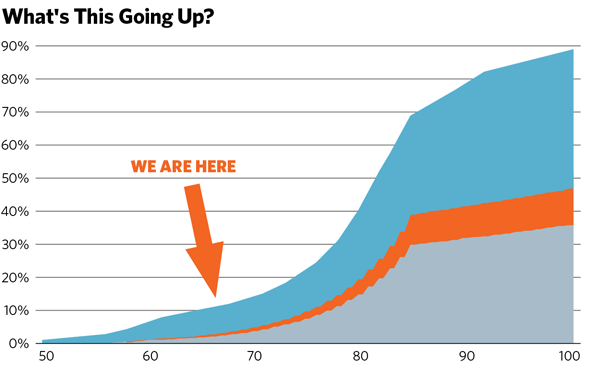

I recently attended a meeting of top advisors hosted by Wright State University in Dayton, Ohio, and while I was there, I shared the chart below with the attendees.

“What’s that going up?” you may ask. Is that Tesla’s stock price? Is it a projection for bitcoin? Is that the amount of money spent by fintech firms?

It’s a nearly perfect S curve, so whatever it is, it favors early adopters. Note where the arrow is.

So imagine the surprise from my audience at my big reveal:

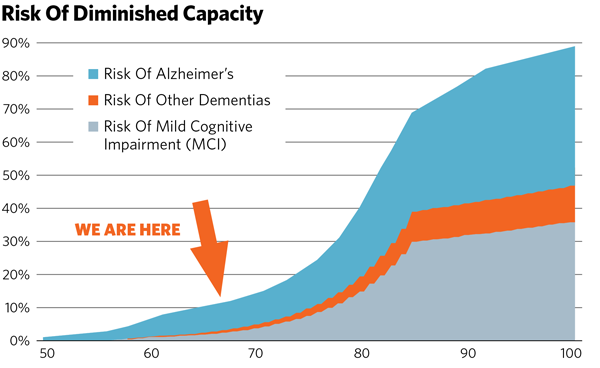

The chart is actually a measure of the risks clients face from incapacity as they age—specifically their risk of debilitating problems like Alzheimer’s, other kinds of dementia or MCI—mild cognitive impairment. My surprise got a mixed reaction. Many audience members nodded their heads. They see these problems every day among their clients, friends and families.

Savvy advisors know these ailments change both clients’ lives and the lives of their family members. The impact of these debilitating diseases is both immediate and ongoing. Nothing will be the same.

People’s priorities must change. And when clients face diminished capacity, their financial advisors will be needed more than ever, and in more complex ways.

The response of the advisory community to these problems is critical. We have to react with empathy but also engage clients professionally and with confidence when they go through these changes.

Like doctors, let’s start in a place much like an emergency room—and end up in a place that looks more like long-term care. It won’t just be our primary clients affected by these conditions. We’ll also have to be there for perhaps three generations of family members affected by their aging parent’s or grandparent’s new reality. Everyone needs to know we can help.

As you can see from the chart below, we don’t have much time before these conditions accelerate in frequency. Currently, one in eight people at age 68 will suffer from one of these illnesses. That figure more than doubles by the time they reach 78, and it increases sixfold by the time they are 88. Over the next 10 years, nearly one in three people we now serve is likely to become incapacitated, and a great many more will be affected when someone in their life does.

For advisors and their firms serving the nation’s 76 million baby boomers, this transition has been looming, yet our preparation is still light. Every firm and every advisor will need policies, procedures and supportive tools to do the following things:

• Determine a client’s incapacity;

• Protect them from things like identity theft and fraud and elder abuse;

• Engage their family to discuss their incapacitation (or otherwise determine that the client has no family support);

• Optimize the client’s finances for risk, taxes, income and long-term care, keeping in mind how the choices will affect more than one generation.

Don’t Ignore This Moment

If you are winding down your advisory career, you might be doing the math and saying that in 10 years you will be on a beach living “la vida más fina.”

Your clients likely know your plans too. But when you win clients, you have a “contract” with them—something noted by Ross Levin, founder of Accredited Investors Wealth Management, at our Next Chapter Rockin’ Retirement event in May. And your relationships with aging clients likely determine your firm’s valuation, something noted by another speaker, Tom Bradley of Schwab. If you skip out on these clients, the value of what you’ve built will be eroded or destroyed.

The Price Of Ignorance

I’ve spent a lot of time worrying about this issue on behalf of big company clients, and I count five significant risks from keeping our heads in the sand about this issue:

1. We can lose our current clients and their assets.

2. We might lose the ability to consolidate the assets that our clients hold elsewhere.

3. We could lose the clients’ families if we fail to take care of a member in turmoil. (Surviving spouses and adult children will have no sympathy for us if our response to a difficult topic is inertia.)

4. We could draw scrutiny from regulators if we don’t really sufficiently “know our clients” and their needs, which is part of our fiduciary responsibility.

5. Finally, we also risk our reputations. When it comes to aging clients in financial trouble, the more colorful cases tend to make headlines.

Other Than That Mrs. Lincoln, How Was The Play?

Every corner of the financial industry has benefited from the historic demographic of retiring baby boomers, a powerful wave lifting all our boats. It’s time to pay it back by at least meeting the needs of loyal clients and their families, all of whom will soon be dealing with the less pleasant issues that come with increased longevity. Our ability to serve them will be a function of both our will and skill. I’m completely confident we have the skill. Do we have the will?

Steve Gresham is on a mission to improve longevity and “retirement.” He leads an industry initiative, Next Chapter, and is CEO of the Execution Project LLC, a consulting firm. He is also senior educational advisor to the Alliance for Lifetime Income.