strong balance sheets, and which are purchased at a reasonable price.

“Those things tend to defend better when the market is going down, but if the market is in a risk-on environment, the rising tide lifts all boats,” he says.

As of early September, the market was firmly in risk-off mode. This turbulent investing environment has caused a lot of financial pain, but long-term investors in real estate would be wise to stay the course, and investors thinking of adding real estate to their portfolio could use the current downdraft to stake out positions.

At least that’s Kirschner’s take. “The diversification benefits of real estate are well-documented,” he says. “Total returns of real estate over time have been very competitive. After we get through that slower growth environment and consumers can regain their health and inflation gets under control, then we feel that real estate can take off in terms of responding to the healthier demand environment and a more reasonable inflation and interest rate environment.”