While some have noted that the recent stock leadership has been too defensive in nature, it has been anything but that at the sector level, with cyclical sectors crushing defensive sectors by 11.58% in 2019 thanks primarily to Technology representing over a 30% weight in the cyclical basket.

Absent a material tightening of financial conditions or a deterioration in the restarted China-U.S. trade talks, we believe that cyclicals will remain in the driver’s seat for the remainder of the year even if total returns begin to moderate.

What We’ve Seen

• With Tech’s over 30% return on the year, they have driven 40% of the outperformance of cyclicals relative to defensives. On the flip side, Health Care’s political-driven struggles leading it to be the worst performing sector was the second greatest contributor representing nearly 48% of defensives.

• From a ratio perspective, cyclical sectors offer better growth and quality characteristics even with higher valuations than Defensive Sectors. More specifically, both the Price-to-Earnings Growth and Return on Equity to Price-to-Book Ratios are higher implying that investors looking for quality growers in a low economic growth world may continue to find opportunities with cyclicals.

Cyclicals Offer Better Long-Term Earnings Growth And Quality Than Defensives

Source: Bloomberg Finance, L.P., as of July 9, 2019. Cyclicals represented by the MSCI USA Cyclical Sectors Index and defensives represented by the MSCI USA Defensive Sectors Index. One cannot invest directly in an index.

Money in Motion

• Over the last 3 months, ETF investors have added $1.29 billion to cyclical sectors and redeemed $1.34 billion from defensive sectors. However, over the last month, defensive sectors have brought in $1.29 billion helping to cut into the large gap between the groups.

• However, the recent outflows in the Tech sector in June are notable. While we do not view this is a true rotation away from cyclical exposure, some gains have been taken off the table prior to the upcoming earnings season.

• To put recent flows into perspective, investors have generally favored cyclical sectors over defensive sectors since mid- April. This stands in sharp contrast to investor sentiment during Q4 2018 and the better part of Q1 2019 highlighting how much performance has driven flows.

ETF Investors Have Been Favoring Cyclicals

Source: Bloomberg Finance, L.P., as of October 1, 2018 to July 9, 2019. Data represents the daily percentile rank of the rolling 3-month net flows of U.S.-listed U.S. Cyclical Sector ETFs and U.S. Defensive Sector ETFs specifically targeting exposure to sectors defined by MSCI as cyclicals and defensives, respectively.

What’s Next?

After the last period when defensives beat cyclicals (Q1 and Q2 2016), cyclicals went on to outperform in 7 consecutive quarters. Using this period as a potential prologue, cyclicals have room to continue besting defensives after suffering for 3 quarters in a row last year.

• Along with Real Estate and Communication Services, defensive sectors – Health Care and Utilities – are expecting to see positive EPS growth in Q2 2020; although, Consumer Staples and Energy are anticipated to be negative.

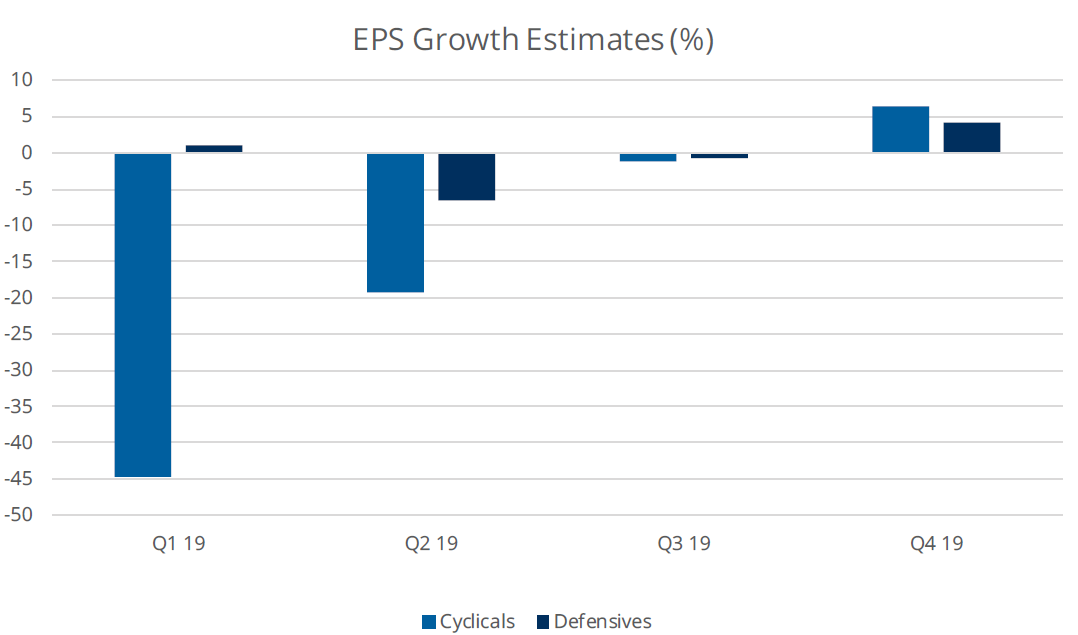

• On the other the hand, driven by pronounced margin compression in large Tech names, the near-term earnings picture does not look favorable for cyclical sectors. However, investors will likely look beyond Q2 and even Q3 as they anticipate the benefits of looser monetary policy and a potential pickup in economic data that historically boosts cyclicals on a relative basis.

Q2 2019 Earnings Look Better For Defensives

Source: Bloomberg Finance, L.P., as of July 9, 2019. Cyclicals represented by the MSCI USA Cyclical Sectors Index and defensives represented by the MSCI USA Defensive Sectors Index. One cannot invest directly in an index.

— David Mazza is managing director and head of product at ETF provider Direxion.