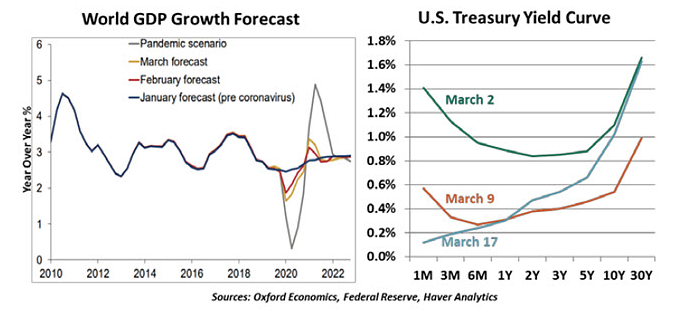

This month’s consequences from the COVID-19 virus have been substantial. Apart from the impact on public health, equity indices have corrected with considerable speed amid a massive shift away from risk assets. Consumers have pulled back, by choice or by mandate. The optimistic tone seen in the economy and markets just two months ago has given way to fear and uncertainty.

To counteract these contractions, citizens around the world have looked to policy makers to expand their efforts. This week saw substantial movement in that direction.

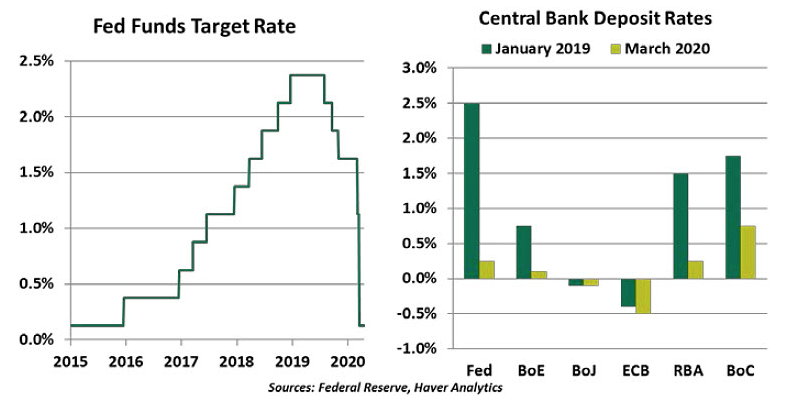

The U.S. Federal Reserve has been the first and most decisive agency to act. Two weeks ago, its governors agreed to a 50 basis point cut to the federal funds rate, acting quickly to help markets find their footing. But investors were unimpressed. So, over this past weekend, the Fed pulled out all the stops with a comprehensive package of stimulus. Overnight interest rates returned to their crisis-era lows of 0%-0.25%, accompanied by strong forward guidance that rates would “maintain this target range until…the economy has weathered recent events.”

The Fed took additional steps that draw on crisis-era strategy. Quantitative easing has returned, as the Fed plans to add $700 billion to its balance sheet before the end of the year. It reopened swap lines with other central banks to ensure an ample supply of dollars worldwide. And it encouraged banks to use the Fed discount window to meet their liquidity requirements. Despite past hesitation to take advantage of borrowing from the Fed, several major banks stated they will incorporate it as a funding source.

The Fed reopened several programs first chartered in 2008, committing to purchase commercial paper (short-term unsecured corporate debt) and providing credit to primary securities dealers to help them finance their inventory. Support has also been extended to the money market mutual fund industry, which has seen accelerating outflows from certain products.

The Fed was not alone in its efforts. Late on Wednesday, the European Central Bank committed to €750 billion of sovereign and corporate bond purchases. The Bank of England slashed its policy rate and made an unlimited commitment to support its commercial paper market, while the Bank of Japan doubled its asset purchase program. Central banks in Australia, Brazil, Indonesia and the Philippines, among others, have taken actions to support their economies. The coordinated global monetary response is underway.

As well, central banks in many jurisdictions have formally encouraged banks to use their capital and liquidity to support the economy. In some cases, central banks are making funds available for direct lending to borrowers harmed by the coronavirus.

With these supports, central banks have resumed the accommodative posture adopted during the global financial crisis. But COVID-19 is not a monetary problem, and it cannot be cured with monetary solutions. An equivalently strong fiscal stimulus is required.

The U.S. fiscal response has been frustratingly slow. Congress initially passed a limited, $8 billion bill to fund emergency response and vaccine development. Another measure followed this week that includes support for the cost of virus testing, paid sick leave for many workers caring for children, and funding to states to expand unemployment, health care and food aid programs. But greater support is still needed to bring the country through this crisis.