While China’s stock market handily outperformed the U.S equity market in 2020 (+29.7% versus +18.4%, respectively), 2021 has been a very different picture. During the first nine months of 2021, China’s stock market fell 33% from peak to trough. Alternatively, the S&P 500 reached numerous new highs during the first nine months of 2021, ending September with a year-to-date gain of nearly 16%. What are the forces that have pushed Chinese stocks deep into bear market territory, and how should investors respond?

Recent Developments

Over the last 12 months there have been frequent announcements from the Chinese Communist Party (CCP) establishing new top-down economic and social regulations. In fall of 2020, the CCP clipped the financial plans of Jack Ma, founder of the Chinese e-commerce giant Alibaba Group and the third-wealthiest person in China (26th globally). The financial markets had been anticipating the planned IPO of another of Ma’s companies, Ant Group, a digital payment platform serving 80 million merchants. In the two weeks prior to the scheduled IPO, Ma had been outspoken in his criticisms of Chinese financial regulations. The CCP responded by blocking Ant Group’s public offering, a clear message that it would not tolerate Ma’s public dissent, his growing access to the valuable Chinese consumer data, and perhaps his potential for ever-expanding personal wealth. Ma had become a threat to the country’s strong sense of homogenized culture controlled by the CCP.

Several months after shutting down the Ant Group IPO, the Chinese government ordered private, after-school tutoring companies to abandon their for-profit status and adopt a non-profit structure. Private schools were paying their teachers very attractive wages, and government-run schools were suffering from the migration of teaching talent. Further, the growth of private tutoring companies was challenging Chinese communism’s prioritization of “common prosperity.”

In late summer 2021, the Chinese government decided not to bail out the massively indebted real estate conglomerate, Evergrande. The Chinese stock market sold off on the government’s steps to rein in the speculative use of corporate debt, as well as to counteract the forces leading to housing becoming increasingly unaffordable. Further social engineering was evidenced by the government limiting online video game playing by young people to three specifically designated hours per week. Regulations were also targeted at overseas equity listings, cryptocurrency, online finance, labor practices, drug prices and food product disclosure.

As president of the People's Republic of China and general secretary of the Chinese Communist Party, Xi Jinping is free from the checks-and-balances of term limits, legislative debate, and potential dissent from the media and his citizens. Economic and social changes in China can happen quickly and with force, which has sometimes contributed to rapid economic growth, as well as quick pullbacks in the country’s stock market.

The Global Economy And Stock Market

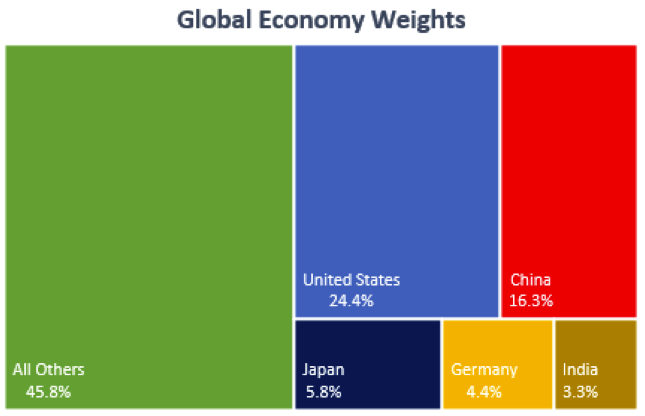

The U.S. and China rank as the world’s largest economies, at 24% and 16%, respectively, according to World Bank estimates (2019). From another perspective, China’s GDP is currently about two-thirds the size of the US’s economy. According to Andy Rothman at investment manager Matthews Asia, in the 10 years through 2019, on average, China accounted for about one-third of the world’s economic growth, larger than the combined share of global growth from the U.S., Europe and Japan (Source: “Why China? A Macro Perspective,” Andy Rothman, Matthews Asia, March 11, 2021). Looking forward, Oxford Economics has forecasted that the Chinese economy will be larger than that of the US by 2029 due to its stronger expected economic expansion (Source: “China’s 2020 GDP means it will overtake U.S. as world’s No. 1 economy sooner than expected,” Naomi Xu Elegant, Fortune, January 18, 2021).

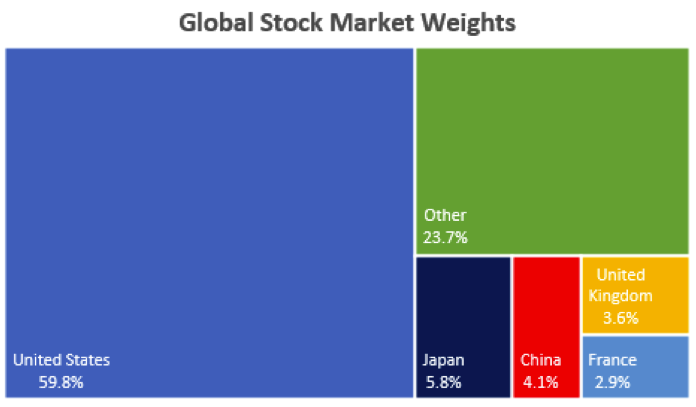

The market capitalization of China’s stock market is dwarfed by that of the U.S., as measured by the MSCI All-Country World Index. Just over 4% of the global stock market is in China-based companies, versus 60% in the U.S. (Source: MSCI, August 31, 2021) Viewed another way, the U.S. stock market is more than 14.5 times the size of the Chinese stock market when weighted by market capitalization. Nonetheless, investing in the emerging markets can entail a notable allocation to Chinese stocks, as China constitutes about 38% of the MSCI Emerging Markets (EM) Index.

Three-fourths of the way through 2021, equity valuations (as measured by the price/earnings ratio for the next-12-months) in China were about 5% above their 25-year average (Source: J.P. Morgan Asset Management, September 30, 2021). Alternatively, U.S. stocks were priced approximately 22% above their long-term average valuations. Emerging markets as a whole, including China, were trading about 6% above their average.

In recent months, Innovest solicited comments about China from several emerging markets managers who have passed our rigorous due diligence process. Some EM managers looking for long-term value were adding exposure to Chinese stocks, including in those companies that may benefit from regulatory changes. Other managers in search of earnings momentum were trimming their Chinese exposures. Perhaps most notably, none of the managers who we contacted were abandoning all exposure to China’s stock market.

Recommendations

Bad news about political and regulatory interference in a country’s economy, while unwelcome, is usually reflected quickly in stock prices. Bear markets create opportunities. It is important to note that while China’s stock market fell 33% during the first nine months of 2021, the more broadly diversified MSCI EM Stock Index had a pullback of less than 15%. Country diversification within the emerging markets will likely continue to benefit investors going forward.

As EM economies evolve, they ordinarily shift from lower-cost, labor-intensive industries such as agriculture and manufacturing to higher paying, service-oriented sectors. Technology stocks, which represented about 2% of the EM index in 1995, are now the largest sector in the index at 21%. The increase in higher paying jobs has fueled the growth of the middle class and economic growth through higher consumption. According to Lazard Asset Management, the EM middle class is expected to represent 58% of the world’s middle-class population by 2030.

As of early 2021, Innovest’s Capital Markets Expectations for the next five to 10 years anticipated that emerging markets should have the highest expected volatility and the highest expected long-term returns when compared to U.S. and international developed markets stocks. We believe that the best approach to global equity diversification includes an appropriately sized allocation to EM equities, as well as diversification within EM by countries, sectors and stocks. Considering the risks and long-term return opportunities in the emerging markets, including China, we remain comfortable with our recommended EM equity allocations.

Innovest believes that the soundest approach to investing in the emerging markets is not to micromanage country exposures, but to entrust the country, sector and individual stock decisions to those professionals hired to evaluate those opportunities on an ongoing basis. A patient, long-term outlook is the approach that is most likely to be rewarded for equity investors.

Scott Middleton, CFA, CIMA, is a principal at Innovest Portfolio Solutions, and Peter Girard is an analyst at Innovest Portfolio Solutions.