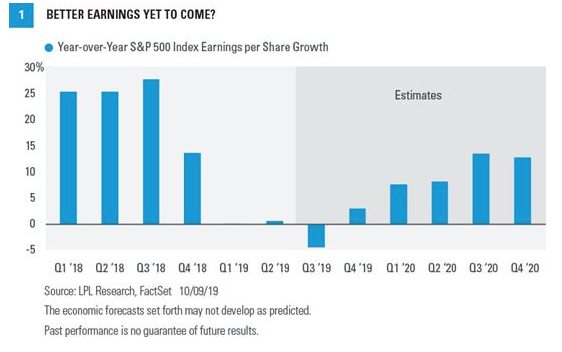

Corporate earnings growth has ground to a halt, but we think better times lie ahead. While tariffs and ongoing trade uncertainty could delay improvement, we remain optimistic that some progress on trade will be forthcoming and earnings growth could pick up over the coming quarters.

Our View

Corporate America is unlikely to deliver much, if any, earnings growth in the third quarter. However, we think better days lie ahead. We expect progress on trade to keep U.S. economic growth at or above the trend for the current economic expansion. The U.S.-China trade conflict is unlikely to be resolved anytime soon, but we believe any small steps forward could increase business confidence and spark capital investment, lifting corporate profits. Flat earnings are hardly exciting, but we think prospects for better growth in 2020 will support stocks at current valuations.

Watch Out For Trade This Earnings Season

Third quarter earnings season kicks off this week, and there may not be much to cheer about. Even with the typical upside surprise, S&P 500 earnings are unlikely to have grown much, if at all [Figure 1]. Given trade uncertainty, opportunities for positive guidance from corporate America may be limited. However, that won’t stop market-watchers from trying to gauge the impact of the U.S.-China trade conflict amid a wide range of possible outcomes.

The trade conflict is weighing on earnings in several ways. Slower economic growth in the United States is hampering revenue, while tariffs and supply chain disruptions are hurting profit margins. Uncertainty around future trade actions is weighing on corporate confidence, which has limited the capital investment needed to drive productivity gains (output per hour worked) that can boost profit margins. On top of all that, slower growth of international economies—partially due to the trade dispute—has added to near-term pressure on revenue. Roughly 40% of revenue for S&P 500 companies is derived internationally.

Economy Hits A Soft Patch

The future path of trade actions carries extra importance given weak manufacturing and services data. The domestic manufacturing sector has contracted, based on the latest readings from the Institute for Supply Management (ISM) Manufacturing’s Purchasing Managers’ Index. Meanwhile, the services sector, which makes up a much bigger piece of the U.S. economy, has slowed considerably despite the strong job market, based on the ISM Non-Manufacturing Index. While surveys like ISM’s manufacturing and services reports continue to show deterioration, other domestic data increasingly has been beating expectations overall. That trend suggests the S&P 500 may be able to beat fairly low expectations.

We believe consensus S&P 500 revenue growth estimates just below 3% for the quarter are achievable in this economic environment (Source: FactSet). Historically, revenue growth has been closely correlated to gross domestic product (GDP) growth, and GDP has grown at a respectable 4% pace (including inflation) over the past year.

Headwinds Are Blowing

Trade and soft ISM readings for September were not the only earnings headwinds during the third quarter of 2019. In the third quarter, the U.S. dollar rose 3% year over year as compared with the year-ago quarter, which has weighed on earnings from international markets.

In addition, the average price of oil was down 19% compared with the year-ago quarter. Oil’s decline could be a significant drag on energy sector profits, which are expected to drop nearly 40% (Source: FactSet).

The flat yield curve, in which short-term and long-term interest rates are close together, creates a difficult environment for banks and could be a headwind for profit growth in the financials sector.

Technology sector profits are expected to drop on weakness in the semiconductor industry, which is caught up in the trade dispute.

Making Our Forecast

We lowered our 2019 S&P 500 earnings per share forecast back in August to $165 due to increased risk to economic growth and profits from the ongoing U.S.-China trade conflict. Until we have clarity on trade, we do not expect earnings growth to pick up meaningfully from current levels. We believe our 2019 earnings forecast is achievable, even if we see only as much as a temporary trade truce in the near term. If no tariffs are reduced or eliminated, and if additional tariffs go into effect on October 15 and December 15 as has been reported, then we expect to see several dollars’ worth of possible downside risk to S&P 500 earnings this year.

The complicated environment makes forecasting in 2020 very difficult. Our base case for S&P 500 earnings is $175 per share, representing a mid-single-digit increase from our 2019 estimate. That forecast is roughly $7 below the current consensus (Source: FactSet), which we expect to come down significantly over the next several quarters. In the absence of any progress on trade, earnings will likely stagnate near current levels. Escalation in the trade dispute could introduce $10 per share or more of downside risk to our 2020 forecast, although we place a lower probability on that scenario.

We maintain our year-end 2019 S&P 500 Index fair value target of 3,000, based on a price-to-earnings (P/E) ratio of just over 18 times our 2019 S&P 500 earnings per share forecast of $165. Next year, we expect S&P 500 earnings to increase to $175 per share. Couple that forecast with that same P/E, and we calculate the index could reach the range of 3,150 to 3,200 at the end of 2020. We believe mild inflation and low interest rates support these valuations.

John Lynch is chief investment strategist at LPL Financial.