“I look to the future because that’s where I’m going to spend the rest of my life.” —George Burns

The bull market continues, with the S&P 500 Index now up more than 10% in 2021. With stocks up more than 80% from the March 2020 lows, the reality is a well-deserved break or consolidation could happen at any time. Looking to the future, as George Burns said above, we would be a buyer of any material weakness, as we believe this bull market is alive and well as we’ll discuss more in this blog.

Here are four bullish stats we’ve found recently that indeed suggest this bull market could still have plenty of life left.

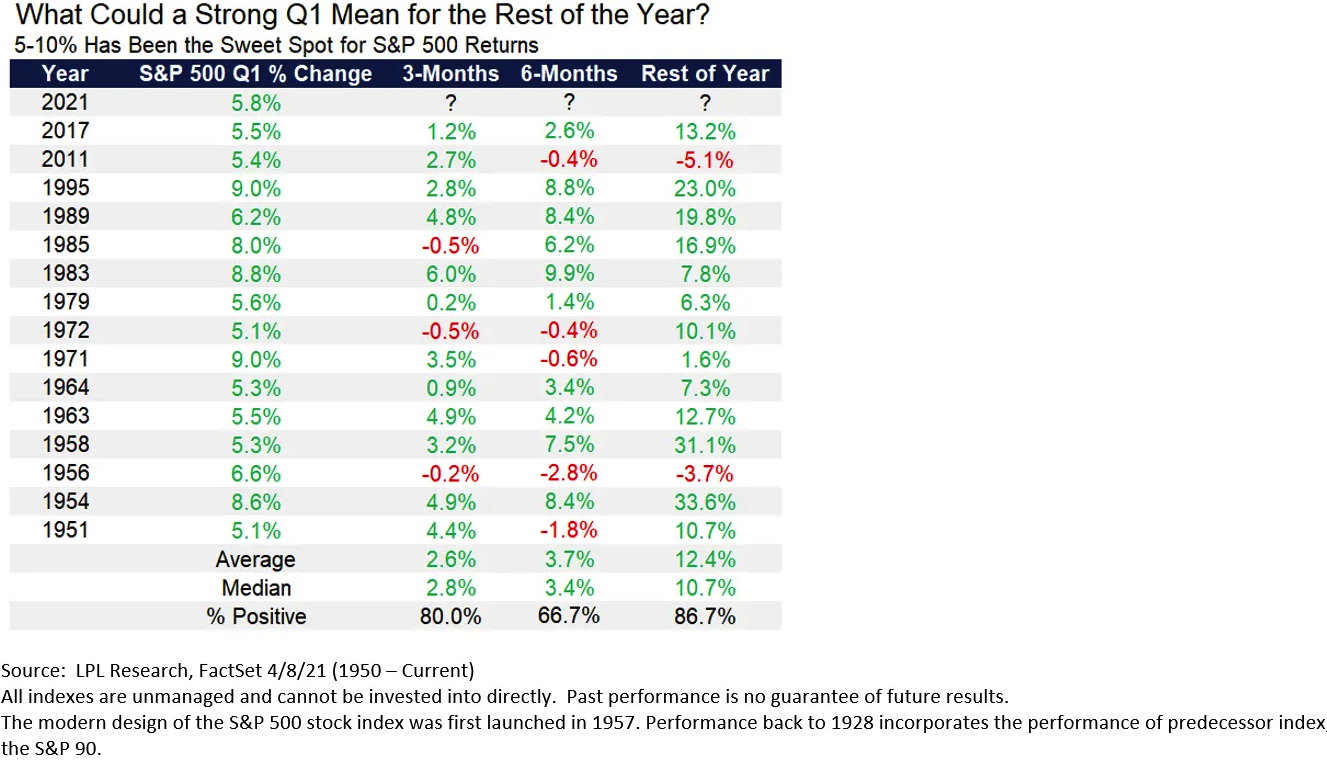

First, the S&P 500 Index was up just under 6% in the first quarter, an area we’d call the sweet spot. Looking back since 1950, when the S&P 500 was up between 5-10% in the first quarter, the rest of the year (so the final three quarters) gained another 12.4% on average and was higher 86.7% of the time. Compare this to when the S&P 500 was up >10% in the first quarter and the returns drop to 6.5% the rest of the year. Lastly, if the first quarter was negative, then the rest of the year was up only 3%. Sweet spot indeed.

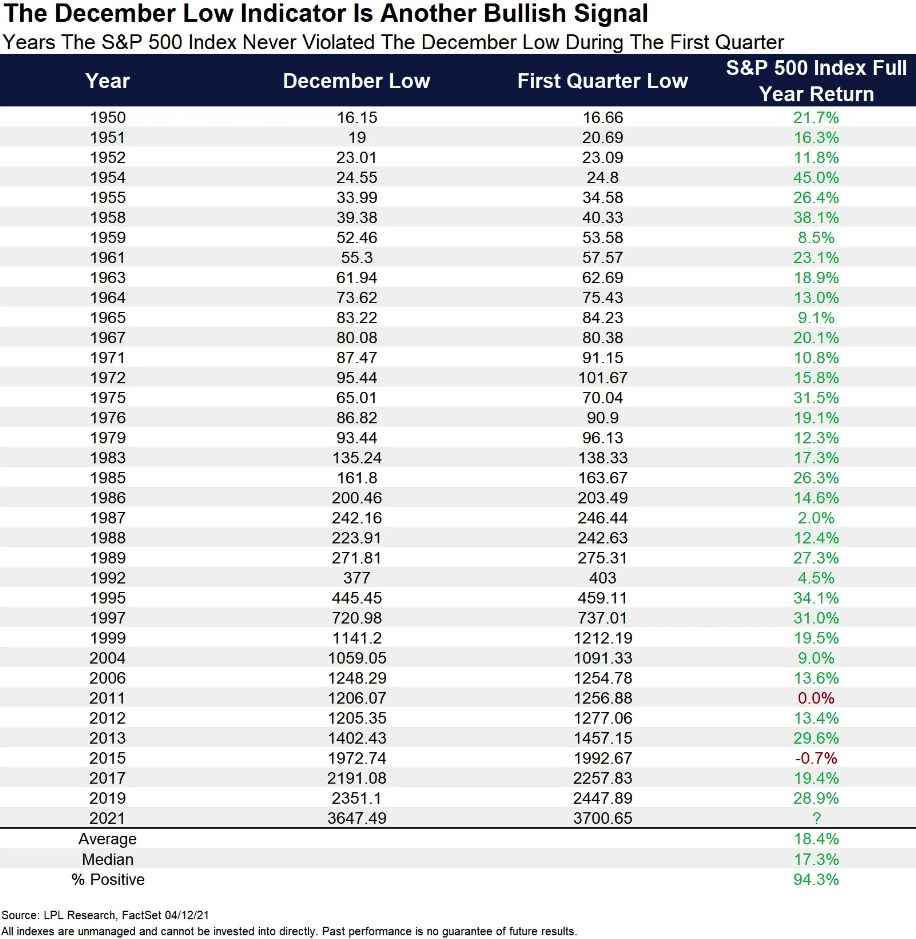

Second, the December Low Indicator has bulls smiling. This was created by Lucien Hooper, a Forbes columnist in the 1970s, and it simply says that if the S&P 500 closes beneath the December low during the first quarter then future weakness could be in the cards. But if this critical level holds, then higher prices could be around the corner.

As the LPL Chart of the Day shows, stocks held above the December lows in 2021 and this could mean continued higher prices, as the S&P 500 was up more than 18% on average previous years when this level held and incredibly was higher 33 out of 35 years.