The Certified Financial Planner Board of Standards today announced sanctions against 25 current or former certified financial planners for violations ranging from regulatory actions, arbitrations and civil court litigation that involve professional conduct, bankruptcies, civil judgments and tax liens.

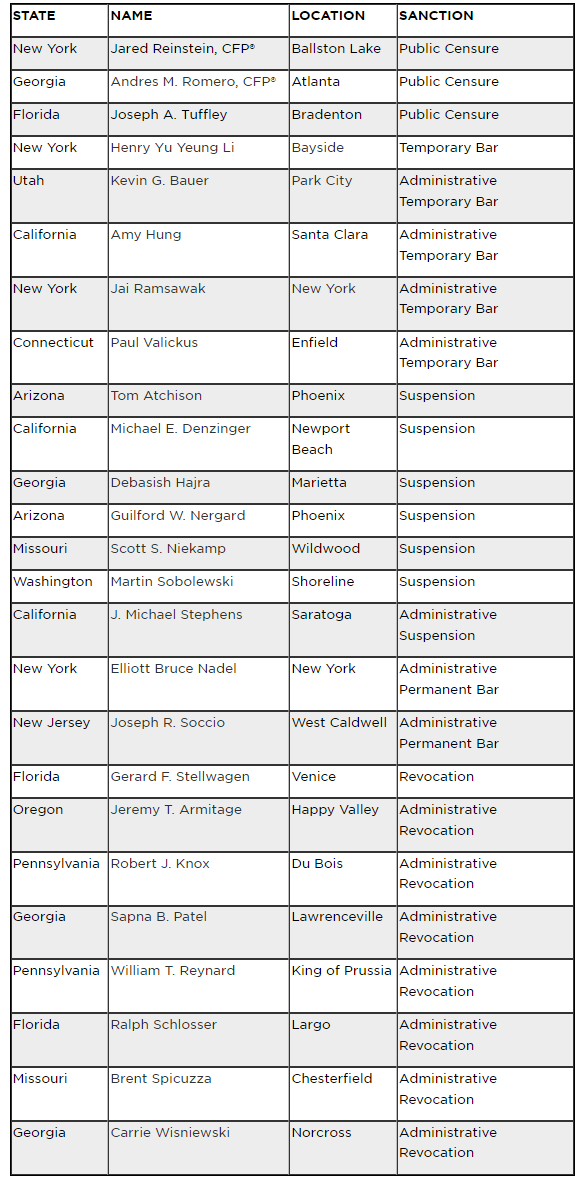

Three advisors were publicly censured, one was temporarily barred, four received administrative temporary bars, one received an administrative suspension, six were suspended, two receive administrative permanent bars, seven received administrative revocations and one had his right to use the CFP marks revoked.

Gerard F. Stellwagen of Venice, Fla., had his license revoked after he consented to findings that he had been charged with 10 counts of possession of child sexual abuse material, a third-degree felony in Florida, the CFP Board said. The board said Stellwagen pleaded not guilty to the pending charges. He also consented that the filing of such charges against him violates board standards and the Code of Ethics and Standards of Conduct. His revocation was effective as of December 16.

The board issued an administrative order of revocation to Sapna Patel of Lawrenceville, Ga., for failure to file an answer to the board’s complaint. The board alleged that in June 2016 a client filed a civil lawsuit against Patel in Georgia that was eventually settled. However, in December 2017, the court ruled she failed to make payments required under the settlement agreement, the board said. The board also alleged that Patel failed to disclose to the CFP Board that she was a defendant in the lawsuit. Her administrative revocation was effective as of April 11.

Also receiving an administrative revocation was Brent Spicuzza of Chesterfield, Mo. The board said Spicuzza's failed to file an answer to its complaint. The board alleged that he entered into a consent order with Missouri regulators after he was found in violation of state securities laws. He was accused of, among other things, failing to disclose outside business activities. The board said Spicuzza was fined $15,000, placed under heightened supervision, and disqualified from exercising any supervisory authority. His administrative revocation was effective as of June 8.

Among those receiving an administrative permanent bar was Joseph R. Soccio of West Caldwell, N.J. Soccio's failed to answer the board’s complaint alleging that he refused to respond to CFP Board's requests for information. Soccio failed to pay his federal taxes for several years, which resulted in a federal tax lien and a total outstanding debt to the IRS of about $135,000, the board said. His administrative permanent bar was effective as of February 18.

Michael E. Denzinger of Newport Beach, Calif., was suspended in March for one year and one day in a consent agreement, the board said. He was convicted of driving under the influence in 2015 and again in 2021, the board said. The CFP Board said it had previously cautioned Denzinger against violations relating to similar conduct. His suspension is effective from March 29 through March 30, 2023.

Paul Valickus of Enfield, Conn., was temporarily barred from applying for or obtaining the CFP certification marks for one year and one day following his failure to respond to board inquiries related to 2019 and 2020 criminal charges against him for alleged possession of drug paraphernalia and driving under the influence, the board said. His administrative temporary bar was effective as of April 13.

The complete list of sanctioned planners is as follows: