For financial advisors who want to significantly build their practices, there are many ways to pursue new wealthy investor clients. Obtaining referrals from current clients is one approach. Another is to join and be involved in conclaves such as mastermind groups. Still, the most effective approach is creating strategic partnerships with other professionals who have the wealthy investor clientele you are interested in.

These other professionals—commonly known as centers of influence—tend to be accountants and attorneys. The latter are usually trusts and estates lawyers, but while these are excellent potential strategic partners, other types of attorneys, such as divorce lawyers, can also be great referral sources.

In this article, we’ll be looking at lawyers specializing in mergers and acquisitions, especially those working with privately held companies. These are also excellent sources for advisors looking to cultivate wealthy investors.

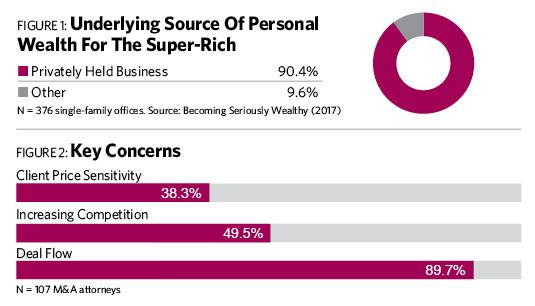

Many potential wealthy clients have built their wealth by building successful companies as entrepreneurs. In a survey of 376 single-family offices, the underlying source of the wealth for nine out of 10 of these super-rich families was a privately held business (Figure 1).

Key Concerns

To enter strategic partnerships with M&A attorneys, it’s necessary for you to understand their professional problems—and one of the big ones is the big competition they face.

In a recent survey we performed of 107 corporate attorneys focused on buying and selling private companies, we found that competition from other lawyers is a source of distress for almost half of them (see Figure 2). Most attorneys say they are living in turbulent times, and this has led some of them to take on more diverse legal work such as corporate sales.

More than 38% of M&A attorneys said that another problem is their clients’ sensitivity to fees, which have been compressed as a result. Lower fees can readily translate into lower profits and lower incomes. Entrepreneur clients may even know the attorney’s hourly rates going in, but they start to feel the pain as the hours get racked up. That means the lawyers must effectively communicate their value early on.

The greatest concern of M&A attorneys is their deal flow. Nine out of 10 of them report that business development is the hardest part of their practice. This is far from surprising. Extensive research with all manner of attorneys (as well as financial advisors, accountants, bankers and consultants), shows that one of their biggest challenges is finding new clients. And no matter how technically adept they are in their fields, if they can’t win clients, their practices suffer.

Building Strategic Partnerships with M&A Attorneys

The process for partnering with M&A attorneys is very straightforward. Success is a function of how well you implement the process.

The Assessment: Here is where you start developing a very solid understanding of a particular M&A attorney’s practice. While the research gives us perspective and helps guide the assessment, you need to determine what is happening in the world of the individual M&A attorney you are considering as a partner.

A very good way to start is by saying, “Tell me about your practice.” Then take copious notes. You are looking to grasp a number of issues including:

• What business concerns are keeping the attorney up at night?

• How has the business changed in the last few years?

• How does the attorney find new clients?

• What approaches to business development have worked well and not so well for the attorney?

• How many new deals is the attorney involved with currently and how many in an average year?

• Does the attorney specialize in a particular industry or is he or she a generalist?

• What are the common deal sizes the attorney works on?

• How many deals at what size would be optimal for the attorney to work on in a given year?

• Is the attorney hungry? (I.e., does he or she want to become much more successful?)

• How amenable is the attorney to referring you for your expertise if you can help him or her build up the legal practice?

This information and more is unlikely to be ascertained in a single meeting. Still, it is important to focus your conversations so you can get as much necessary information as quickly as possible. If the attorney is not addressing these points, probe for the answers.

It is during this phase that you decide if it is worth your time and effort to work with this particular lawyer. Critical to your considerable success in sourcing wealthy investors from other professionals is the fact that you are choosing whom to work with. They are not choosing you.

Along these lines, when an M&A attorney is not a good fit, it is important to say N.E.X.T. (never extend extra time). You need to move on, and it is advisable to do so relatively quickly.

Adding Value: Having chosen an attorney with great potential to be a strategic partner, you now have to add value. You can enhance the attorney’s practice in different ways. Using the research as a guide, helping him or her increase deal flow is probably a very good strategy.

It’s OK to refer one of your own clients to this attorney if that client wants to sell a business. But you won’t build an entire practice that way. The math doesn’t work. Client trading is rarely a viable strategy for any type of professional. Instead, you have to help this attorney get more business from other sources.

One of the most powerful ways to accomplish this is to help him or her become a thought leader. Give the attorney high-caliber thought leadership content to send to prospects and other professionals. If you do, there is a very good probability that the lawyer will see deal flow increase.

Some of the topics the lawyer can cover are:

• When an entrepreneur should hire an investment banker;

• Common mistakes entrepreneurs make selling their businesses; and

• Powerful negotiating strategies entrepreneurs use when selling or buying companies.

When this arrangement is properly structured, you will also see a steady stream of new wealthy investor clients. But there are caveats. If you want to become a thought leader, you need both patience and the ability to deliver content regularly, and that goes for the lawyer, too.

Another effective thing you and your M&A attorney can do is produce workshops and presentations to successful business owners. Give presentations at elite mastermind groups—often a powerful way to find clients. But the material you present must be seen as worthwhile.

By helping your strategic attorney partners become thought leaders themselves, you are creating more opportunities for them to refer wealthy investor clients to you.

Obtain Wealthy Investor Referrals: Once you have increased your attorneys’ deal flow, they will be motivated to send you wealthy investors for your services and products. The complication is that relatively few M&A attorneys know how to effectively refer their clients to you. You therefore have to correct this “disconnect.”

A good starting point is that you can explain the range of services and products you provide business owners, especially people selling their companies. A good technique is to provide the attorney with a one-page bullet point non-technical overview of your expertise. It usually also helps if you can provide the attorney with “talking points” addressing how to introduce you.

While it might be blindingly obvious to you, many other professionals, including M&A attorneys, will not see opportunities for your expertise. To correct this deficit, it may be worthwhile for you to review their client situations with them. This approach moves the conversation from the abstract to the concrete … you are talking about actual clients. When the process is done well, new possibilities are almost always unearthed for wealth management.

By systematically implementing the process, you could create a strategic partner that can deliver you clients in need of a variety of services and products, especially discretionary money management.

Russ Alan prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.