-You are meeting with a client about her retirement plan. “When I began withdrawing four years ago, I started at 5.5%,” she explains. “I knew you thought that was risky, but I really needed the income! Then the market crashed, and the last few years my withdrawals have climbed above 8%. I am worried. What should I do? Cut back?”

After supplying her with an oxygen mask and urging her to breathe deeply, you promise to give the issue some serious thought. But when you do, you are confronted with a dilemma. According to the charts, an 8% withdrawal rate would be “safe” for only another dozen years, leaving your client about 14 years short on her 30-year plan. Does that mean she needs to cut her withdrawals back to 4.5% to get “safe”? That would be a draconian measure. Or is it better to do less and wait for stocks to recover, thereby naturally reducing the withdrawal rate?

In this article, I am going to suggest an approach for dealing with withdrawal plans that appear to be in trouble. We’ll begin by studying three historical retirement portfolios, each with a different inflation backdrop, to provide a foundation for our understanding of “stressed” portfolios. Then we’ll explore techniques helpful in determining whether a withdrawal plan is indeed dying, or whether it merely caught a cold. Finally, we’ll have some fun with a few case studies, in which you’ll be asked to diagnose the situation and prescribe a “cure.”

Just a brief word on my methodology. In studying withdrawal rates, I use historical data for investment returns and CPI. To date, I have reconstructed the portfolio performance of 241 investors who retired on the first day of each quarter beginning January 1, 1926, through January 1, 1986, the last year for which 30-year returns are available. For this article, I will be using U.S. small-company stocks, U.S. large-company stocks and intermediate-term U.S. government bonds as the sole asset classes, with returns derived from the Morningstar Ibbotson database. The asset allocation in all cases will be 35% large caps, 20% small caps and 45% intermediate-term government bonds. The portfolios are assumed to be tax-advantaged and are rebalanced once annually. Dollar withdrawals are assumed to increase each year by a percentage equal to the previous year’s CPI.

Part 1: Three Historical “Stressed” Portfolios

I’d like to begin by examining three “stressed” historical retirement portfolios, each of which experienced a different inflation backdrop: high inflation, moderate inflation, and low inflation to outright deflation. By “stressed” I mean that each of these portfolios had to employ a relatively low initial withdrawal rate to survive 30 years of withdrawals (the initial withdrawal rate is the first year’s dollar withdrawal divided by the starting portfolio value). Each of these three portfolios represents the historical “worst case” for its respective inflation backdrop. The importance of the inflation element will become increasingly apparent as we proceed.

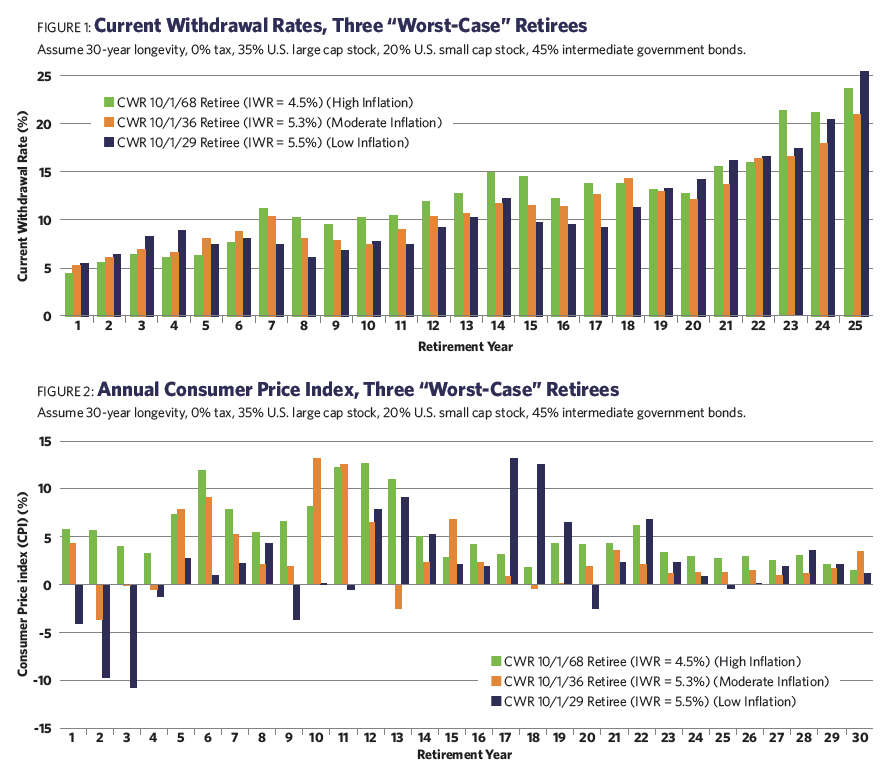

Figure 1 shows annual current withdrawal rates for three retirees, one retiring on October 1, 1929 (a time of deflation), one retiring on October 1, 1936 (a time of moderate inflation), and one retiring in October 1968 (a time of high inflation), over their first 25 years. The current withdrawal rate is simply a year’s dollar withdrawal divided by the value of the portfolio at the start of that year. I omit the current withdrawal rate values for the last five years, as they are enormous and would distort the chart.

For each retiree, the initial withdrawal rate is set at a value that leaves a zero balance in the investment account on the last day of the 30th year. As you can see, all three retirees showed similar behavior in their current withdrawal rates, which rose sharply in the early years, leveled off during the middle third of retirement, and then soared toward infinity during the last third of retirement.

Figure 2 displays the year-by-year inflation values for each of the three retirees over the full 30-year period. It’s apparent from this chart that each of the three retirees experienced substantially different inflation regimes, especially in the early years of retirement.

Fixing A Broken Retirement Withdrawal Plan

December 2017

« Previous Article

| Next Article »

Login in order to post a comment

Comments

-

Once again, a hugely important contribution. Thanks Bill! Way too much emphasis is being placed on sequence of return, when it is, as Bill demonstrates here, inflation that poses the far greater threat to a retirees prospects. When explaining "the 4% rule" to clients, to classes, or at presentations, I always ask what year they would think would have been the worst to retire in and almost everyone says 1929 - but, of course, it wasn't. The impact of downturns is quickly reversed as long as the market recovers, while the impact of inflation (absent a period of deflation) only compounds.