A major source of volatility in the global financial markets over the past year relates to the emergence of a huge secular change in the global monetary order, the first since the early 1970s: China’s integration into the global financial system. Highlighting this change was the inclusion of China’s currency last November in the International Monetary Fund’s (IMF) foreign reserve asset known as the SDR (Special Drawing Rights), whose value is determined by a basket of international currencies, including the U.S. dollar, the euro, the yen and the British pound.

This integration is momentous, marking another major advance by China onto the world stage. China’s imprint on the global financial markets is now unmistakable; its actions influence foreign exchange rates, interest rates, capital flows, equity markets and, by extension, the decisions made by global central banks.

Adjustments to China’s integration contributed to the two swoons in global equity markets last August and this past January, with two dips of about 10% in major markets. The severity of these market moves demonstrates that investors need to gain a greater understanding of this “new order” to avoid the potential pitfalls and take advantage of the potential opportunities.

The sunny side of the disruption

China’s integration into the global economic system began literally decades ago, starting in 1978 with a series of market reforms in China. It accelerated after China became a member of the World Trade Organization in December 2001. Today, China is a dominant force in global trade and the world’s biggest exporter.

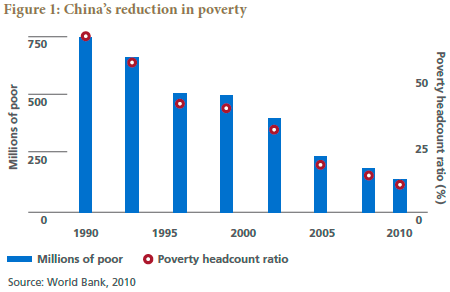

China’s rapid pace of economic growth, averaging around 10% for over 30 years, has been integral to its success on the world stage and is the fastest sustained expansion by a major economy in history.1 This growth has also led to remarkable domestic achievements, in particular a spectacular reduction in poverty2 (see Figure 1).

While this by far is the most notable achievement for the Chinese people, the increase in the standard of living is also evident in photographs taken of Shanghai recently versus 25 years earlier (see Figure 2).

In contrast to China’s relatively smooth integration into the global economy, China’s recent integration into the global financial system has been far less seamless, with investors focusing often on the negative near-term consequences.

There are legitimate causes for concern. For starters, China’s economic growth rate is slowing, probably toward 6% or so, its population is aging and it is attempting to transform an economy from investment-led to consumption-led on a scale never seen before. This requires a delicate balancing of many reforms that could easily tip China’s economic and financial system in the wrong direction. Moreover, China’s indebtedness has increased, and it is attempting to carefully manage a non-performing loan problem in the banking sector without upsetting its economy or its plan to transform its growth model.

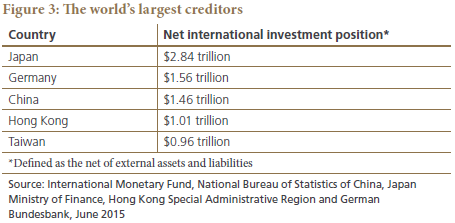

Despite these concerns, there are potentially positive considerations. China may someday surpass Japan as the world’s largest creditor (see Figure 3); it could thus provide an enormous amount of financial liquidity to the world, including neighboring Asian countries, which account for about a third of the world’s economic growth, well above the U.S., which accounts for about 22%, and Europe, at around 18%.

Those who today worry about capital outflow from China should perhaps consider the sunny side: Chiefly, the outflow frees up “trapped” capital in China that can then be invested in the rest of the world. Moreover, they may want to recall Bagehot’s dictum, which central banks have followed profoundly and effectively in the aftermath of the 2008 financial crisis:

“to avert panic, central banks should lend early and freely (i.e., without limit), to solvent firms, against good collateral…”

To this end, China’s role as a major liquidity provider could well increase in the new order if the yuan becomes more widely used as a form of payment and becomes a bigger share of the foreign currency reserves held by the world’s central banks. Today, however, very few reserve managers hold reserves in the yuan; most are held in U.S. dollars, as has been the case for decades.

China now tops the world in international reserve assets, with holdings of $3.2 trillion (out of $11 trillion held globally) built from the world gobbling up goods “Made in China” (see Figure 4). So China has both the wallet and the will to ably navigate these challenges – if it applies its skills to manage them. It bodes well that China has already achieved what many have dubbed an economic “miracle.” Perhaps investors should consider applying Warren Buffet’s “Don’t bet against America” mantra to China too until they find reasons to bet otherwise.

Uncertainty and plenty of it in the new order

Giving China the benefit of the doubt hasn’t been easy for investors given the volatility stemming from uncertainties over China’s foreign exchange policy. Investors ask, what exchange rate is China targeting? Which currencies will it manage against? At what speed would China like its exchange rate to move? Will China surprise investors yet again with more “one-off” currency devaluations?

Uncertainty is the bane of financial markets, and uncertainties over monetary policy can be especially gut-wrenching. Former Federal Reserve Chairman Ben Bernanke, an advisor to PIMCO, has famously said that monetary policy is 98% communication and 2% action. Clearer communications by China could go a long way toward reducing uncertainty and restoring calm in global markets, and it has made some progress. Christine Lagarde, head of the IMF, said she was “delighted” by China’s recent communications effort.

China has been clearer about its policies since the G-20 meeting in Shanghai in February, where a “ceasefire” in the global currency war seems to have been declared and China’s central bank governor Zhou Xiaochuan clarified the PBOC’s foreign exchange policy. The calm that has followed is likely to persist in 2016 because China is hosting a series of G-20 meetings, including the heads of state in early September, and it will probably want to convey a sense of stability.

The return of state control

What’s so different about the new global monetary order? China’s integration into the global financial system, and in particular its inclusion into the IMF’s SDR, has reintroduced an element of state control into the world’s foreign exchange system, something that has been missing since the Bretton Woods system ended in the early 1970s, which itself was a managed system lasting about 25 years. The post-Bretton Woods regime has been far different: a free-floating free-for-all that some believe is at the root of a very volatile era in exchange rates.

What, then, is so bad about having an element of state control returned to global foreign exchange? Again, we return to uncertainty. Unlike the Bretton Woods era, when markets operated with an understanding of what the governing states intended with respect to exchange rate movements, investors today are unsure because China only recently began its communications effort.

Uncertainty over the direction, depth and speed of movement in China’s currency can complicate monetary policymaking throughout the world and cloud the economic outlook, especially for nations that compete and trade with China. Like ripples in a pond from drops of water, developments in China ripple throughout the global economy and the financial markets.

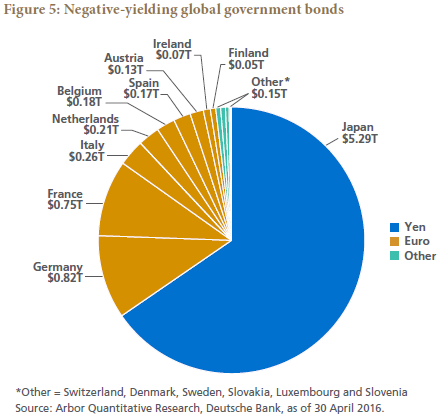

The impact has extended to the Federal Reserve, whose monetary policy since last year can accurately be described as “made in China” as China’s actions altered the Fed’s projected course on interest rates. The European Central Bank and Bank of Japan have also been affected, each taking actions in response to global economic and financial strains emanating from China. Their actions, in turn, contributed to market volatility, in particular Japan’s decision to lower a key policy rate below zero, thrusting two-thirds of Japan’s $7.0 trillion in government bonds into negative-yielding territory (see Figure 5).

While an element of state control could turn out to be a positive development owing to the certainties it creates, for now uncertainty remains in force, albeit less so than at the start of 2016. Investors nonetheless eventually will adapt to the new order, and as long as China is successful in transforming its economy, they could well see the sunny side of China’s integration into the world’s financial system.

Notes:

1http://www.worldbank.org/en/country/china/overview

2World Bank

Tony Crescenzi is an executive vice president, market strategist and generalist portfolio manager in PIMCO's Newport Beach, Calif., office.