Reducing Volatility

Volatility can eat away at returns over time, so it’s important to keep it managed in long-term portfolios. One of the ways we accomplish that is with international diversification.

A report from Vanguard found that having between a 40-50% allocation to international equities actually reduced volatility to below 15%.

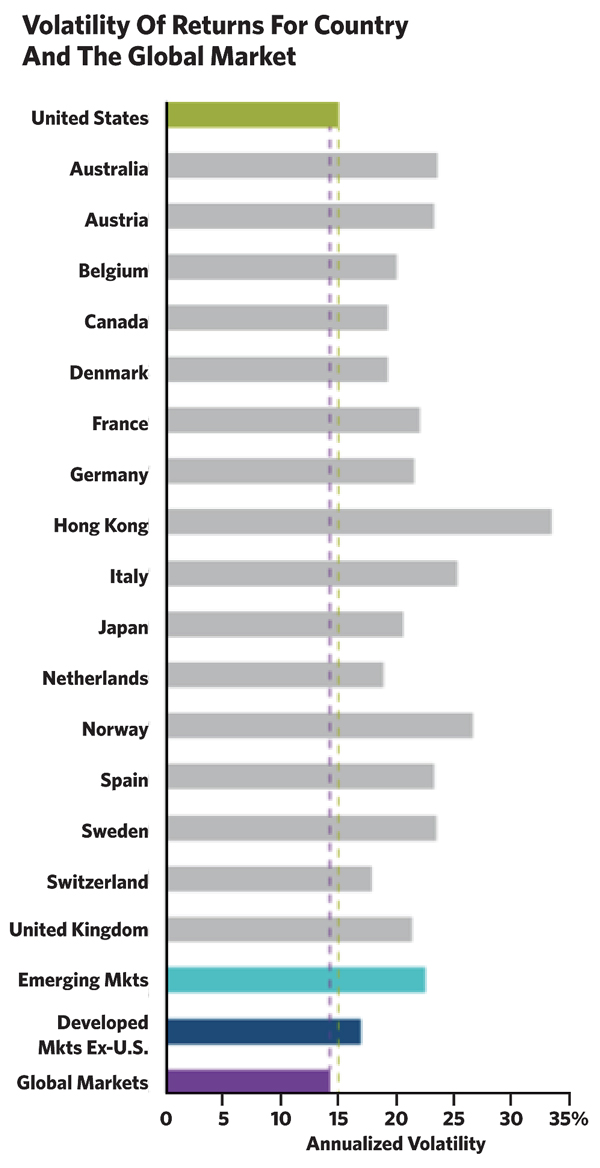

“The benefit of global diversification can be shown by comparing the volatility of a global index with that of indexes focused on individual countries. While the United States had the lowest volatility of any individual country examined, its volatility was slightly higher than that of the global market index. Other countries examined had volatilities that were 15% to 100% greater than the global market index.”

The chart shows this trend. From 1970-2018, a globally diversified portfolio had lower annualized volatility than any individual market (Source: Vanguard).

Managing Global Exposure

International investing comes with its own kind of unique risks.

You expose yourself to, among other risks, currency volatility, political instability and economic fluctuation. Plus international markets can be less transparent and harder to navigate than those in the U.S. This is partly why managing global allocations is an area where professionals can come in handy. Advisors with the ability to conduct research on foreign companies and rebalance portfolios based on market performances provide their clients a unique edge.

The importance of rebalancing portfolios, in particular, cannot be understated.

Vanguard estimates that a hypothetical traditional 60/40 U.S. portfolio created in 2014 would now more closely resemble a 70/30 split given the outperformance of stocks over bonds.

According to the 2019 Credit Suisse Global Investment Returns Yearbook, the U.S. stock market accounted for 15% of the world’s total stock market in 1989. At the start of 2019, it was 53%. These disproportionate performances cause portfolio weightings to get distorted from where they started. Having someone who can see these shifts and rebalance accordingly keeps your asset allocation and risk exposure where they should be.

The most common argument you’ll see against international diversification (such that they exist) is that correlations between the U.S. and global markets are shrinking. While this is true, it doesn’t change my view that having a strategic allocation to global assets puts portfolios in the best position to achieve long-term growth.

Aaron Hodari, CFP, CIMA, is a managing Director of Schechter, a boutique, third-generation wealth advisory and financial services firm located in Birmingham, Mich.