Most investors are only vaguely aware of the scope of their investments outside of the U.S. International equity funds generally invest across a wide range of more than 50 developed, emerging and frontier markets. While the allocation between countries is generally assumed to be highly diversified, in fact a few larger markets dominate portfolios, and some of these allocations will increase based on relatively technical factors driving index weightings. These index weightings matter more than ever, with more than half of all mutual fund flows going to index-tracking funds, and more than one-third of all institutional assets being index-based.

Given how Chinese-U.S. relations are dominating the headlines, it is important that investors be fully informed about the largest shift in the risk profile of emerging market benchmarks since these indexes were first launched more than 30 years ago. These weight shifts now underway mean that more than 30% of most emerging market equity funds are already allocated to Chinese stocks, with the percentage growing further—to more than one-third—later this year, and likely rising toward 40% in the coming few years.

At the end of May, the flagship MSCI Emerging Market Index significantly altered its country weights by adding the first tranche of locally listed Chinese A-Shares to China’s already large overall weight in the benchmark—an overall index allocation to A-Shares that will grow from 1.1% to 3.3% by end-November 2019, on its way towards a projected 18% when fully included. Combined with the existing Hong Kong and U.S. listed Chinese stocks already in these benchmarks, China’s total weight in the index has already risen to more than 31%, will increase beyond 34% by year-end, and go substantially higher in the coming years.

Similarly, in late June FTSE Russell—the benchmark for many large institutional investors (such as CalPERS)—also began adding Chinese A-Shares to their flagship FTSE Emerging Markets Index, with similar ramifications. And most emerging market and international equity index funds from Vanguard, the most popular manager of funds for American individual investors, have already added the majority of the increased China exposure to their FTSE Russell-benchmarked funds over the past few years, so that their Emerging Markets Index fund has more than 33% of its $89 billion of assets invested in Chinese companies.

Finally, the third most popular global index family, calculated by S&P Dow Jones, will be adding Chinese A-Shares to their Emerging Market index in September, bringing China up to a weight of more than 35% in this benchmark which has its roots in the original IFC Investable Emerging Market Index family developed at the World Bank in the early 1990s.

With the higher allocation to China, the weight of the top five emerging markets now encompasses more than two-thirds of the index, creating what is known as concentration risk in these benchmarks and the funds that track them. And this risk will keep growing; it is quite possible that by 2022, Chinese equities with full A-Share inclusion will be close to a 40% total China weight, bringing the concentration of the top five countries in FTSE’s EM indexes to more than 80%, a level not seen since the early days of emerging market indexing when there were far fewer markets included in the index. (See Figure 1, below)

Figure 1: Top-Five Countries Dominate The FTSE EM Index

These changes constitute a dramatic concentration of global benchmark weights in a single country. In fact, by the end of this year alone, the Top 10 Emerging Markets will account for close to 90% of the MSCI Emerging Markets Index, effectively rendering many of the smaller 15 countries in the benchmark almost irrelevant.

Chinese stocks account for a similarly large percentage of index funds and ETFs tracking the MSCI Emerging Market index, including those from BlackRock/iShares, Fidelity, State Street/SPDR and Northern Trust).

It should be noted that the massive Thrift Savings Plan for Federal and Military Employees, does not offer an emerging market fund. Its International Fund (the “I Fund”) only invests in developed markets. However, in late 2017 its board voted to evolve the benchmark of its international fund to MSCI ACWI IMI ex-US, which includes Emerging Markets. Senators Jeanne Sheehan and Marco Rubio have recently questioned this substantial planned allocation to China.

What this means is that American investors—both institutional and individual—already have very high exposure to Chinese companies; this exposure will be growing substantially later this year, and likely further accelerating in 2020 and 2021.

This transformation of the two benchmarks that guide more than $3 trillion in indexed and actively managed emerging market assets globally will have an enormous impact. While index fund must track the weights of the key EM indexes, active managers also tend not to allow large deviations of country weights, and thus these funds will also likely be increasing their allocation to Chinese stocks.

Massive Global Capital Flows Driven By MSCI And FTSE Index Changes

To quantify the flow of assets into China during this year of major structural change in global equity benchmarks, BlueStar estimates the following: Just considering indexed/passive assets, approximately $40 billion flowed into Chinese locally listed stocks in late-May through early-July. This will be followed by another $20 billion or more in August’s MSCI inclusion and $20 billion for September’s FTSE inclusion, followed by another $25 billion or more in November for MSCI’s third tranche, which will include mid-cap stocks. This total of more than $100 billion in passive assets will be supplemented by perhaps another $200 billion or more of actively managed assets which are benchmarked to the same indexes and thus loosely need to shift their allocations. An even larger aggregate investment flow—$400 billion—was projected by Chinese asset manager CSOP earlier this year.

The "elephant in the room" being ignored by institutional and individual investors alike is in fact a Chinese panda. This “Panda in the Index” should lead investors to contemplate whether such a high allocation to China is aligned with their values, as well as consider a range of alternative benchmark weighting approaches that attenuate the unintended country and sector bets that the standard Emerging Market indexes make.

Controlling Emerging Market Risk: Single-Country And Sector Concentration

The BlueStar Indexes team has a legacy of emerging market thought leadership stretching back to the early 1990s, beginning at the International Finance Corporation (IFC) arm of the World Bank. In fact, IFC Capital Markets Department staff coined the term “emerging markets” in the late 1980s and “frontier markets” in the mid-1990s. (“Emerging markets” was coined in 1988 by Antoine van Agtmael, who led the Capital Markets Department as part of the process of launching the first emerging markets investment fund, and the term “frontier markets” was coined by Farida Khambata and the Global Capital Markets Department when launching IFC’s coverage of Frontier Markets within its Emerging Markets Data Base (EMDB) index family.) During these momentous three decades, we have observed the weight of single countries rise and fall as isolated crises devastated local markets and often triggered contagion effects across global markets.

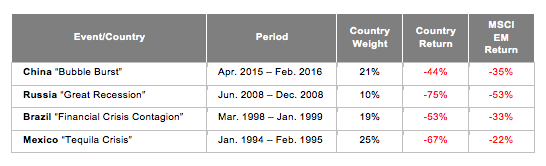

Figure: 2: Examples Of Major Single Country Drawdowns Since Mid-1990

While we are not predicting a similar sharp drop in Chinese equities today, it is always a possibility, especially given the disruptive trade war underway between China and the U.S., and the rising geopolitical tension in the East Asia region. But even if the risk of such a correction may be low, having an index-tracking strategy with more than one-third of its weight in a single market can be considered imprudent.

Emerging market country (and sector) concentration is a natural outcome of capitalization-weighted index construction and should be assessed—and in BlueStar’s opinion, challenged. But regardless of the pure investment implications, American investors—who are embracing mission-driven/values aligned investment at a rapid pace—should also consider whether they are comfortable on a policy level with such a major allocation to China.

Mitigating Emerging Markets Concentration

Given the growing allocation to China in standard emerging market benchmarks, which drives high weights in both index and active funds, investors should "look under the hood" of their portfolios and consider ways to mitigate the concentration risk. BlueStar has designed several index-based solutions to mitigate the impact of idiosyncratic country and sector specific events, while considering other risks relevant to emerging market investors including operational risk, stage of development, volatility and correlation among countries and sectors. The BlueStar Emerging Markets Risk-Controlled Strategy Index is designed to deliver broad emerging market exposure while attenuating country and sector concentration, resulting also in a lower weight for Chinese equities.

Regardless of where you or your organization stand on the topic of trade negotiations, human rights policies and geopolitical tensions between the U.S. and China, it is imperative for investors look under the hood of their international equity portfolios to be aware of the extent of exposure to Chinese companies. And regardless of one’s investment philosophy, approach and choice of vehicles, investors must be aware of the current concentration risks in emerging market benchmarks, and how they are growing even larger starting this year…Caveat Emptor.

Steven Schoenfeld is the founder and chief investment officer of BlueStar Indexes.