Faced with an aging advisor and client base, the financial services business has sought ways to attract millennials as clients as their earning power increases and they stand to receive trillions of dollars in potential wealth transfers over the next few decades.

Cerulli Associates expects another transition of assets and influence, of younger financial advisors succeeding baby boomers across the industry. The financial services research firm estimates that 35.5% of the industry, more than 110,000 advisors, will retire within the next 10 years.

This means that nearly 37% of the total advisor-managed assets, almost $6 trillion, will fall under the stewardship of younger advisors. Yet according to the CFP Board, there are more advisors over 70 than there are under the age of 30. Fewer than one in four CFP professionals is under the age of 40. The average age of an advisor is over the age of 50.

“I think the biggest challenge is awareness,” said Rachel Moran of RTD Advisors in Philadelphia. “Most young people are unaware that this career exists.”

When you take a look at Financial Advisor’s 2018 “Young Advisors to Watch,” you realize there is no one-size-fits-all solution to the industry’s demographic challenges.

RACHEL MORAN

Financial Planner / RTD Financial Advisors / Philadelphia, Pa.

Like many of our 2018 Young Advisors to Watch, Rachel Moran grew up with a love of personal finance, but had no idea that she could build a career out of it.

Moran, 28, was recently elevated to a senior financial planner position at Philadelphia-based RTD Financial and also made a shareholder. She discovered the financial planning profession while a student at Virginia Tech University.

At RTD, she engages in financial life planning for a clientele with $3 million to $5 million in AUM. Most of her clients are married couples with a few children trying to stay on course for their retirement.

“Your relationship with clients becomes deeper when you’re engaging in financial life planning,” says Moran. “When you’re talking about money, you’re getting at the heart of their fears, values and what’s really important to them. You know so much about them, their experience becomes personal to you.”

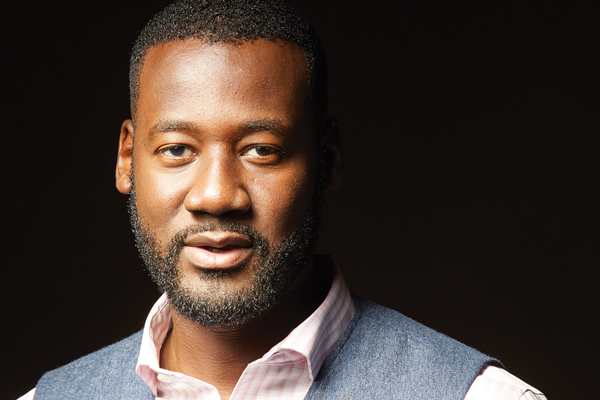

BILL SIMONET

Principal Advisor / Simonet Financial Group / Kyle, Texas

Bill Simonet, founding principal of Kyle, Texas-based Simonet Financial Group, didn’t know what he wanted to do immediately after high school, so he joined the U.S. Marine Corps.

Simonet, 34, born in Florida as Billy Graham Simonet, is the child of Haitian immigrants.

“They worked hard for the American dream. Most of the people in my family and in my culture go on to become preachers, teachers, attorneys, doctors or engineers, but I didn’t fit into those categories,” says Simonet.

SHANNON MCLAY

Founder and President / Financial Gym / New York City

Shannon McLay, 39, wants the world to get financially fit—that’s why she founded the Financial Gym, based in New York’s Flatiron District.

While working at Merrill Lynch, McLay was engaged by her young, low-net-worth peers who needed financial advice. At the time, traditional financial firms were ill-suited to serve such clients.

The Financial Gym charges a flat monthly fee: $85 for individuals, $145 for couples and $35 for students. Services include a monthly meeting, an on-call advisor and a financial plan. Advisors are branded “trainers” who provide a variety of different services to clients, whom McLay has deemed “members.”

“Members are mostly people getting their finances together, they’re working and looking at their whole picture,” she says. “We help them with managing their student loans and learning how to invest.”

DON HANCE, JR.

Founder / LifeSighted / Pacific Palisades, Calif.

For many financial advisors, serving clients primarily involves addressing life cycle needs like retirement and legacy—but Don Hance Jr., founder of LifeSighted, believes it’s not always the final life cycle goals but the lives themselves that need attention. His primary clients are high-earning people in their 20s, 30s and 40s who aren’t necessarily thinking about retirement saving just yet.

“Many people put off doing the things they want to because they think they can’t afford them, so they wait until they retire to do them,” says Hance. “I like to help people realize that they can do those things now, or maybe in a few years as opposed to waiting decades to do them.”

Hance has a background in coding and programming, and he spent several years running a technology and sports-related start-up. At a certain point, he found his tech career unsatisfying and pivoted to financial planning, where his father has worked for decades.

DOMINIQUE MCQUEEN

Financial Advisor / Finwell Benefits / Encino, Calif.

Dominique McQueen started small. Born on a tiny island, today she works in one of the world’s largest cities, serving employee benefit plan participants with planning and financial wellness services.

McQueen, 34, currently serves as director of financial planning at Encino, Calif.-based Finwell Benefits. She hails from Harbour Island in the Bahamas, which is three square miles in area and known for pink sand beaches with little industry beyond tourism.

“There wasn’t anyone or anything there that could guide me into this; I had to look to myself to take a role in forging my career,” she says.

Like many young women, she learned to appreciate financial stewardship and budgeting after being paid as a babysitter. Her parents weren’t college educated and she didn’t really have financial role models—as a result, she became a bookworm eager to learn more.

MIKE SALMON

Principal and Financial Advisor / Moisand Fitzgerald Tamayo / Orlando, Fla.

Mike Salmon, 34, is helping to lead the next generation movement in his firm. In 2014, Salmon was made a partner in Moisand Fitzgerald Tamayo, an Orlando-area financial planning practice.

“I’ve spent most of my time fine-tuning the client experience here and developing ways to educate and mentor newer paraplanners and other entry-level people coming into the profession,” says Salmon. “We’re becoming involved with several academic financial planning programs and we’re trying to hire a person per year going forward.”

LORI CHOI

Partner / Veris Wealth Partners / New York City

Lori Choi is a partner and senior wealth manager for Veris Wealth Partners, a San Francisco-based, ESG-oriented wealth advisory firm.

Choi, 37, works with a group of Veris’s 30 to 40 largest clients in the New York office, serving them with impact investing solutions, as well as serving personal clients with financial advice.

Choi is co-founder of Women Investing for a Sustainable Economy (WISE), a professional networking group for women in the impact investing industry. “It’s a growing, wonderful community of women who are trying to take ESG and impact investing mainstream,” she says.

“We have an approach that is very conducive to working collaboratively with people looking for education to guide them through their life stages, but we’re also working alongside their life values,” says Choi. She also helps serve her clients with advice on charitable giving and legacy planning.

INGA CHIRA

Founder and President / Attainable Wealth / Los Angeles, Calif.

Inga Chira is president and founder of Attainable Wealth, where she offers financial planning and investment services to a clientele composed mostly of academics.

After immigrating from Moldova during high school, Chira, now 36, earned a doctorate in finance, and she also works as an assistant professor of finance and financial planning at California State University, Northridge. In addition to her academic roles, she is a veteran of CitiStreet and ING, where she worked in benefits administration.

“Originally, I wasn’t going to practice, but to be a good professor, you have to have experience,” says Chira. “I wanted to be able to teach what I practice.”

HANNAH MOORE

Owner & Principal, Financial Advisor / Guiding Wealth Management / Dallas, Texas

Hannah Moore is the owner and founder of Dallas-based Guiding Wealth Management.

Like many young planners, she entered college largely unaware that she could make a career out of giving sound financial advice. It wasn’t until she was at Baylor University that she was introduced to the profession.

After school, Moore was taken in by a solo practitioner looking for a young planner who could eventually be part of a succession plan. In 2013, she ended up buying out her partner and bought another practice several months later, giving her a roster of more than 250 clients.

“I was so clueless, I had jumped into the deep end,” she says. “I started the week the market hit its low in 2009. It was a great time to start, but looking back, I realize that I didn’t know what I was doing.”

DARIA VICTOROV

Financial Advisor / Abacus Wealth / Sebastopol, Calif.

Daria Victorov, 26, a financial advisor at Abacus Wealth, was indirectly pushed into financial planning by her parents.

As a teenager coming home from orientation at Virginia Tech, she was told by her father that her parents had not saved for her education. She had no idea what college would cost and started to scramble to figure out how she was going to afford her schooling.

The mad search for financial aid and funds to cover living expenses led Victorov right into the arms of a financial planning program in school—she became hooked on the thought that she could help people like her parents make sound financial decisions.

“My experience really deepened my passion for this profession and topic,” she says. “My family made a lot of mistakes, but people can learn to manage their money. I want to help people achieve their goals.”