With the right motivation and skills, almost any financial advisor can make a wealthy client highly satisfied. That’s not the real issue.

The real issue is can you do it with a couple hundred affluent clients all at the same time? Do it profitably? And continue to do it year, after year, after year? That’s the real issue. How can you balance the apparently contradictory needs of a high level of customization with hundreds of demanding clients?

One answer is by using high-net-worth psychology to build high-touch service tracks for your wealthy clients. You must focus on a homogenous core of clients and then get systematic. Let’s review the model for client relationship management and then discuss how to apply it to the most common high-net-worth personality types, family stewards.

The C.L.A.S. Relationship Management Model

It turns out that when clients judge their financial advisor, the main areas they weigh regarding satisfaction with the relationship fall into four categories. They are:

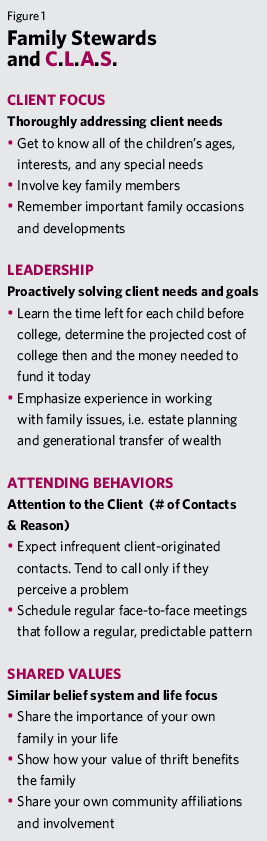

Client Focus: Your level of focus on the client’s needs, interests and goals.

Leadership: Proactively providing solutions to your clients based on their unique financial motivator.

Attention to the Client: Understanding and providing the level of desired attention and the motivation for attention.

Shared Values: Demonstrated sharing of core values, common ground and personal goals.

Financial advisors who can deliver solid investment performance, coupled with high quality relationship management, are in an excellent position to develop a highly satisfied wealthy clientele, which in turn leads to more assets under management per client and more referrals from existing clients.

The results of the research on this point are as startling as they are clear. When affluent clients classify themselves as “highly satisfied,” more than one out of four of them will increase assets under management each year. These are incremental increases in assets under management year after year, not increases in the value of existing investments.

Better still, nearly nine out of 10 affluent clients will refer at least one person who becomes a client every six months. This is the engine that drives every successful financial advisor’s practice in working with the wealthy.

Integrating the Nine High-Net-Worth Personalities & C.L.A.S. for Improved Satisfaction

Now that you have a basic overview of the specific components of C.L.A.S., the question becomes how do you positively impact “the relationship?” The answer is by combining high-net-worth psychology with an understanding of the C.L.A.S. model.

C.L.A.S. shows you the four ingredients impacting client satisfaction with the relationship. The nine high-net-worth personalities help you understand what each wealthy client seeks by way of the C.L.A.S. model. For example, “Leadership” (the second element of C.L.A.S.) applies to all nine high-net-worth personalities as a strategic need, but it means something far different to a family steward versus an independent.

To a family steward, providing “leadership” can mean proactively providing solutions on how to fund college for their kids or grandkids, or how to build up and distribute a nest egg to the kids, so they use it as a down payment on a house rather than for the purchase of a car. Contrast that with “leadership” for an independent. For an independent, “leadership” can mean proactively providing them with ideas on how to retire by 50 or ensure that their money lasts through their retirement. These are the same strategic goals, but they mean something tactically different to each of the nine high-net-worth personalities.

Applying the C.L.A.S. Model: Family Stewards

Family stewards are the largest group among the nine high-net-worth personalities, and the desire to take care of their family is the core motivation behind all of their investing decisions. Financial advisors working with this group need to understand this driving principle to maximize the service that they provide this client group. That said, let’s look at how the C.L.A.S. Relationship Management Model can be used (Figure 1).

Client focus refers to time management with your affluent clients, the thoroughness with which you address client needs, and how effectively you foster client involvement. Because the family is central to a family steward, you would want to orient yourself to the family’s needs. For example, when scheduling a meeting with a client, you want to avoid a time that conflicts with a family activity like a daughter’s soccer game or their quality time at home together. You can simply ask the client, “Is there a time we could meet that doesn’t intrude on your family time?” By doing so you indicate to your clients that you understand their priorities and are willing to accommodate them to the best of your ability, thereby increasing their satisfaction.

Client focus also refers to how thoroughly you address the client’s needs. With family stewards, you want to thoroughly address their central motivation for investing-—their family. Get to know all of the client’s children, their ages, interests and possibly, special needs. Maybe the client’s mother is likely to need a live-in nurse one day, and he’s concerned about how to provide for this and college for three kids. Maybe his daughter is being groomed to run his business (it’s very common for the children of a family steward to join the family business) and is going to get her MBA after obtaining her undergraduate degree.

The point is clients are unique, and you need to take the time to get to know their families so that you can thoroughly address all of their needs and stay on top of the ongoing developments.

Leadership involves proactively addressing their needs and providing solutions as they relate to their family. As affluent individuals, they all have busy lives and would like nothing better than to know they have a competent expert keeping a watchful eye on any new developments or concerns that might affect their family’s well-being.

For example, with a family steward you can take the lead on planning for college funding with no more information other than the children’s birth dates. Take it upon yourself to determine the year each child graduates from high school, how many years remain to invest money for college, and which college they may be considering.

Learn what tuition is projected to cost at the time each child will be graduating high school and develop a plan to fund it. Or if you have already established college funding programs, revisit the subject every so often to make sure there haven’t been any major changes you will need to make adjustments for.

Perhaps the client’s daughter has decided to become a doctor, and instead of four years of college education, eight years now needs to be funded. You can then schedule checkpoint reviews with the client when the children are freshmen and then juniors in high school to discuss any important developments like a child’s desire to attend a much more expensive private school. Imagine how impressed a family steward would be if you proactively developed a plan such as this for the children’s education. This is leadership.

“Attending behaviors” refers to the fact that you are diligent about responding to any phone calls and questions clients have, as well as proactively contacting them when necessary. You can positively impact this area of client satisfaction with a family steward by scheduling regular face-to-face meetings with them at a time that doesn’t conflict with any family time. Also, family stewards like stability in their life, so it’s a good idea to have meetings that follow a regular, predictable pattern. For example, it might be a good idea to have a client meeting at the end of every school year, as it’s a good time to discuss any changes in the children’s college preferences or interests. Plus, it helps to jog the client’s memory that it’s time to meet with their advisor to discuss the children’s futures.

“Shared values” is the final element of C.L.A.S. We all like to do business with people who are like us and share similar values. Accordingly, it is helpful to your business relationship to communicate to your client that you share a similar belief system with them and place importance on many of the same values. With family stewards, you would want to let them know how important spending time with your own family is to you.

Additionally, family stewards typically favor stability over high returns. Thus, you might communicate that, like them, you believe in a slow, steady and stable investment strategy. The main point being that the more values you share with your clients, the more comfortable they will be with you and the more satisfied they would be with the relationship.

Conclusion

The C.L.A.S. Relationship Management Model is applicable to all nine of the high-net-worth personalities. It’s a uniquely effective model for you to systematically break down how you can improve your relationships with your affluent clients, which ultimately should culminate in increased assets under management as well as referrals.

Russ Alan Prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.