Credit Suisse is shuttering five more exchange-traded notes next month, eliminating a pair of structured products that let investors bet on swings in stock markets and a trio of notes tied to oil prices.

The investment bank, which infamously closed the $1.9 billion VelocityShares Daily Inverse VIX Short-Term ETN, ticker XIV, in February amid a maelstrom in which the S&P 500 Index tumbled 8.5 percent in five sessions, seems to be targeting smaller, less popular funds this time around. None of the funds set to shut Aug. 15 has more than $7 million in assets.

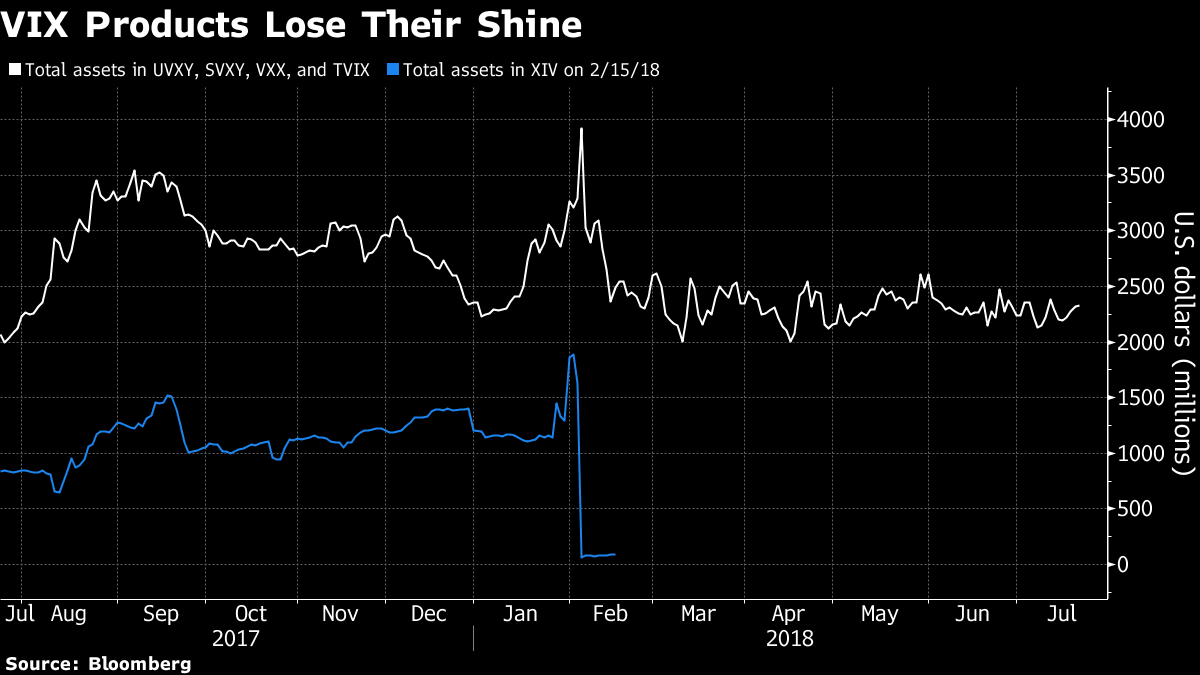

Retail interest in exchange-traded products tied to volatility has dimmed since early February, even among offerings whose size dwarfs that of Credit Suisse’s two notes.

The four largest products have seen total assets fall from nearly $4 billion to less than $2.5 billion. That figure excludes XIV, which saw assets plummet to $90 million at the time of its closing. On July 13, the investment adviser behind the REX VolMAXX Long VIX Futures Strategy ETF announced the end of that small fund.

Eric Balchunas, a senior ETF analyst with Bloomberg Intelligence, notes that Credit Suisse is keeping its more popular offerings in the volatility space, the VelocityShares Daily Inverse VIX Medium Term ETN (ZIV) and the VelocityShares Daily 2x VIX Short Term ETN (TVIX).

“This is more about pruning products that aren’t selling as much, rather than getting out of the VIX world,” he said.

The funds that will close are the VelocityShares VIX Medium Term ETN (VIIZ), which has $7 million in assets and has gained 2.6 percent this year, and the VelocityShares Daily 2x VIX Medium Term ETN (TVIZ), which has about $1.8 million and is down 3.7 percent in 2018.

Implied equity volatility was roughly three times higher when Credit Suisse killed the bigger fund on Feb. 6, the morning after a record spike in the Cboe Volatility Index.

“In an overall sense there has been a downturn in interest in VIX products,” Balchunas said. “XIV scared some smaller investors.”

Credit Suisse Closes Five More ETNs

July 26, 2018

« Previous Article

| Next Article »

Login in order to post a comment