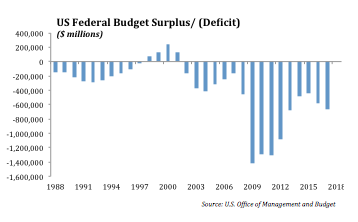

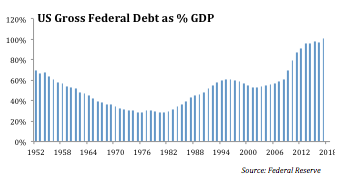

There’s no other way to say it—the financial position of the United States is a disaster. After the Financial Crisis in 2008, the government went on a spending spree designed to stimulate economic growth. As a result, the United States has run budget deficits every year since 2001. The current budget deficit is projected to reach $650 billion in 2018. The total debt as a percent of Gross Domestic Product is now at 100 percent, a level not seen since the end of World War II.

We have benefited from nine years of ultra-low interest rates, which have helped to inflate asset prices. It worked. Now, as the Fed pushes short-term interest rates higher, we expect asset prices should decline. A sustained shift higher in short-term interest rates will most likely lead to increased volatility and some dislocation in equity markets.

Investors are used to being spoon fed by the Federal Reserve, and the financial press leads investors to believe that this low interest rate environment and record setting stock market will continue. In a recent interview with Bloomberg, Federal Reserve Chairman Powell even commented: “There is no reason to think this cycle can’t continue for quite some time, effectively indefinitely.”

We are always looking for indications of excesses in capital markets. We view the strong growth over the past 5 years in real estate development, leveraged loans, and high-yield debt as three signs of excess developing in the domestic capital markets. In addition, the decline in the quality of loan covenants in leveraged loan transactions is a concern, and generally, it is presage of a decline in valuations.

Prudence would dictate reducing risk in portfolios given the shift in monetary policy toward higher domestic interest rates. Interest-sensitive sectors, such as autos and home builders, are having a rough year with Ford and General Motors stocks down 16.6 percent and 22.7 percent over the past 12 months respectively. The dichotomy in performance between stocks in the “old economy” and “new economy” is significant and continues to warp the structure and performance of Index and Exchange-Traded Funds. Ultimately, we believe we are moving into a period that will benefit the “stock pickers” approach to managing portfolios.

At the end of the day, valuation matters for investors. The “Follow the Herd” strategy and late stage market aggressiveness is more often an ill-fated and dangerous strategy.

While It Is Impossible To Predict The Timing, Here’s What To Expect In The Near Future:

• Central bank balance sheets will continue to shrink, which will put additional pressure on interest rates to rise.

• Credit quality will deteriorate as corporate balance sheets show higher leverage. Expect more downgrades than upgrades from the rating agencies.

• As the credit cycle begins to turn, we expect an increase in debt restructuring and bankruptcies.

• Stock buy backs will continue and take priority over capital investment.

• Volatility will increase as capital markets adjust to higher interest rates.

• The pace of earnings growth in 2019 will begin to slow, as year-over-year comparisons become tougher after the initial impact of Tax Reform on earnings subsides.

• With higher capital levels and relatively solid loan portfolios, U.S. banks will weather market turbulence well.

• Corporate reorganizations will increase in late 2019, resulting in a rise in bulk layoffs.

• Expected returns in financial assets will be lower than normalized historic returns.

Greg Hahn is president and chief investment officer at Winthrop Capital Management.