Becoming a financially secure adult is hard. Establishing yourself in your career, securing a home, starting a family … it’s a struggle as old as the modern economy, maybe even civilization itself. As is the lament of every generation that they have it worse than their forebears.

Millennials, assisted by the internet, made an exceptionally fine art of intergenerational ranting. For the last 10 years they have been saying that earlier generations not only had it easier, but they also robbed millennials of resources.

They’re wrong about that—wealth creation across generations is not a zero-sum proposition—but they do have a point about how different generations face different challenges. In this case, however, the generation that has it harder is Generation Z—and millennials are to blame. Ultra-cheap mortgages over the last decade enabled millions of millennials to buy homes, and now the housing market is distorted, which will make it harder for Gen Z to buy.

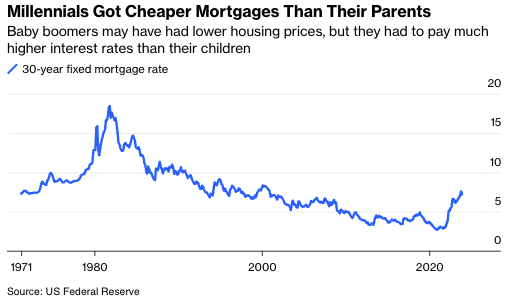

Millennials are fond of saying they were priced out of the housing market, in part because they are overwhelmed with student debt. It fact, the more student debt you have, the greater the odds you own a home—because higher debt tends to mean more education, which boosts earnings. Yes, housing costs were higher for millennials than they were when their parents were their age, in the 1980s: Based on the Case-Schiller Index, house prices increased more than threefold between 1989 and 2022. But mortgage rates were also much, much lower. When their parents were buying, rates more than 10% were not unusual, and fewer people had fixed rates.

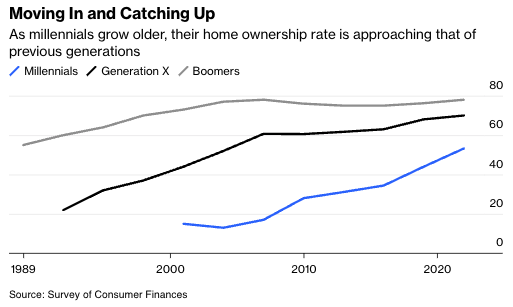

Millennials tended to buy later in life, just as they married and started families later. But they bought homes in droves leading up to and during the pandemic. Between 2019 and 2022, homeownership among millennials increased almost 10 percentage points. In 2016, about 34% of millennial-headed households owned a home; by 2022, 53% did.

The last several years saw one of the biggest increases in homeownership of any generation. Some of it was a function of getting older, having more money, and marrying and settling down. But a lot of it was subsidized by very low mortgage rates.

It is important to note that these figures are for households headed by millennials. Because this generation is more likely still to live with their parents or roommates, even as they approach middle age, they aren’t always counted as heading their own household.

All the same, a look at the entire millennial population shows that they are still buying homes like crazy. In 2016, when they were aged 20 to 35, only 25% of millennials were homeowners. In 2022, when they were aged 26 to 41, 47% were. Yes, this is a lower homeownership rate than it was for boomers at their age, 54% of whom owned homes. Much of the difference comes from men without college degrees living with their parents or others (not a partner).

The bottom line is that, by 2022, millennials had a similar homeownership rate as baby boomers did at their age. They were less likely to own a home than Gen Xers at their age, but Gen X also reached their first-home buying age during the start of the housing bubble.

Millennials who bought homes will benefit from these low rates for years to come. Most outstanding mortgages are fixed rate, and 62% of mortgages have interest rates of less than 4%. Some 88% of millennial homeowners have a mortgage, compared to 48% of boomers, who are more likely to have paid off their (more expensive) loan.

This is good news is that just as the millennials are entering middle age, they’ve locked in cheap housing. The outlook is not so good for Gen Z. The low rates that facilitated all that home buying were the result of both market forces and Federal Reserve policy. Now that interest rates have increased and the Fed is no longer buying up mortgage-backed securities, mortgage rates are multiples higher. Unless there is more intervention, it is unlikely that sub-3% mortgages rates are coming back.

Higher rates might normally mean cheaper homes. But because rates were so low for so many years and then increased so quickly, many homeowners—including millennials—locked in low rates and now won’t move. This will restrict supply and keep prices high. As Gen Z looks to buy their starter homes in the next few years, they will face both high rates and high prices. It may be years before the housing market is affordable again.

This could create even more intergenerational conflict between cheap-mortgage-paying millennials and high-rent-paying Gen Zers. I look forward to the TikTok videos.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.