Other advisors in less-dynamic places such as Michigan and parts of the Northeast said sluggish local economies have been a headwind. Meanwhile, some advisors said the economy has been a non-factor in their business, while others are following the macroeconomic picture and bracing for potential change.

The Big Get Bigger

“We haven’t felt much in the way of any economic impact with the Fed stimulus continuing to bolster the markets,” commented Keys Tinney, managing partner at Aveo Capital Partners, a Greenwood Village, Colo.-based firm with more than $300 million in assets and an AUM growth rate of more than 41% last year. “However, we believe there will be a reversion to the mean at some point in the near future that will have a major impact on client portfolios, and we are planning ahead for such an occurrence.”

“We haven’t felt much in the way of any economic impact with the Fed stimulus continuing to bolster the markets,” commented Keys Tinney, managing partner at Aveo Capital Partners, a Greenwood Village, Colo.-based firm with more than $300 million in assets and an AUM growth rate of more than 41% last year. “However, we believe there will be a reversion to the mean at some point in the near future that will have a major impact on client portfolios, and we are planning ahead for such an occurrence.”

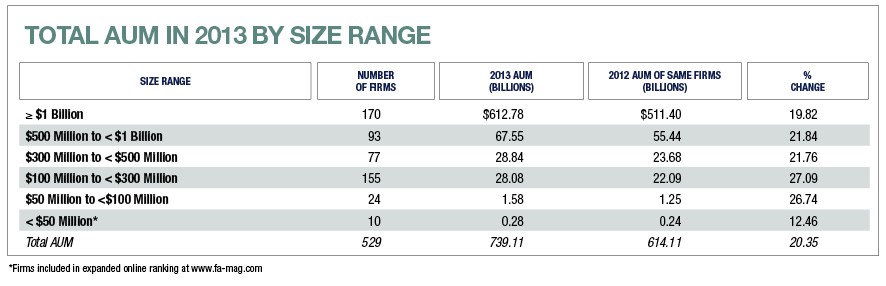

Growth rates among RIA firms varied by size range, with firms in the $100 million to less than $300 million (27.09% AUM growth) and $50 million to less than $100 million (26.74%) categories leading the way. Firms that manage more than $1 billion in assets turned in an average growth rate of nearly 20%, no small feat given their big size. There were 170 such megafirms in this year’s survey versus 143 among the 522 firms from last year’s edition, which made them the largest cohort in the recent survey. That seems to corroborate the notion that the largest firms in the RIA space are getting larger.

One such firm is Halbert Hargrove in Long Beach, Calif., which nearly doubled its assets to $4 billion last year after a concerted effort to not only boost its asset base but also to boost its capacity to serve clients and propel the firm going forward.

“A couple of years ago, we started thinking about what we needed to do to remain relevant and to be sustainable in the future,” says chairman and CEO Russ Hill. “We wanted to develop deeper research manager capabilities than what we had been using.”

That quest yielded two significant results last year. First, after a nine-month negotiation, the firm added a $1.5 billion family office to the fold, which joins an existing family office with about $125 million in assets. Hill notes this new family office comes with a group of active-management investment advisors who he says have consistently generated returns of 250 to 300 basis points over index returns for the past 20 years or so.

Focus On Growth

July 1, 2014

« Previous Article

| Next Article »

Login in order to post a comment