On the surface, Austin Hawley seems to have little in common with his investment idol, Warren Buffett. At 42, he’s less than half the Oracle of Omaha’s age. Unlike Buffett, who invested in his first stock at age 11, Hawley had no idea what he wanted to do when he graduated from Dartmouth with a degree in history. “I wasn’t one of those people who started buying stocks when I was 10 years old,” he observes.

It wasn’t until he returned to Dartmouth for his MBA that he caught the Buffett bug from a professor, who was a big fan of the value-oriented, think-like-a-business-owner style.

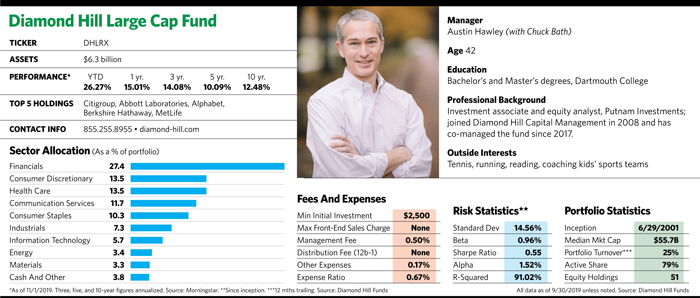

For Hawley, who began co-managing the Diamond Hill Large Cap Fund two years ago with Chuck Bath, that style involves looking for companies trading at less than their intrinsic value, or the present value of future cash flows, over a five-year time horizon. In addition to being good values, the 40 to 60 stocks in the fund must have sustainable competitive advantages and conservative balance sheets. Once a stock reaches the estimate of intrinsic value and no longer sells at a discount, or a more attractive opportunity pops up, the team will sell it.

“We try to determine what a company will be worth in five years to a buyer,” Hawley says. “Growth is a key part of the value calculation, but we’re not willing to pay too much for it.”

Like Buffett, senior executives at Columbus, Ohio-based Diamond Hill Capital Management also believe in keeping a decent amount of skin in the game. To that end, Hawley and Bath each have more than $1 million invested in the fund. All told, the firm has $22 billion under management, with about half that in the large-cap strategy.

Although Morningstar classifies the $6.3 billion fund as large-cap value, the managers prefer companies with solid balance sheets and ample cash flows that have distinct quality growth overtones. This taste for “growthier” fare than what’s found in the typical value fund has helped put the Diamond Hill fund in the top quartile of its peers over the trailing three-, five- and 10-year periods.

The strict sell discipline has helped the managers put brakes on the fund in downturns. From its inception in 2001 through September 30, the fund’s downside capture ratio relative to the Russell 1000 Index was 94%, while it managed to ride 101% of the index’s upside. The Diamond Hill fund also has a reasonable 0.67% expense ratio and a low $2,500 minimum for I class shares.

Hawley says he’s well prepared to take the reins of the fund from the 63-year-old Bath (the latter has managed the fund since 2002). But such plans aren’t in the works at this point. “My coming on as co-manager is a clear succession plan,” he says. “But Chuck still loves what he does.”

Buying The Dip

To get favorable prices, Hawley and his team often zero in on stocks unfairly beaten up. Some of these stocks might enjoy quality and growth characteristics that help them thrive over the long term, but they’re currently stumbling because investors are ignoring them or overemphasizing bad news about them.

At 27% of assets, financials are by far the largest sector represented in the fund—which won’t dedicate more than 30% to any one sector or more than 7% to any one position. The financials position isn’t that unusual for a value offering. When the fund began adding to the sector in 2012, the emphasis was on large banks that sold at highly attractive valuations and stood to benefit from an expanding economy. More recently, the focus has shifted to a broader swath of financial sector industries, including property and casualty insurers.

One such company, American International Group (AIG), is a top 10 holding that was added to the portfolio at the end of 2018, a time when financial stocks were being particularly hard hit by a brutal market slide. Even though the fund had owned the property and casualty insurer before selling it in 2015, Hawley continued watching it for signs of fundamental improvement. Things began looking up in 2017, when Berkshire Hathaway entered into an agreement with AIG to take responsibility for some of its insurance claims if they exceeded a certain amount.

AIG has also built up its management team to include several respected property and casualty industry veterans, and the company boasts a global distribution platform that’s hard for competitors to replicate. By the time the stock re-entered Diamond Hill’s portfolio, it was selling at a discount to book value and an unusually attractive price-to-earnings multiple.

Another financial sector holding, Charles Schwab Corp., was added to the portfolio in the third quarter of 2019. Diamond Hill re-established its position in Schwab when the company’s shares declined amid yield curve and interest rate uncertainties. Hawley believes Schwab’s growth prospects are strong thanks to its established customer relationships, digital capabilities, services and pricing, as well as its strong position in the registered investment advisor channel.

Hawley’s fund tends to tread lightly in technology stocks, mostly because investors put too high a price on their growth prospects. But he will occasionally buy them when their valuations look particularly attractive. One such company he holds is Booking Holdings, which owns travel sites Priceline and Kayak. Hawley bought the stock in early 2019 when investors were concerned about its slower-than-expected growth and its price had dropped. He says the company’s increased expenditures on brand name recognition, along with promising growth prospects for hotel bookings, make the company an attractive long-term bet.

‘Mid-Single-Digit’ Returns For Market

Hawley has modest expectations for stock market returns over the next five years, the time frame the fund uses as a performance yardstick. On the plus side, interest rates remain low by historical standards. While tariffs have spooked the stock market, companies facing higher costs have been able to pass them along in the form of higher prices to consumers. “The likelihood of reaching a trade deal seems to rapidly fluctuate, but we believe cooler heads will eventually prevail and a deal will be reached,” he says.

On the other hand, economic growth has slowed from peak levels in 2018, and some economic signals suggest continued slowing. Current price/earnings multiples are high by historic standards, and returns could be held back if historically high corporate profit margins and interest rates revert toward long-term averages. Tariff talk and trade disputes also bear watching.

“The types of companies that are most vulnerable to trade disputes and tariffs include those in the retail industries, some industrials and auto manufacturers,” he says. “We’re monitoring holdings in those areas closely.”

Hawley notes that there has been a clear slowdown in earnings, especially among more cyclical and industrial companies. “There are more risks in the system, and it’s more likely than not we will see a full-blown recession at some point,” he says. “Considering these factors, mid-single-digit returns seem reasonable for equity markets over the next five years. But we believe we can achieve better-than-market returns over that period through active portfolio management.”

He points to a distinct earnings and valuation gap between industrials and higher growth sectors. Some growth companies in the tech sector continue to grow earnings at an annualized rate of 15% a year. And the valuation gap between the cheapest and most expensive corners of the market is unusually wide.

The fund usually shies away from stocks highly sensitive to economic cycles. But a select few of these names have unusually cheap valuations that make them more attractive “buy” candidates. One such stock, Archer Daniels Midland, was added to the portfolio earlier this year. The company, which transports and processes commodities, owns a growing portfolio of specialty food ingredients for human and animal health products, and it has a 25% stake in Singapore commodity processor Wilmar.

Although trade wars, adverse weather and African swine fever have hurt ADM, Hawley believes the company should benefit from a shift toward higher margin, more stable businesses in the nutrition segment over the long term. In addition, ADM’s management has sold underperforming businesses and expanded to areas with more stable earnings streams. “Many people think ADM’s fortunes are tied to China,” Hawley says. “But that is more perception than reality. Over the long term, we think global demand for its products will continue to be strong.”

Despite ongoing trade disputes and a stronger U.S. dollar, both of which would seem beneficial for small caps, since they generally derive a larger percentage of revenue from the U.S. than large caps do, stocks of smaller companies continue to lag. Usually, small caps trade at a price/earnings premium to large caps. Now they’re trading at a discount of more than 20%.

Hawley says that over the last decade or so, large companies have strengthened their foothold in the marketplace and beefed up their balance sheets, making it harder for small companies to compete and to graduate into mid-cap or large-cap territory. And large caps’ comparative financial stability appeals to investors in the late stage of an economic growth cycle.

“The market is acutely aware of the risks of a slowdown in the economy, and it’s pricing those risks aggressively,” Hawley says. “The fundamental strength of large companies compared to smaller ones is far more persistent than we would have guessed five or 10 years ago.”