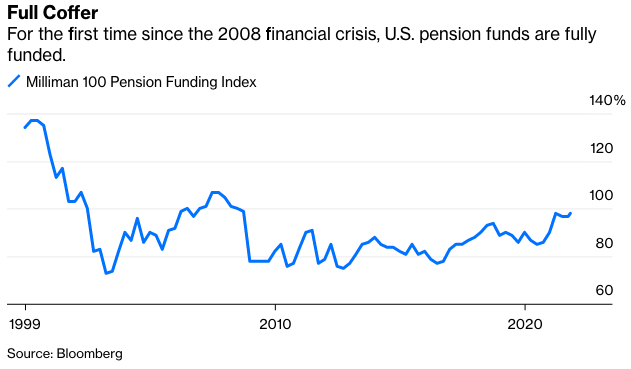

Future U.S. pensioners should feel pretty happy about their golden goose. A strong stock market, coupled with a dovish Federal Reserve, has buffed up their retirement accounts. For the first time since the 2008 financial crisis, corporate pension plans are edging close to being fully funded. Over the past year, their collective retirement pot has grown an average 15.6%, data compiled by Milliman shows.

But adversity is always looming over the horizon, and investors I spoke to in New York recently have their eye on one potential crisis that could upend decades of portfolio planning: What happens if a war breaks out over Taiwan? Despite more frequent diplomatic contacts and a joint Glasgow statement on climate change, the U.S. and China nonetheless have entered dangerous territory over the island that Beijing claims as its own. Chinese bombers have flown in recent weeks off the southern end of Taiwan, while U.S. politicians talked tough. On Sunday, refueling aircraft joined the People’s Liberation Army’s air patrol for the first time after a bipartisan group of U.S. lawmakers vowed “rock solid” support for Taiwan during a surprise visit.

Money managers and analysts are now mapping out potential war scenarios. An official notice last month from authorities in Beijing on stockpiling food ahead of the winter holidays was interpreted by Chinese traders as a sign of imminent conflict with Taiwan. In the U.S., Taiwan was such a hot topic among institutional investors that even JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon waded into the politics; he talked about the political unpopularity of “body bags” in a speech in Boston last week in remarks that prompted an apology for his joking about the longevity of the Communist Party.

But a threshold problem for U.S. financiers and their clients is that they don’t quite realize the extent of their exposure to China or how politically sensitive their assets can be. Data from the Treasury Department, for instance, tell them that they had $154 billion of Chinese shares as of 2017. But that’s a profound understatement. The actual amount would be 4 1/2 times the official figure (about $700 billion) because many publicly listed Chinese companies, including Jack Ma’s Alibaba Group Holding Ltd., were incorporated in tax havens such as the Cayman Islands. These are counted as non-Chinese by the Treasury.

Similarly, a pension fund that aims to grow its assets inevitably has a lot of China exposure too. Of the top 10 largest state public pension funds, all have allocated money to track global indexes that have exposure to the country. In the past two decades, China overtook Taiwan and then South Korea as the biggest component, at about one-third, of the MSCI Emerging Markets Index. It now accounts for about 11% in the MSCI All-Country World Index.

In the years following the financial crisis, to juice up their returns, pension funds increasingly diversified into private equity and real estate investments, with an equal-weighted average of 19.6% by 2017 from 7.4% a decade earlier. The top pension funds want to do even more. California Public Employees’ Retirement System, or Calpers, is aiming for 28% from 21% currently, to hit its 6.8% annual return target—and this is where the China exposure could prove even trickier.

U.S. pension funds often do not have teams on the ground, relying instead on private equity or venture capital funds to make investing decisions. Unfortunately, foreign money often chases politically incorrect sectors.

Between 2017 and 2020, local affiliates of Silicon Valley venture firms such as Sequoia Capital more than doubled their support of Chinese semiconductor companies, despite—or perhaps because of—U.S. government’ efforts to thwart China’s technological advance. Investors tend to channel money toward Beijing’s preferred destinations, which these days are in chips, electric vehicle supply chains and industrial automation. But then these start-ups, whose technologies could be adopted by the Chinese military, would all be subject to economic sanctions in the event of a war. Will pension funds write down their entire stakes then, if there’s no exit in sight?

In the event of a PLA invasion, the sanctions list Washington D.C. has placed on Chinese companies will only broaden beyond the likes of Huawei Technologies Co. and China Mobile Ltd. U.S. pension funds will be forced to sell their holdings, possibly incurring losses in tens of billions of dollars.