Although traditional investing philosophies have long relied on the distinction between “growth vs. value,” we believe both categories are becoming irrelevant. As the economy becomes more digitized and businesses are disrupted at an increasing rate, a low multiple on current earnings (i.e., a classical view of “value”) is not a bargain if the business is structurally disadvantaged going forward.

Rather than looking at the world through this traditional lens, we think a more constructive framework is “digital vs. decline." In our view, digital businesses have substantial structural advantages, making them far more likely to prosper and generate long-term cash flows than incumbents who fail to adapt. Moreover, we feel that sector classification is now materially less important than the strength of a company’s business model.

Techceleration Is The New Normal

Technology has always progressed exponentially (as per Moore’s Law, processing power doubles every 18 months), but the pace of innovation has increased recently as the digital landscape has evolved. With the proliferation of devices (PC, smartphone, IoT, cloud, etc.) technologies are increasingly able to leverage one another to accomplish tasks that previously would have been impossible, creating a virtuous circle. Machine learning algorithms, for example, require large data sets that are sourced from online applications and are generally analyzed using cloud-based technology. This is just one of many examples where each individual component enables the other to achieve its full potential—a technological symbiosis that benefits the entire ecosystem.

A recent research report from Bank of America Merrill Lynch (Source: Transforming World—The Next 5 Years,” Bank of America Merrill Lynch, October, 2018) argues that the next five years will see the fastest rate of technological change ever, citing the following factors:

• Data doubles every 2-3 years

• Computing costs continue to decline

• Emerging 5G cellular network will facilitate a global, connected world

Not surprisingly, the report also predicts that the forthcoming digital transformation will affect a wide range of industries, providing a strong tailwind to a few obvious sectors (e.g., technology hardware and software) and equally strong headwinds to others (e.g., old media companies and traditional healthcare providers).

Adoption Rates Continue To Climb

One of the natural byproducts of increased innovation has been higher rates of technology adoption. New technologies are accepted by the public faster than ever before. For example, it took 80 years for telephones to reach half of U.S. households, but it took less than 10 years for cell phones to achieve that mark.

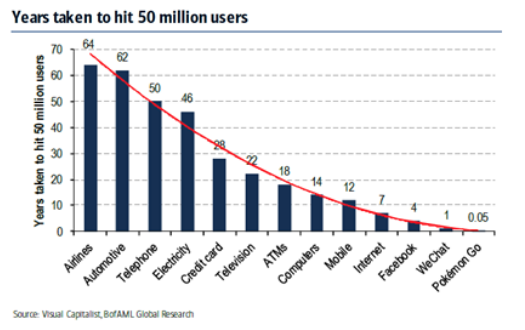

The chart below (from the same BofA report) provides a broader perspective on adoption rates. The trend is unmistakable—if a new technology is popular, it can spread exceptionally quickly. For example, while it took airlines 64 years to reach 50 million users, Facebook reached this mark in just 4 years.

More recently, ride sharing companies like Uber and Lyft achieved mass scale in just a few years. And according to a recent report by JMP Securities, shared scooters and dockless bikes offered by private companies Lime and Bird achieved adoption of 10 million cumulative rides in just over a year, an even faster rate.

Economic Data Aligns With Experience

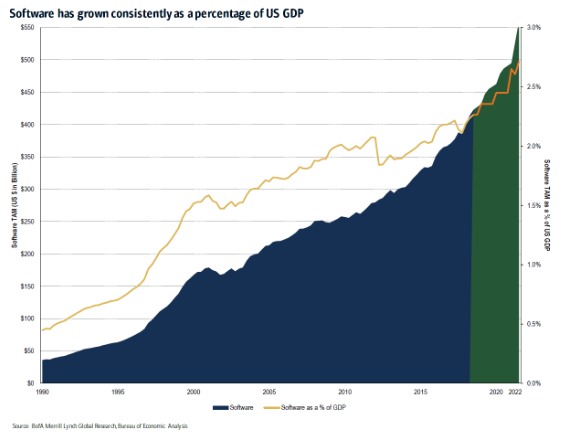

The economic data strongly validates the innovation and adoption trends. Perhaps most strikingly, based on 2018 data from the U.S. Bureau of Economic Analysis, software revenues steadily increased as a percentage of domestic GDP from 2002–2017, and Bank of America Merrill Lynch expects this to continue (Source: “2019 Year Ahead: Growth Defensive Amidst a Slowdown,” Bank of America Merrill Lynch, December, 2018).

While the trajectory is impressive, with software at less than 3 percent of GDP, we are still in the very early days of the structural shift towards greater software penetration. Across industries, companies are increasingly deploying new applications to maintain market share and grow their competitive advantage. Even traditional sectors, like industrials, are beginning to take technology more seriously. In a recent report, Deutche Bank estimated that industrial firms are poised to invest $500B in new technology over the next 5-7 years. It’s no surprise that the U.S. Bureau of Labor Statistics predicts the number of software developers in the world is going to be growing 24 percent annually through 2026 (Source: Bureau of Labor Statistics, Occupational Outlook Handbook, April, 2018).

Sectors No Longer Matter

As Microsoft CEO Satya Nadella said recently, “every company is becoming a digital company.” Indeed, disruptive technological innovation can occur within any sector of the economy. Amazon began as a bookseller, shaking up an industry that hadn’t seen any major advancements since the Dewey Decimal System in 1876. The company has continued to innovate, disrupting the broader retail, grocery, logistics, media, advertising and information technology landscape.

In our view, the strength of a company’s business model is much more important than its sector. Although many of our core positions are technology-related, we also own several non-IT companies that are directly benefiting from the shift to digital. Below are three firms in our portfolio that we believe have excellent upside potential and that demonstrate the breath of disruptive possibilities in the digital economy:

• Avalara is a software company, which allows companies to more efficiently address a very boring and traditional problem—sales tax. With 12,000 tax jurisdictions and >$377 billion in sales tax in the United States alone, there is a growing need for software and Avalara processes 5 billion transactions per year and remits $18 billion in taxes. In a sign of a more connected and digitized retail environment, the Supreme Court ruled last year in Wayfair that a physical presence was no longer required for a state to be able to collect sales tax. Following the decision, several large states (California, Texas, New York) have begun to shift the standard to laws requiring remote sellers to collect and remit sales tax, which we believe should accelerate adoption of Avalara’s cloud-based compliance software.

• Teladoc is a classic example of a disruptive company that is leveraging technology to take market share from traditional incumbents. The firm is a telemedicine pioneer, utilizing videoconferencing technology to provide on-demand remote medical care. By eliminating the need for an in-person visit, it has substantially reduced the cost of delivery (telehealth visits cost $40 compared to $150 for a typical urgent care or doctor visit). What’s intriguing is that many of the patients who used the platform in 2018 were new to the service. We believe that these individuals are now much more likely to use the platform going forward, which should steepen the adoption curve.

• Rapid7 is a pure technology company—solving a problem that didn’t exist before the digital era. The firm develops security software for enterprises that monitors a customer’s network and identifies potential vulnerabilities. It is benefiting from strong market demand due to a rise in high-profile security attacks (e.g., Target, Equifax, Marriott) as well as the regulatory trend towards increased privacy and security. Recently, Gartner ranked vulnerability management as one of the top two priorities in security, suggesting Rapid7 has a long runway of growth given it currently monitors an average of only ~30 percent of a customer’s total IT environment. The company has several highly integrated products, offering a turnkey platform that identifies security vulnerabilities then prioritizes and automates an effective response. In short, Rapid7 is well positioned in a growing market and has strong internal catalysts to drive higher product adoption, cross sell and upsell.

The market intelligence firm IDC predicts that by 2021 at least 50 percent of global GDP will be digitized. In our view, it’s still very early in the technology cycle and we believe that only companies that adapt will be able to thrive in the future. As such, we think investors would be well served to reconsider the traditional style distinction between growth and value, and instead determine whether each company in their portfolio is digitally savvy enough to prosper and generate long-term cash flows.

James L. Callinan is vice president and portfolio manager at Osterweis Capital Management. Bryan Wong is an analyst at Osterweis Capital Management.