Prepping your clients’ children for the future can start way before the children apply for financial aid for college. And work with children can help you deepen your relationship with clients and invest in the future of their families.

In 2013, the University of Cambridge released a report in conjunction with the U.K. government on how young children form lifetime habits and learn about money. The report, authored by Dr. David Whitebread and Dr. Sue Bingham, says there are certain financial behaviors in children that are typically shaped by the time they are 7.

And the report says those behaviors are largely due to the parents, who young children normally enjoy being with and mimicking. By age 7, most children can count and understand the basics of exchange and equivalence, and they are beginning to conceptualize an income (or earning) and planning ahead.

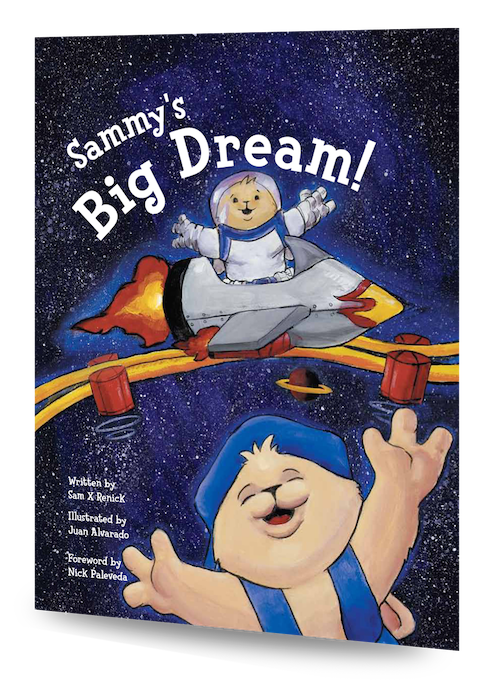

This report became the soundboard that Sam Renick, the author of the children’s book Sammy’s Big Dream and the founder of a socially conscious "It's A Habit" Company, has been using to reinforce the importance of financial literacy in young children. Renick believes parents are not only communicating financial values to children explicitly, but implicitly as well since they’re always indirectly talking about money.

Sammy’s Big Dream

Sammy’s Big Dream

The inspiration for Sammy Rabbit came from several places, said Renick.

"I was in financial services at the time,” he said. “Clients repeatedly shared with me their regret for not having been taught to save and invest when they were young. Then one day, a wholesaler showed up to give a presentation at a sales meeting [and] he encouraged us to give clients with kids an Etch A Sketch as a promotion and relationship-building tool if they opened up a college savings account."

The pitch reminded Renick of the financial habits his father had instilled in him when he was as young as age 4. Those habits led to Renick starting an automatic investment and saving program right after graduating from college. After the wholesaler’s pitch, Renick researched financial literacy among children and found that it was a challenging experience for parents and educators.

"That then got me to think it might be a better idea to give families with kids a resource that was both fun and communicated a financial education message."

Renick published Sammy's Big Dream in 1999. Sheryl Garrett, founder of the Garrett Planning Network, sponsored a revised edition last year to give to her own clients.

“I think Sam Renick was brilliant with his focus on young children,” said Garrett, who has a 7-year-old daughter. She spent over $2,000 for 1,000 books and gives copies to advisors in her network to share with their own families and clients.

Garrett said she used the book and songs with her daughter about two years ago and liked how the material intrigued and excited her. Garrett was then moved to spread the word of Sammy’s Big Dream to her local community in Eureka Springs, Ark.

“This is the same thing we talk to adults about, except we use the big words,” said Garrett. The story of Sammy Rabbit’s journey to accomplishing his big dream, she said, coincides with her belief that advisors should prompt adult clients to think about what they really want, too.

She then told the story of a client who helped her understand the concept of a big dream without the "shackles of adulthood." A couple came to her office seeking advice on how to safely transition to retirement. When Garrett asked the husband what he sincerely wanted to do with his retirement, he said he wanted to run a bait-and-tackle shop. The man's wife and Garrett both thought the idea was too small, and so took it as a joke and giggled. However, once Garrett realized that her client was serious, she began to recognize that this was what he really wanted.

She recommends switching up traditional promotional materials with something more family friendly.

“Instead of having the stereotypical financial planning or investment-related trade journals, instead—it’s crazy—let’s put a child’s book out there,” she said.

Renick said an idea like that is an opportunity for advisors to develop a deep relationship with their clients and build their practice. He also added that the book Sammy’s Big Dream has an additional benefit to clients: It might spark a much-needed dialogue between parents.

“If [spouses] are not on the same page, it might catalyze a conversation between them,” he said.

Sammy’s Big Dream does what the University of Cambridge report recommends—helps parents initiate the conversation about delayed gratification and planning ahead by learning to save.

“I think learning to save money is the No. 1 skill that they should teach kids,” Renick added. “It’s about protecting yourself and positioning yourself for opportunities.”

An Opportunity To Bridge Generations

George Gagliardi of Coromandel Wealth Management in Lexington, Mass., is another advisor who wants to include children in financial literacy discussions. He has been an avid reader of Ron Lieber’s “Your Money” column in The New York Times and hands out an assortment of books to his clients about money, including Lieber’s parental guidebook, The Opposite of Spoiled. This is a marketing tool, Gagliardi says, and “a way to educate people in a gentle, simple way.”

Danielle Howard is a financial advisor in Basalt, Colo., who services the Roaring Fork Valley area. She’s been working with an organization called Youth Entity and its program, “I Am Financial Knowledge.” She has taught classes for fifth and eighth graders in the program.

“I always felt that there is a need for financial literacy among the younger years,” said Howard, who has children. “To see their faces and the lights go on in their heads when they start getting it and they get excited about money in a healthy way ... you’re making an investment into the future of your community. It’s a beautiful thing.”

Mitchell Kraus is a financial advisor and the co-owner of Capital Intelligence Associates in Santa Monica, Calif. His practice includes legacy planning in which advisors focus on multigenerational wealth planning, philanthropic planning and socially responsible investing.

“A lot of studies say that financial education is very hard to teach in the classroom, and it’s not taught with real-life examples in family life,” said Kraus, who started focusing some of his advising on the younger generations.

He hands out children’s books and also gives tips to parents on teaching their kids financial literacy. First, he said, he tells his clients to go shopping with their children. He took his own son to the local farmer’s market every week for him to buy flowers for his mother so he could be familiar with handling money and exchanging money for goods.

As his son got older, Kraus encouraged him to estimate what the tax would be for the things his son wanted to buy. And Kraus and his wife implemented a three-bucket approach where his son would divide his allowance into jars labeled “for later,” “for now” and “for others.”

“I’ve been giving the advice for years, but I’ve found that once I give a personal story with it, my clients listen a little bit more intently,” Kraus said.

This is a layering approach that helps his practice because the policy is that clients' children automatically become his clients, too.

He added, “What we’re doing here with young children is trying to build a base … as children get older, we build on how investing works and so on.”