As the number of ultra-high-net worth people swells, so too does the pay for those who oversee their assets.

C-suite pay at family offices, firms that manage the wealth of the very rich, is surging, according to a report by UBS Group AG and researcher Campden Wealth. The average base salary for a chief executive officer jumped almost 10 percent to $367,000 this year from 2016, while chief investment officers got an increase of 8 percent to $314,000.

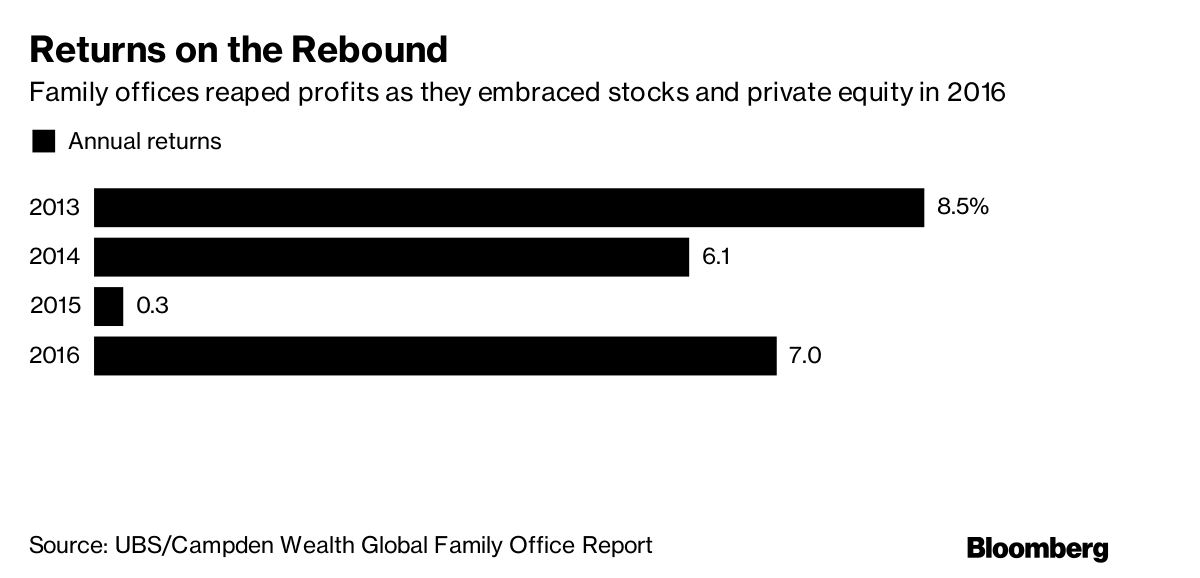

It looks like they’re earning their keep as family office investment returns rebounded last year. Returns averaged 7 percent in 2016, compared with 0.3 percent the year before, according to the report, issued Tuesday. The gains were strongest among North American firms, which had less money invested in real-estate than their international counterparts.

“The rebound can largely be attributed to two factors, better performance in equity markets and improved returns due to allocation shifts,” Stewart Kesmodel, head of global family office for the Americas at UBS, said by email. With investors moving out of fixed income and hedge funds, “those dollars have flowed into private equity, operating companies and cash flow producing assets such real estate,” he said.

With bonuses, which can account for half of total pay, the average pay for a North American family office CEO totaled $631,000, the highest among geographic regions. European family office CEOs made $497,000.

As with much of the investment world, the best-paid executives are predominately male. Women accounted for only 7.7 percent of family office CEOs and 13.2 percent of CIOs. Women appeared more frequently as chief operations officers and chief financial officers.

Traditionally set up to manage the accounting and tax planning affairs of a wealthy clan, family offices are growing in size and complexity, in some cases even beginning to resemble small hedge funds or investment banks. They’ve been poaching talent from Wall Street, taking advantage of challenges elsewhere in the investment management world to build in-house staff.

More Risk

“Those family offices which are looking beyond preservation of capital have become more aggressive in their thesis, as well as, the talent they hire for execution,” Kesmodel said.

Returns have risen as families embraced risk by pushing cash toward public and private equity investments. Public stock investments comprise 27.1 percent of families’ allocations this year, while private equity investments are 20.3 percent of portfolios, the report said.