The Certified Financial Planner Board of Standards today announced sanctions, including three cases where planners were banned from using the CFP mark, against 17 current or former certified financial planner professionals.

Two planners were publicly censured, four temporarily barred, five were suspended, three received permanent bars and three had their rights to use the CFP marks revoked, the board said.

The list of those whose use of the CFP designation has been revoked, the most serious of the sanctions, include Brian Bogart of McLean, Va., who failed to timely file an answer to the board’s alleged complaint that he was permitted to resign from his firm, Purshe Kaplan Sterling Investments, during an investigation into his alleged participation in an unapproved private fund, the board said. Bogart also failed to make conflict-of-interest disclosures to multiple clients and a prospective client when he sought to obtain their investment in the private fund, of which he was a partial owner, the board said.

Iva Hauck Girtman of Bushnell, Fla., was stripped of her rights to use the CFP marks after failing to provide requested information in a timely manner to the board regarding charges of grand theft larceny in March 2015, the board said. She admitted that she stole about $19,500 in reward points from her employer's company credit card over a five-year-period, the board said. She entered a pre-trial intervention program, paid restitution to her former employer and later had her felony charges expunged.

The board permanently barred Brandon Self of Colorado Springs, Colo., from applying for or obtaining the CFP certification marks following his failure to timely respond to allegations that he engaged in “exam misconduct.” The board said Self participated in a GroupMe chat group where he requested information about exam questions from people who had already taken the test. The board alleged that Self “knowingly” gained an advantage over other test takers when he studied topics based on the chat group information.

J.C. Morrow of Washington, Pa., was permanently barred after the board said he failed to respond to its complaint alleging that he failed to pay his federal tax obligations for 2015, 2016 and 2017. The debt led to two federal tax liens totaling about $202,000, the board said.

Richard L. Carman of Memphis, Tenn., had his right to use the CFP certification marks suspended for one year and one day following his failure to respond to the board’s investigation notice. The board said it sought to investigate three federal tax liens filed against Carman totaling about $920,000; his July 2021 termination from a firm for exercising improper time and price discretion in client accounts without written authorization; and his April 2022 termination from another firm for violating its policy related to the disclosure of tax liens.

Jennifer Todd Nash of Tallahassee, Fla., and Robert Lyman of Barrington, Ill., both agreed to public censures related to unpaid taxes, the board said. Nash failed to timely pay taxes to the IRS between 2010 and 2018, resulting in federal tax liens totaling about $573,000, the board said. Lyman failed to pay his federal taxes for tax years 2011 through 2018, resulting in a debt of $246,393 to the IRS, the board said.

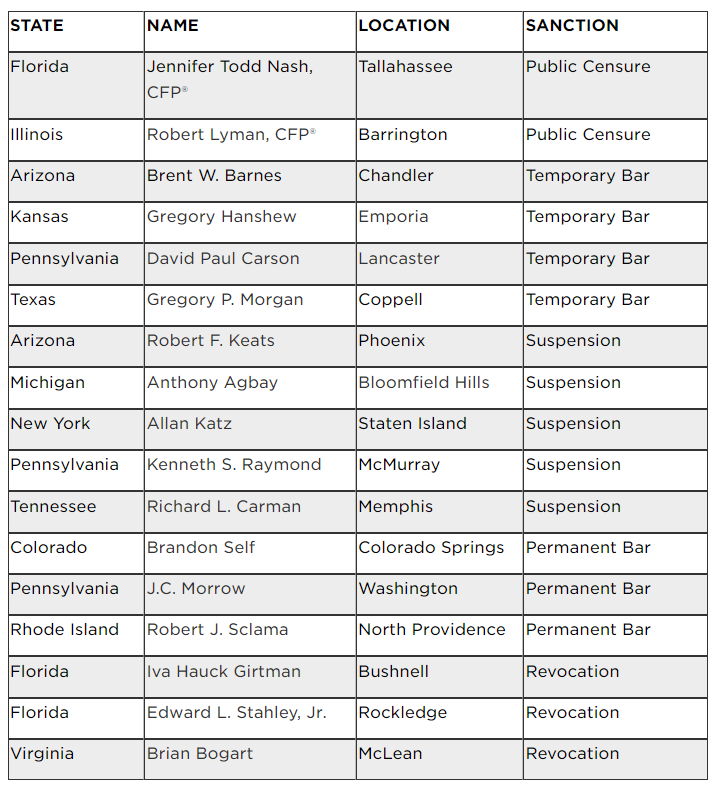

Following is the complete list of CFP Board disciplinary actions.