Advisors can no longer service just one individual in a relationship or they risk alienating the other person and likely losing the business if something happens to the point person.

Kathleen Burns Kingsbury, a wealth psychology consultant, author and speaker specializing in women and wealth, and Christine Moriarty, owner of MoneyPeace Inc., gave a two-part interactive presentation to the FPA of Massachusetts annual conference attendees on the topic of "Couples & Money."

A Need For Balance

Most advisors find the partners in couples are often on different pages or one partner is dominant in the meeting (and relationship), according to the speakers.

"They are a system that wants to remain in balance," Kingsbury said. "If you are looking at a traditional relationship, you're looking at key gender differences. When something happens to one person, it ripples through an extended family system like a ripple in a pond."

Both presenters suggested the attendees think of working with couples as 1 + 1 = 3 (counting two individuals and the couple relationship). They added that planning for just one individual is very different.

"A couple is an organism and it wants to stay in balance," stated Kingsbury. For example, a male might be a saver and a female might be a spender (or vice versa).

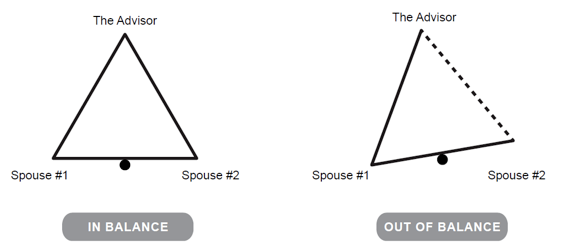

Kol Burke, financial behavior specialist at Commonwealth Financial Network, attended the conference and suggested advisors try to think in terms of the following image.

Source: How to Give Financial Advice to Women by Kathleen Burns Kingsbury (McGraw-Hill, 2012)

It shows how a relationship between a couple can be in or out of balance.