The Federal Reserve’s forward guidance program has been a disaster, so much so that it has strained the central bank’s credibility. Chair Jerome Powell seems to agree that providing estimates of where the Fed sees interest rates, economic growth and inflation at different points in the future should be junked. “We think it’s time to just go to a meeting-by-meeting basis, and not provide the kind of clear guidance we had provided,” he said after the Fed’s July 26-27 monetary policy meeting.

When it began providing forward guidance almost 14 years ago, the Fed hoped that by making clear its intentions through its Quarterly Summary of Economic Projections and press conferences, it could avoid disruptive market shocks and reduce volatility. The financial meltdown of 2008 had revealed the opaqueness of the old system and the need for transparency. The central bank succumbed to the transparency pressures and in December 2008 began the use of forward guidance when it cut its overnight federal funds policy rate to near-zero and said it “will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the [Federal Open Market] Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.”

The basic problem with forward guidance is that it depends on data that the Fed had a miserable record of forecasting. It was consistently too optimistic about an economic recovery after the 2007-2009 Great Recession. In September 2014, policy makers forecast real gross domestic product growth in 2015 of 3.40% but were forced to constantly crank their expectations down to 2.10% by September 2015.

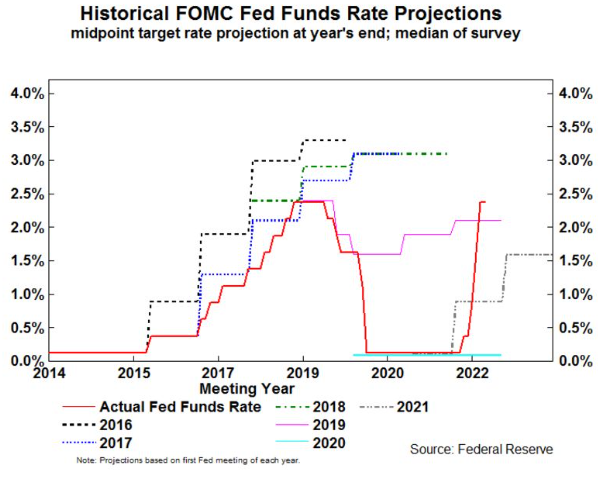

The federal funds rate is not a market-determined interest rate but is set and controlled by the Fed, and nobody challenges the central bank. Yet the FOMC members were infamously terrible at forecasting what they themselves would do, as seen in the so-called dot plot of individual FOMC members’ rate projections shown in the chart. In 2015, their average projection of the 2016 federal funds rate was 0.90% and 3.30% in 2019. The actual numbers were 0.38% and 2.38%.

Not only has forward guidance been a failure, but it may have increased, not reduced, financial market volatility. The Fed raised rates in February 1994 without warning and in six months doubled the federal funds rate from 3% to 6% in November. That disrupted markets and caused U.S. Treasury yields to skyrocket in what became known as “The Great Bond Massacre of 1994.” The yield on the 10-year Treasury note jumped an unprecedented 2.3 percentage points from February to November of that year. The Chicago Board Options Exchange Volatility Index, or VIX, tracking the stock market spiked from 10.8 to 23.9 in April.