Financial advisors, millions of your fellow Americans desperately need your help and the sooner the better.

Many of them don’t save a cent. They have no protection for an emergency. They are not on the road to getting a house. They are not saving for retirement.

These points were mentioned in a recent report from Goldman Sachs celebrating declining household savings rates—the celebration being that lower savings rates means more spending to boost the economy.

“The good news for the U.S. economy, then, is that if the savings rate reverts back to normal, there should by definition be more spending. The Goldman forecast is for the savings rate to fall by 2 percentage points through 2022,” according to Goldman Sachs.

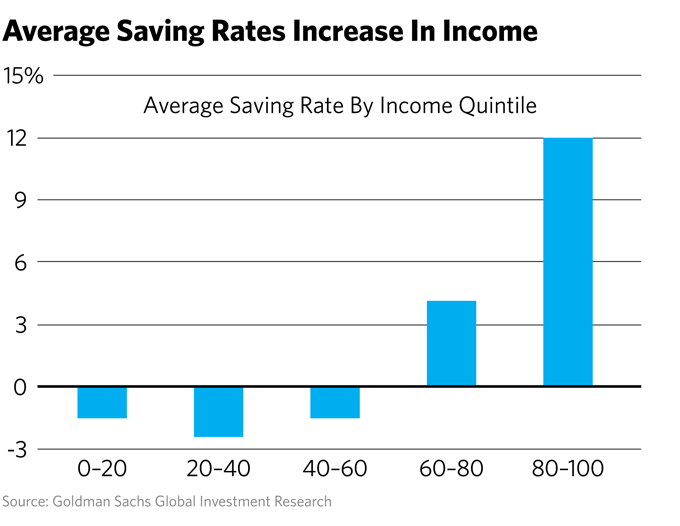

However, there is another side to this notion that more spending and less saving will be great for the economy. A chart accompanying the report illustrated that those in the bottom three income quintiles are saving nothing.

What might or might not be good for the economy as a whole could simultaneously be disastrous for millions of Americans because an all-spending/no-savings approach boosts the odds of facing a retirement without retirement assets.

What might or might not be good for the economy as a whole could simultaneously be disastrous for millions of Americans because an all-spending/no-savings approach boosts the odds of facing a retirement without retirement assets.

How can this be changed?

Clients need to be motivated. Advisors need to use both fear and greed to get people to save, according to Charles Hughes, a certified financial planner in Bay Shore, N.Y.

“Sometimes you need to put fear into the client; you need to look the client in the eye and say you won’t able to retire if you don’t begin saving,” Hughes says. “You need to motivate the younger client by explaining that even just $100 a month when you’re in your 20s is a good way to start.”

For older clients who may already have substantial assets, Hughes says sometimes “you need to use greed to show them how to get those extra things that they would like to have.”