This year we have seen a phenomenal resurgence in volatility after years of historically low VIX while the market continued happily upward. While it is common knowledge amongst option traders that when volatility spikes it makes selling shorter duration contracts far more lucrative, digging deeper reveals insight on how to manage duration effectively in a changing volatility environment. It is true that shorter duration contracts typically provide better daily time decay, but that knowledge alone is insufficient to fully structure the best trade for a given situation. When to put the trade on, how far to extend duration initially, and trade management implications are all factors that still need to be addressed.

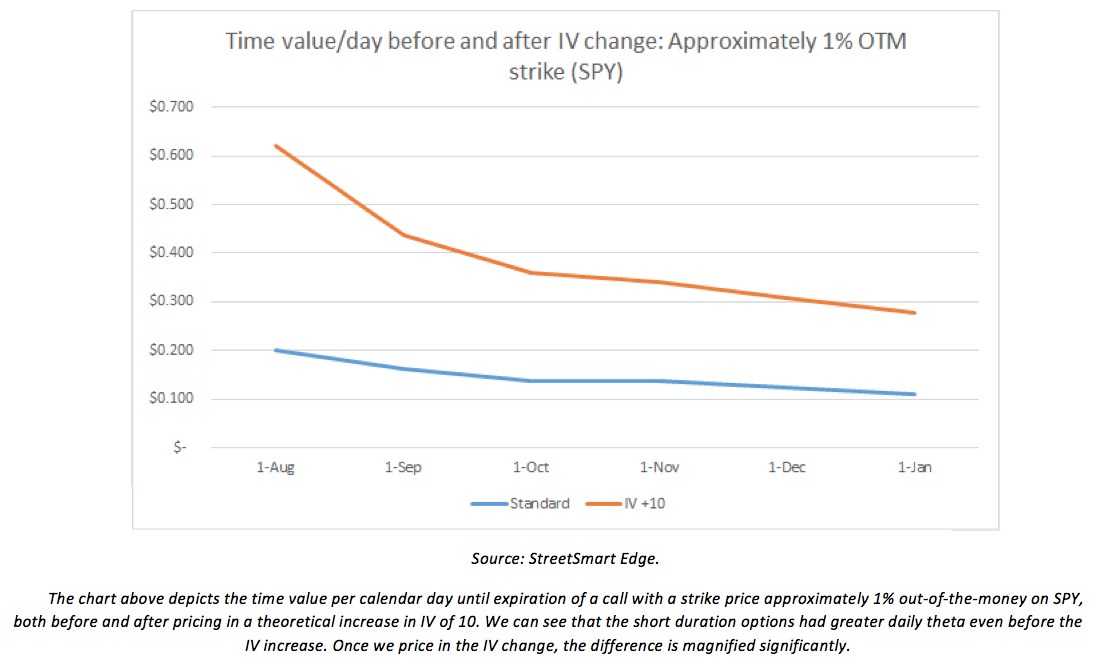

Now that volatility has returned, those in the business of monetizing volatility by selling options need to account for the changing landscape in how they structure their trades. Shorter duration options typically offer better daily time decay than longer duration options, but the difference is magnified when volatility increases. Volatility spikes are far more influential on option pricing at the front end of the chain than the back. In practice, that means a trader will be rewarded even less than usual for selling additional duration when volatility is high. An increase in volatility will cause the difference between the premium of short and medium duration contracts to shrink, increasing the relative attractiveness of the short-term contract.

The effects of volatility on short term pricing is important for the structuring of any option trade, but especially important when there is a future event that is driving a volatility spike. Consider the 2020 Presidential Election in the United States, for example. The increase in premium that comes along with this volatility driving event will become more apparent the closer we get to the event itself. We are months away from the election, and the difference in premiums between an October contract (pre-election) and a November of the same strike and class is certainly apparent. However, based on pricing theory, we would expect that differential to grow the closer the election gets. This is due to the implied volatility in the November options holding the time value up and keeping it from decaying as quickly as it otherwise would.

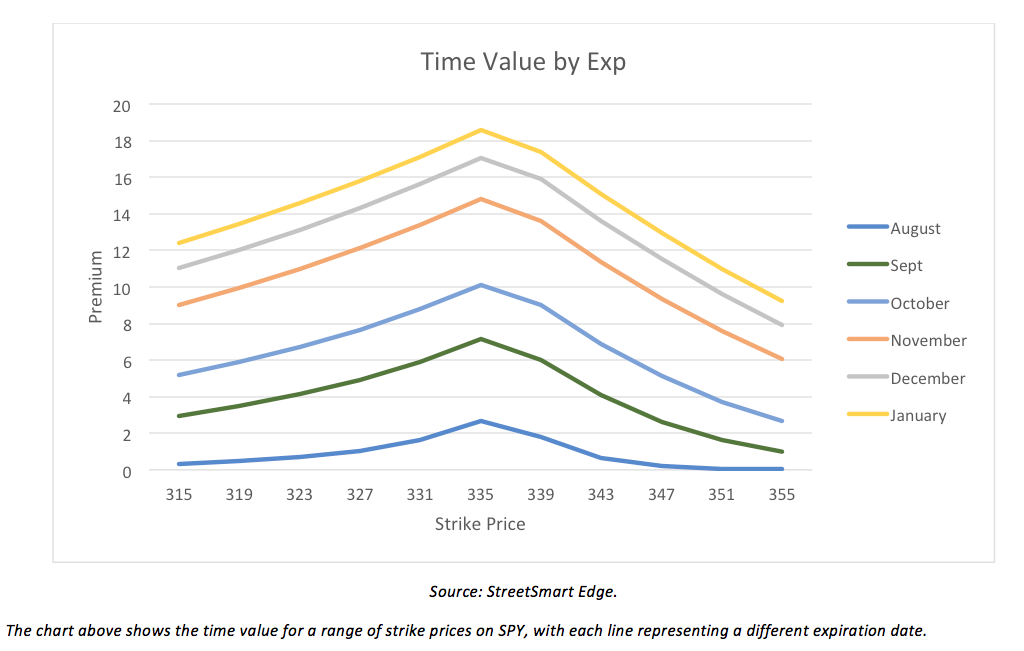

Another trade decision that can be influenced by this analysis is how to determine an ideal expiration based on a desired strike price. From the perspective of a covered call writer, the greater time decay of a short duration option seems attractive. However, the investor may need to write a call closer to the stock’s price than they feel comfortable to get a ‘worthwhile’ premium. When looking at the way time value is distributed across strike prices and duration, it is easier to identify a point on the curve that meets the investor’s criteria.

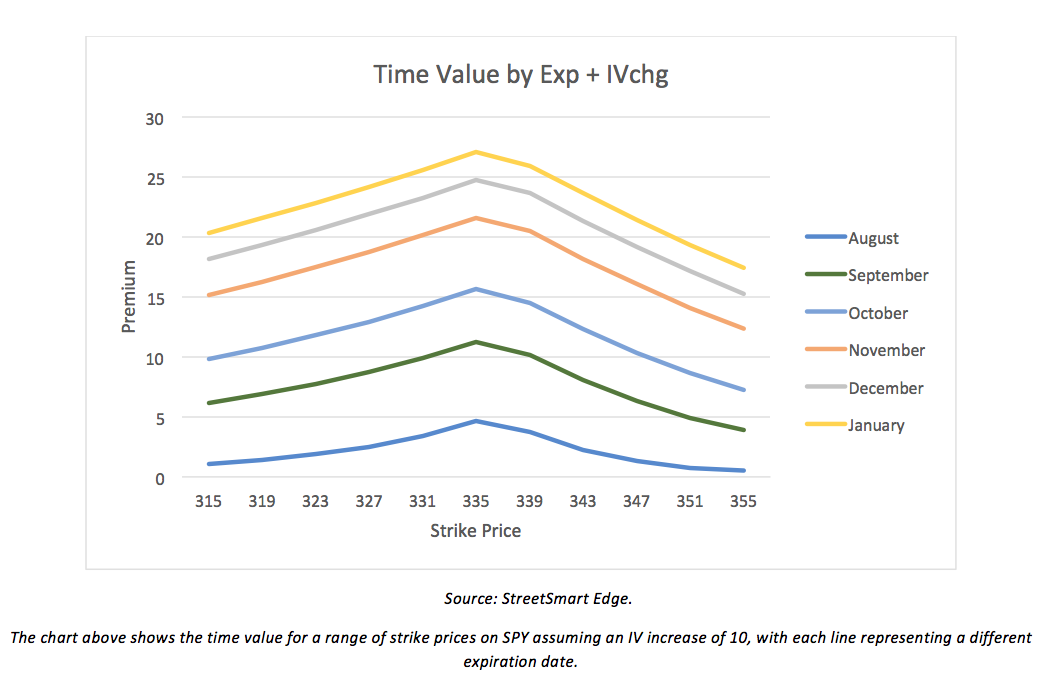

If an investor is looking to write calls at least a certain percentage out-of-the-money, the above graphic could give them an idea of the duration they’ll need to sell to get a desired amount of premium at a specific strike price. If an investor wanted to write calls at least 3% above an underlying’s current price and receive a minimum of 1% of the underlying price in cash flow they would need to compare option premiums across multiple expirations. In the above graphic, SPY was trading at approximately $336. In order to generate 1% cash flow, the premium needed is $3.36 or better at a strike of $346 or higher. By looking at the curves above, we can identify the October contract as the shortest duration to meet the criteria. When IV increases, as is depicted below, the distribution curves become taller at the peak and flatter across the strike range. If implied volatility were to increase by 10, like the below graphic depicts, the investor above would be able to write September calls and meet all of their criteria.

With volatility having returned to the market, premiums are inflated, and option-writing strategies are looking more attractive. After several years with historically low volatility, now is a good time for traders to review their strategy to make sure they are taking advantage of this new environment the best they can. As the country continues to struggle with Coronavirus and heads into a presidential election this fall, we believe volatility is likely to stick around.

Nick Griebenow, CFA, is a portfolio manager at Shelton Capital Management.