As Spain, Italy, Greece and other Southern European countries continue their struggle for fiscal solvency, the possibility of finding even a tidbit of bright economic news in these regions seems remote.

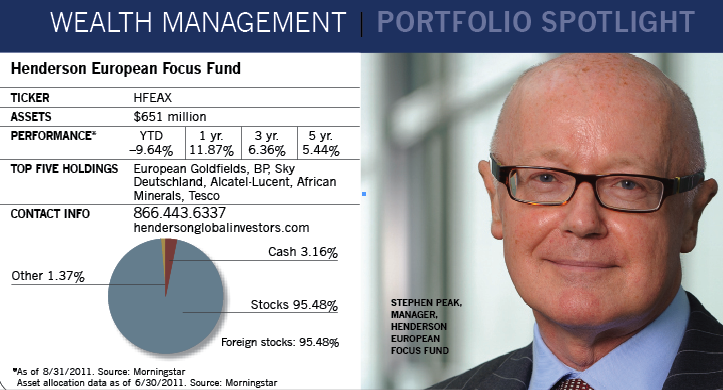

Yet the companies in Europe are an altogether different story, says Stephen Peak, manager of the Henderson European Focus Fund. "Remember, we're not investing in the growth of European economies. We're investing in the growth of companies located in the European markets," he says.

To Peak and others, strong companies represent a bastion of investment sanity at a time that U.S. government bonds have been downgraded, continued debt woes plague the euro zone and slow economic growth in Western markets continues to darken the mood of global investors.

No area has felt the pain of slow GDP growth and government fiscal imprudence more keenly than Europe, where the European Central Bank's efforts to shore up the balance sheets of troubled countries such as Spain and Italy have done little to assuage nervous investors, who fear the worst is yet to come.

Peak sees no easy solution. "Europe has reached a crossroads in terms of the euro experiment," he says. "Member countries might drive linkages deeper, but that could mean giving up individual country rights such as setting tax rates. Another option would be a kind of two-speed euro zone that separates the northern countries from those in the south. In any case, the good thing about all this is the growing pressure to come to a workable solution rather than to just paper over the cracks in the system."

People might point fingers at Europe and its market volatility, but it hasn't been the only region with problems, Peak says. The U.S. has also had its share of fiscal foibles and stock market swoons. And while the economies of China and other emerging markets have been more robust, their stock markets haven't been the powerhouses many had hoped for over the past year.

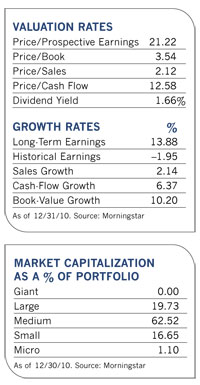

Peak presents a number of arguments in favor of European companies, including their attractive stock valuations. According to his calculations of forward price-earnings ratios and other measures, the valuations of European stocks are the lowest of any stock market in the world.

"I think a good portion of fear has already been factored into stock prices," he says. "Even though the next six to 12 months will clearly be a struggle for Europe and other markets, I feel fairly confident that the world is in pretty good order." He adds that with the threat of rising interest rates, stocks are a better bet than bonds right now.

Despite the region's problems, European companies have a durable appeal. "It's the biggest international region, with a vast array of choices in terms of company size, range and complexity," he says.

But investors also need to pick their spots carefully in European markets, he says. The Henderson fund, an all-cap portfolio, has done that by investing in stocks that most analysts don't cover, and that most European mutual funds don't invest in.

For example, more than 45% of all mutual funds focusing on Europe have Royal Dutch Shell as a top ten holding, according to Morningstar. Another 43% have a major presence in Nestle, while 40% own Siemens. The Henderson European Focus Fund, which has a median market capitalization of just $4.5 billion, owns none of those stocks. In fact, only three of its top ten holdings overlap with top holdings in other Europe mutual funds. And unlike many of its peers, the Henderson fund has a very small presence in the troubled financial sector.

"Most Europe portfolios have the same large-cap, blue-chip names," he says. "We get into more offbeat and contrarian situations."

The strategy has clearly made a difference in comparative performance. From its inception in August 2001 to August 1, 2011, a $10,000 investment in the fund would have grown to more than $55,000, while the same investment in the average fund in Morningstar's 101-member European stock category would have grown to only $20,000. The performance, he says, drives home the point that strong stock returns need not be accompanied by strong economic growth, which has averaged less than 3% annually in Europe over the past decade.

The fund also scores well in terms of risk-adjusted performance, with a standard deviation just slightly higher than the MSCI Europe Index. Since its inception, it has captured more than one-third more upside than the index, but only 87% of its downside.

Based in London, Peak, who Morningstar has labeled "a leading specialist in Continental European investment," has a prime perch for scouting out European companies both on and off the radar screens of most analysts. Nearly one-third of stocks in the fund are covered by ten or fewer analysts, compared to only 6% of stocks in the MSCI Europe Index.

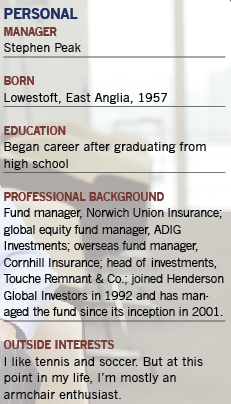

Born in a small village 120 miles from London, the 54-year-old manager is one of the few prominent figures in the mutual fund world that skipped college and went straight to work after high school. As an 18-year-old trainee in the equity department of a life insurance company, he learned about investing in equities "from a boss who gave me enough rope to grow and develop." In 1987, he was tapped to run a Europe-focused mutual fund by a British investment firm and was later promoted to head of the investment department.

Today, Peak oversees European investments for Henderson Global Investors, which has nearly $97 billion in assets under management and 960 employees around the world. In addition to running European Focus, he manages several other European portfolios for the firm.

Many of the companies he invests in are multinationals that don't have to rely on European consumers to feed their bottom line. International sales can be strong even among companies that fall into mid-cap territory, and Peak estimates that two-thirds of the fund's holdings derive at least half their revenue from outside the euro zone.

Over its ten-year history, the fund has only hedged its portfolio against currency fluctuations three times to protect U.S. investors from a weakening dollar. It currently has no hedges in place. "Our basic position is that we want to realize our gains from underlying equity exposure, and over the last decade that is where the vast majority of our returns have come from," he says.

Peak looks for companies whose stock prices don't accurately reflect their growth potential. They may be contrarian plays that for one reason or another are out of favor. Or they could be small and midsize companies that have simply been overlooked by investors. All of them must have ample and sustainable cash flow.

For a stock to enter the portfolio, he must see at least 25% upside potential over a time horizon of no more than two years. The portfolio is focused, averaging between 50 and 70 holdings in a variety of industries, and the annualized turnover rate generally falls under 50%.

At 46% of assets, the U.K. represents the largest country weighting. Peak likes it because it is the biggest stock market in Europe and offers the broadest choice of companies.

One of the fund's largest holdings is global oil and gas company BP, which Peak began accumulating last summer in the wake of the infamous Gulf of Mexico oil spill when the stock was about half its April pre-disaster price. Since then, he's continued to build the position when market dips present a buying opportunity.

"Once fines and litigation issues are settled over the next 12 to 18 months, BP's future will become much clearer," he says. "In the meantime, we have a company whose asset value is double the public value of its stock, and it's trading at a discount to all of its peers."

France's Vivendi, a conglomerate involved in multiple industries such as cellular phones, pay television and gaming, exemplifies another contrarian play. "This hasn't been a terrific performer so far, and people are just bored with the company," he says. "But its public value is less than half what the sum of its parts are worth. And as we wait for investors to realize its value, we get a dividend yield of close to 8%."

With a stock market capitalization of $4 billion, African Minerals, a South African company listed on the London Stock Exchange, is one of a number of less-well-known public companies in the fund. The company plans to ramp up production of the steel ingredient iron ore in its Sierra Leone mines later this year. Two Chinese companies have significant stakes in its stock and mining assets.

Another mining company and top ten holding, European Goldfields, is listed on the London Stock Exchange but has significant mining operations in Greece, Romania and Southeast Europe. The company, which has a $3 billion market capitalization, is on track to become the largest gold producer in Europe over the next few years as it implements plans for mine expansion.