Financial advisors, millions of your fellow Americans desperately need your help and the sooner the better.

Many of them don’t save a cent. They have no protection for an emergency. They are not on the road to getting a house. They are not saving for retirement.

These points were mentioned in a recent report from Goldman Sachs celebrating declining household savings rates—the celebration being that lower savings rates means more spending to boost the economy.

“The good news for the U.S. economy, then, is that if the savings rate reverts back to normal, there should by definition be more spending. The Goldman forecast is for the savings rate to fall by 2 percentage points through 2022,” according to Goldman Sachs.

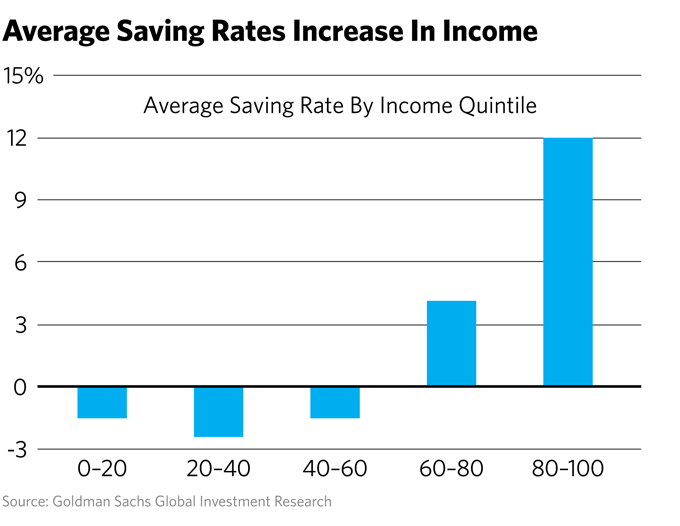

However, there is another side to this notion that more spending and less saving will be great for the economy. A chart accompanying the report illustrated that those in the bottom three income quintiles are saving nothing.

What might or might not be good for the economy as a whole could simultaneously be disastrous for millions of Americans because an all-spending/no-savings approach boosts the odds of facing a retirement without retirement assets.

What might or might not be good for the economy as a whole could simultaneously be disastrous for millions of Americans because an all-spending/no-savings approach boosts the odds of facing a retirement without retirement assets.

How can this be changed?

Clients need to be motivated. Advisors need to use both fear and greed to get people to save, according to Charles Hughes, a certified financial planner in Bay Shore, N.Y.

“Sometimes you need to put fear into the client; you need to look the client in the eye and say you won’t able to retire if you don’t begin saving,” Hughes says. “You need to motivate the younger client by explaining that even just $100 a month when you’re in your 20s is a good way to start.”

For older clients who may already have substantial assets, Hughes says sometimes “you need to use greed to show them how to get those extra things that they would like to have.”

Some clients will save when advisors walk them through basic planning concepts, says Niv Persaud, a financial planner at Transition Planning & Guidance LLC in Atlanta.

“Clients are motivated to save when they know what they are saving for–whether it’s a tangible item or experience,” she says. “I use the ‘5 P’s of Life’ to help clients describe their current lifestyle and what they ideally would like to achieve.”

She notes the 5 P’s of Life are personal relationships, personal finance, profession, peace of mind and physical health.

Daniel Flanagan, an advisor with Canby Financial Advisors in Framingham, Mass., says he persuaded a client to start aggressively saving via her workplace.

“She said she had been accumulating cash in her checking account and asked how best to invest it,” Flanagan explains. “She then shared that her employer provided matching of retirement contributions up to 6%. I suggested that she contribute at least 6% of her salary so she gets the full match because it’s essentially free money.”

Karen E. Van Voorhis, director of financial planning at Daniel J. Galli & Associates in Norwell, Mass., says she tells young people not to fall into the trap of not saving because they don't have anything concrete in front of them to save for such as children or buying a home or a retirement that’s so far into the future that it’s almost like an abstract concept.

Her advice to them is as follows: “It’s okay to save a little every month and to not know what specifically you are saving for.”

Beginning early with regular savings has multiple benefits, Van Voorhis says. “Not only will a person be creating a pool of saved-up funds, it also does double duty by creating a valuable habit, which has been shown to be very beneficial. A good habit like saving becomes ingrained.”

Advisors should use psychology, says another financial advisor.

“You must use behavioral finance and have the client come up with their own action plan,” says Mike Alves, an advisor at Vida Private Wealth in Pasadena, Calif. “Otherwise, they will feel it was your recommendation and your idea, not theirs.”

Do the numbers to make clients see the benefits regular savings, says another advisor.

“Honestly, it is as simple as running the numbers through financial planning software,” says Liz Windisch, an advisor with Aspen Wealth Management in Centennial, Colo. “Showing clients or would-be clients how much longer they will have to work does the trick. This is true whatever the goal [whether it’s] retirement, buying a house or sending their kids to school.”

Michelle Buonincontri, a financial planner in Anthem, Ariz., says the most important factor is to just get going with regular savings no matter how small the amount.

“Start small to get folks hooked on the good feeling of saving,” she says. “I like to use ‘gamification’ and automate the process. For example, identify a small win like cutting out daily Starbucks, create a visual to show them how their money will grow, and automate that savings. There are even game forms that we can create for younger clients.”